What Can You Buy With Bitcoin? Is it for Real? Where is it Headed?

How’s this for interesting? At a few recent conferences where I presented, people approached and asked me if they could buy property with bitcoin. Didn’t see that one coming, but my immediate answer was, “Yes. Of course.” Why wouldn’t we take bitcoin for a property purchase?

I know a lot of folks think bitcoin’s a scam, and we’ll get into that later. But for now, let me say that any hard currency is fine for people who want to own an ECI property, or even make an investment into the company. Metals too, for that matter. Why should we care how somebody pays for a property as long as the value traded is deemed equal and fair by both parties?

Really. We’ll take Dollars, Yen, Euro, Canadian, Pounds, Gold, Silver, Platinum, and a host of other freely tradable currencies and commodities of the world. For international companies, the type of currency for a trade is largely irrelevant, or at least it should be. Consumers should feel free to pay in the currency they choose, as long as the provider is willing to accept it. And we are. Why not?

For me, it’s simple. Our company, ECI Development, has a hard asset commodity called land that we will trade for other hard assets like gold, or convertible soft assets like currencies, as a means to transact a sale. While bitcoin has some challenges facing it, and these issues are discussed later in this column, for now it would be an acceptable means of payment at ECI.

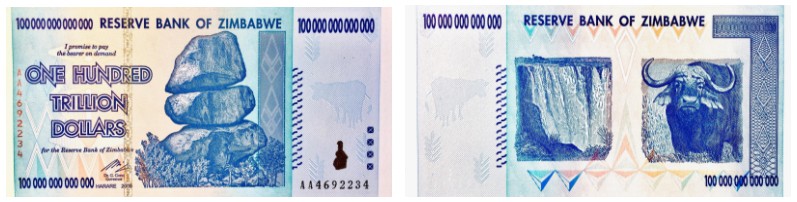

But there are some currencies we won’t take, especially ones that are restricted by their government for exchange, or other currencies that are risk-prone from governments who print too much. For example, we want to stay away from currencies like the Zimbabwe dollar. This currency was trashed due to massive government printing and became nearly worthless before being dissolved in 2009.

Imagine this, the 100,000,000,000,000 note was worth just $0.40 USD when it failed. One Hundred Trillion worth literally nothing. As Voltaire so famously said, “Paper money eventually returns to its intrinsic value – zero.”

The Zimbabwe 100 Trillion Dollar Note. Colorful, Pretty, and Worthless.

Interesting fact though, the Zimbabwe dollars are now for sale on the internet as collector’s items, for as much as $69 each. So, on second thought, maybe we would take them.

But back to bitcoin. The question of intrinsic value is a good one. I know I’m going to sound like a heretic here to many of my good friends in the metals business. Sorry guys, but even gold has no real intrinsic value apart from some minor industrial uses. Platinum and palladium probably have far more practical use in the world and therefore more intrinsic value.

But, that said, gold does have something that no other metal or paper currency has ever had or possibly ever will…undying faith by a majority of the world’s population that it possesses worth, great worth as a matter of fact. And in the end, it’s only that faith that counts to support “price,” “value,” and “worth.”

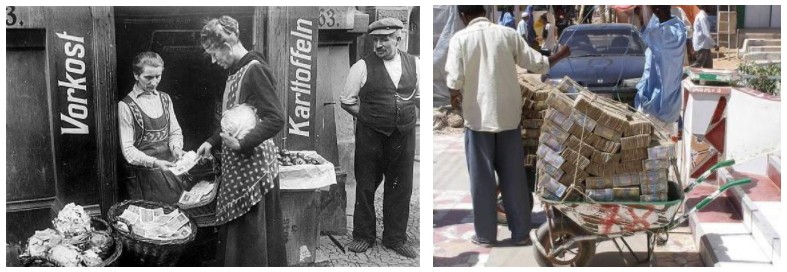

This is especially true of paper currency. When the Reichsmark was over printed in 1920s Germany, people lost faith. The same was true of the Zimbabwe dollar of course. Paper currency worldwide is backed by the full faith and credit of the issuing government. It’s just that simple. When the faith erodes, the value erodes. History is a powerful educator if we listen.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

Germany 1923, Zimbabwe 2008

So that brings us to bitcoin and perhaps why it’s different. This article looks at 3 questions: What is it? Why do people have faith in it? And the $64,000 question…Will it last? Questions 1 and 2 are pretty straightforward. But number 3 is a tough one. Spoiler alert. I’m going to punt on that one, but I do have some thoughts to put out there for consideration.

What is Bitcoin?

If you are like me, you may not know much about bitcoin. I didn’t, so, I used writing this column as an opportunity to learn more. Bitcoin is a type of cryptocurrency. It’s an electronic or digital currency like the Euro, Yen, Renminbi, and the Dollar sitting in the computers at banks. But cryptocurrency differs from regular electronic currency because it’s money built online with “blockchains” (defined later), through a decentralized cash system, without any defined national barriers.

Bitcoin is one of several cryptocurrencies that were invented to act as a means of exchange like traditional currencies, but outside the realm of governments and traditional banks. BerkShares are paper tender, but function in a similar manner outside the traditional banking system in the Berkshire mountain region of Massachusetts. So, the concept is not alien at all in the United States…just uncommon.

Roughly 7,000,000 BerkShares trade through 500 businesses in the Berkshire mountains of Massachusetts

But to give full flexibility and mobility to the currency, bitcoin is designed to be exchanged in digital form through a process made possible by certain principles of cryptography. Put yet another way, cryptocurrency is electricity converted into lines of code with monetary value. In the simplest of forms, cryptocurrency is a digital currency.

I found this great podcast by The Expat Money Show – Bitcoin For International Privacy, Protection And Control – Eryka Gemma

Why do People Have Faith in Bitcoin?

The technology sounds complicated. But before money was used, trade was complicated too. People bartered, using an exchange system that was tediously based upon needs, demands, wants, and willingness to trade goods and services, directly complicating things. It also relied on the physical proximity of the people and goods.

Imagine, I have carrots but want tomatoes. But the guy with tomatoes wants lettuce. The lady with lettuce wants carrots. If we all happen to be at the same place at the same time, no issue. We trade. But if I’m late to market one day, then no one gets what they need and want because the trade can’t happen. “Money” is the way to make these transactions simpler, more efficient, and accessible by buyers and sellers all the time.

As a widely accepted medium of trade, the use of money (or currency) grew quickly, especially for city-states and nations involved in the trade. It was easy to use and allowed great flexibility in the marketplace. This growth made a need for standardization and regulation. Notes could easily be counterfeited and there was no official system of registration in place.

Therefore banks were established to organize the financial needs of each nation, by deterring double transactions, counterfeiting, or false registrations. They provided a level of trust for the system, and as long as that trust held, the monetary system flourished. In the U.S., we still use a national central server that keeps records about all the balances of all the U.S. currency in use daily throughout the world. It’s the Fed, and all funds must balance every day.

The needed standardization of money is what fostered cryptocurrency in the global economy. The internet has its roots in decentralized design, just like cryptocurrency. Before the internet existed, we had “Usenet” as the first global online community. Anyone could create and run their own server, connect with different computers through dial-up, and start receiving/sending messages.

No one controlled Usenet, which in theory explains the birth of a decentralized system. But standardization and centralization are not synonymous. It is possible to have standardization without centralization…just uncommon. The UNIX standard is a great example. The internet is global and, therefore, a standard for digital money was created and is the value of exchange located on the worldwide web.

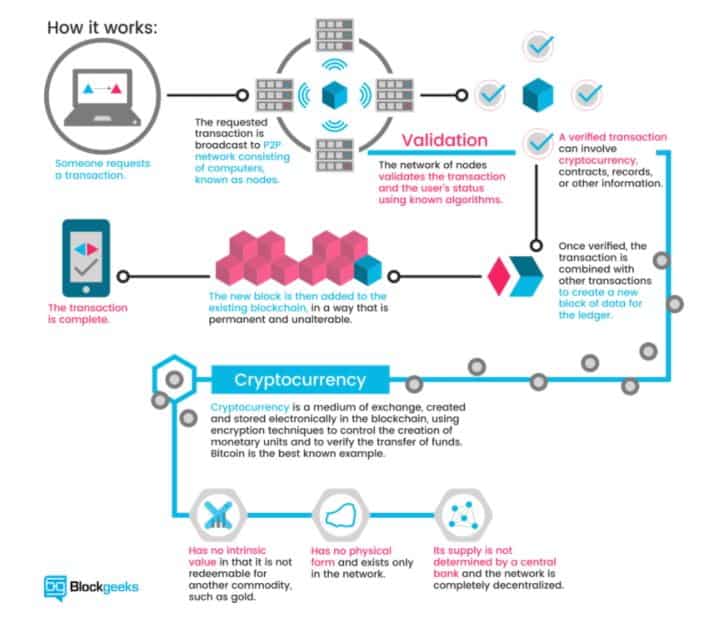

To help explain how bitcoin works, I have included two formats. For visual learners, the chart below is great. Below is a written description of how bitcoin works. Both together make a lot of sense for me, but not quite enough, sadly. I’m still confused.

Text description: Cryptocurrency is managed or administered differently from regular currency. It is kept and managed through a peer to peer network (P2P) not tied to any nation-state. This P2P network guarantees the digital independence of the exchanges on which bitcoin is traded. Very decentralized.

The word “blockchain” is used a lot in the description of Bitcoin and explains why it is safe and secure. Basically, a blockchain is a digital ledger for everything of virtual value. A better way to see it is to imagine using a spreadsheet that is multiplied thousands of times across the web of computers logged into the network and regularly automatically updates all data. The P2P network is blockchain-driven. As the user transacts over the network, there’s a new creation of a “block” in the chain of transactions throughout the system.

Got it? Me neither, actually. But there are a lot of things that I don’t understand that seem to work pretty well and serve my needs, like the inner workings of an iPhone for example. Happy to be using it, but have no clue how it does all the things it does. I have faith that it will continue to work, at least for now.

Faith is an interesting word when applied to currencies. Bitcoin has been called “digital gold.” And the fans of bitcoin say that, unlike traditional currency, digital money does not need to be backed by anything. I’m not sure I agree.

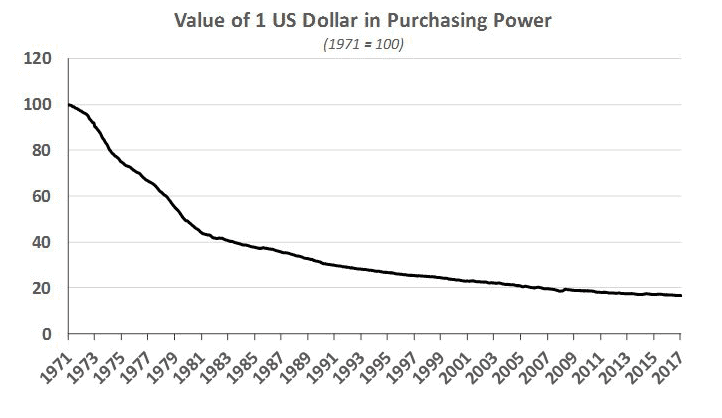

Money in the United States, up until the 1970s, was backed by gold held by the U.S. government in Fort Knox and big vaults under New York City. As of today, 4.46% of U.S. dollars in circulation are “backed” by gold, the rest backed by promises and goodwill. The chart below shows what happened to the purchasing power of the dollar once the hard backing was removed.

The purchasing power of the U.S. dollar has been on a serious decline since the gold standard was removed by Nixon in 1971. But to be fair, the number of dollars people earn to purchase goods has gone up too. A teacher’s salary was $8,600 in 1971. Today it’s $54,700. So, if the value of the dollar has fallen by 80%, and the salary has risen by 6 times, the difference is not as great as it might appear without seeing the two side-by-side.

Nevertheless, advocates for cryptocurrencies don’t assign any measurement for the value of gold or similar backing. Digital currency is based upon mathematical precision instead of a gold standard or government assurance. The lack of necessity to trust or have faith in a centralized government to maintain a standard, and the control such governments require over their own FIAT currency, is one of the reasons bitcoin and cryptocurrencies have flourished as private stores of value.

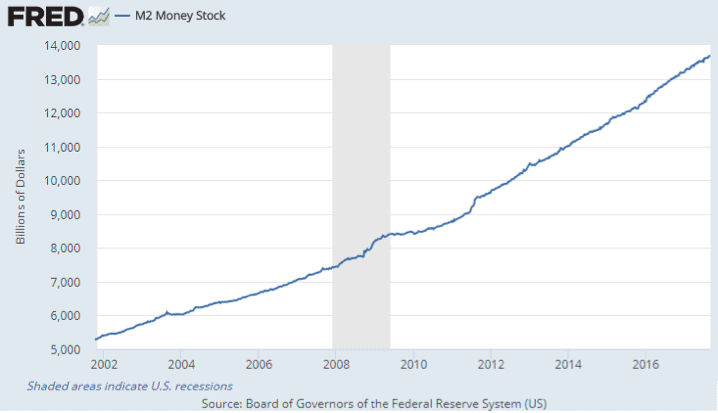

This may explain why bitcoin, a currency by definition, has attracted a huge number of investors and speculators. The U.S. monetary supply is increasing dramatically. Ultimately, this impacts the value of any currency in terms of purchasing power, inflation, or in extreme cases, hyperinflation.

For example, since 2008, the U.S. monetary supply has increased by $8.5 trillion. While that money remained stationary, propping up the balance sheets of banks too big to fail, we didn’t see inflation. But when that money got loose and gained velocity, we see inflation, perhaps showing up in the meteoric rise in the stock market in the past few years. Hmmmm.

But like all currencies, bitcoin does require faith, a faith in technology to keep the system running and protect the value of the currency. And like all paper currencies, bitcoin is FIAT currency. Please make no mistake about that. It’s just a different version of FIAT without any one government in control. There’s no intrinsic value in an electron. For many folks, however, bitcoin represents a currency far safer and more stable, since it’s outside the control of a singular government that may want to print money for a variety of reasons.

Another benefit to a completely virtual currency is that it is ideal for international transactions because it is not tied to any country or regulatory body. The Chinese and Brazilian governments impose onerous currency exchange controls on their citizens. For consumers locked into the Renminbi and Real, bitcoin offers a way to transact with the world if they can acquire them.

Also, opening a U.S. dollar account has become a hassle overseas post FATCA. With bitcoin there are no hassles, nor are there transfer charges or wire fees which can be substantial. Bitcoin is not regulated by a bank or government and for this reason, transactions don’t require intermediaries who charge high fees for acting in this capacity.

The number of companies and services that accept this currency as a form of payment has been growing in recent years. For example, Microsoft lets you buy mobile applications, games, and digital content for Windows and Xbox with bitcoins. Others too.

And ECI also accepts bitcoin. Check out the properties below priced in a variety of ways. Prices are reflective of the date October 17, 2017.

Only 25 Bitcoins – Gran Pacifica Beach and Golf Resort Las Perlas

Existing 22 Condos Sold Out, Phase Two Presales

One-bedroom Pacific Oceanfront Condominiums. Priced from: 25 Bitcoins / ¥15,568,000 / CAD $173,750 / €118,150 / ₤105,640 106 oz. Gold / 150 oz. Platinum / 544 lbs. Silver

Only 81 Bitcoins – Belize Grand Baymen Oceanside Branded Residences

Existing Site Location, New Hotel and Residences Rendering

Ambergris Caye Branded Residences. Priced from:

81 Bitcoins / ¥50,288,000 / CAD $561,250 / €381,650 / ₤341,240 343 oz. Gold / 483 oz. Platinum / 1759 lbs. Silver

Only 68 Bitcoins – 1-Acre Ocean Home Site on the Pacific

New Home Sites up to an Acre on the Ocean, The Waves Right Out Front

Gran Pacifica 1-Acre Oceanfront Home Sites. Priced from:

68 Bitcoins / ¥43,568,000 / CAD $486,250 / €330,650 / ₤295,640

298 oz. Gold / 418 oz. Platinum / 1524 lbs. Silver

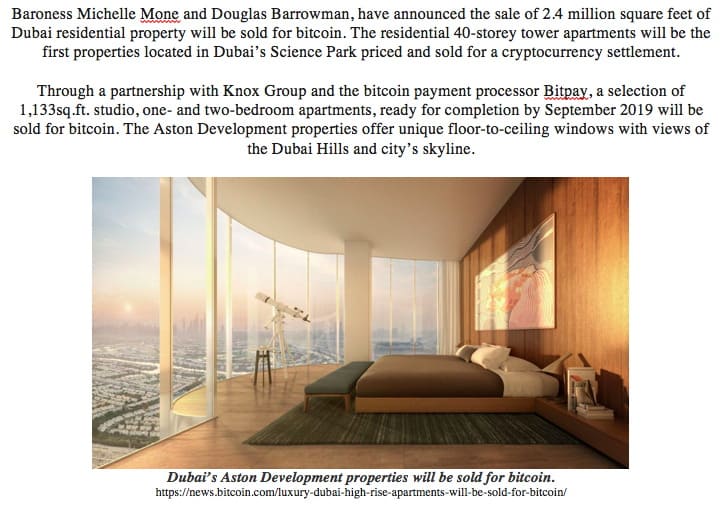

A Luxury Apartment building in Dubai recently went 100% cryptocurrency

Cryptocurrency can be used as payment for a variety of services or goods. You can also buy or trade on websites that specialize in the sale and exchange of this currency. One of the most popular websites for obtaining bitcoins is Coinbase, where you can buy bitcoins using dollars and other currencies. This site can also be used to sell bitcoins. The bottom line is that once you have digital coin, you can use it to buy and sell on the internet as well as with vendors like Dell, Expedia, and WordPress, which also accept this digital currency.

With options like these and more coming online daily, to function and use bitcoin requires an online wallet. An online wallet is a database that holds the bitcoin on your phone, computer, or tablet. There are several mobile applications that allow you to download and use as a wallet. Some of the applications for making payments using bitcoin are BitPay and Bitcoin Checkout.

Another alternative to getting bitcoins is through what is known as bitcoin mining. According to bitcoin.org, “mining” consists of solving mathematical problems in exchange for bitcoin. Mining is crucial, as miners use their computers to approve bitcoin transactions and keep the bitcoin network secure. Anyone can become a miner, but they must have specialized software and hardware. The miners are a group of people who are engaged in processing transactions and, in exchange for this work, they receive bitcoin. But that amount is regulated by mathematical formulas and is limited, so as to expand the supply only minimally.

Where is this Going? Can Bitcoin Survive?

Although bitcoin is not the only cryptocurrency available, it’s more mainstream in penetrating all current money markets, not only because it is preferred by users, but also because of its attractive value. At one end of the spectrum are the bleeding edge adopters who see bitcoin as a saving grace for the FIAT currencies of the world. At the other end are stalwarts of legacy businesses. According to a recent article in Coin Telegraph, Jamie Dimon, CEO of JP Morgan, recently attacked bitcoin, going as far as calling it a fraud that will be shut down.

The bottom line is that bitcoin is a cutting-edge currency popular with the young, tech-savvy, and forward-thinking. On the positive side, it offers users privacy, ease of use, immediate access, and cost savings over traditional banking. Significantly, it is free from any one government’s actions to print money or otherwise debase its currency.

However, the reality is that few transactions actually happen with bitcoin now compared to traditional currencies. And in fact, today, speculators are largely “investing” in bitcoin rather than using it as a medium of exchange and trade. This is what has pushed the price of bitcoins higher and higher, to the $5,570 to the U.S. dollar mark as of writing this article. How sustainable is this? If the price of bitcoin crashes like Enron stock, the black eye to the currency will be significant.

Additional challenges facing bitcoin are public relations pressures from large institutions like governments, banks, brokerage houses, and conservative thought leaders around the globe. The fact that bitcoin is decentralized and exists everywhere all the time has its pluses and minuses. In some important ways, the decentralized aspect works to prevent any one institution or government from exerting control and affecting the value.

In other ways, however, decentralization is a drawback. Big banks and financial institutions are highly centralized, and with that comes power. Unlike a decentralized amorphous system, these banks have lobbyists in the halls of all the major governments around the world to hear their concerns – and they can focus their dollars to lobby for regulation or outright bans of bitcoin. The institutions of banking are centuries old and the placeholders like JP Morgan, Chase, HSBC, Deutsche Bank, and others are not likely to roll over easily.

Bitcoin also faces a trust issue, in that the technology supporting it is complicated and “blackbox” for many, including me. A complete faith in technology is required to feel comfortable about the exact value and security of bitcoin money. When everything tech-wise goes right, we are happy. But when the computer locks up, or the hackers get through the impenetrable wall of Equifax, we might be given pause to assume an absolute faith in the security and technology of the bitcoin system.

The future is hard to predict, and bitcoin is a formidable player. A quote from Zachary Karabell in the August 8, 2017 issue of Wired says,

“In the late 19th century, the populist presidential candidate William Jennings Bryan crusaded against the erosion of value

perpetrated by Wall Street financiers and their gold-backed paper money, at the expense of true value measured by the work of laborers. In fact, you could troll through reams of 19th- and early 20th-century fulminations, replacing the words “paper money” with “bitcoin,” and be hard-pressed to tell the arguments apart.”

https://www.wired.com/story/bitcoin-has-no-intrinsic-value-neither-does-a-dollar1-bill/

So, while the traditional and conservative economists tend to slam bitcoin, new ideas and methodologies do tend to find ways into the hearts and minds of people and become embedded…as long as they are useful. Just like paper currency, which gained usefulness through the 1800s and became fully established as the norm in the early 1900s, so too bitcoin could become a new norm – but only with widespread use and utility which is yet to be seen.

Will bitcoin be a form of money that lasts? Only time will tell if it can not only survive any campaigns to kill it, but also become more than a speculative investment. For bitcoin to thrive it must become a currency used in our day-to-day lives. The lasting value of the bitcoin will ultimately reside in its functionality and its viability as a measure of daily utility. We’ll see.

Here is probably the most extensive ebook on Everything You Ever Wanted To Know About Eliminating Your Taxes, Protecting Your Assets And Regaining Privacy Over Your Life And Investments. It is called The Ultimate Guide To Going Offshore.

I hope you got value from this article: What Can You Buy With Bitcoin? Is it for Real? Where is it Headed? If you would like to discuss your business moving offshore, please contact us HERE. I have included some really great articles for you to read, enjoy!

Libertarianism and Financial Agency

How Millennials View Real Estate

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!