The Paradise Papers: Demystified

Sunday before last (November 5, 2017), 13.4 million documents (emails, bank statements, loan agreements) relating to offshore investments were leaked through German newspaper Suddeutsche Zeitung and offered to the International Consortium of Investigative Journalists (ICIJ). Nicknamed the “Paradise Papers,” the documents link some incredibly high-profile individuals and companies to offshore tax havens, detailing around $10 trillion USD in foreign holdings.

Similar to 2016’s leaked “Panama Papers,” these documents have incited outrage from government officials and media outlets who feel there is an ethical breach in the ability of the ultra-rich and the well-connected to pay less taxes than those in lower income brackets. The majority of the documents were stolen from Appleby, a Bermuda-based firm that helps people set up in offshore jurisdictions. Appleby maintains that it has broken no laws – and as the details pour in, this seems increasingly true.

Now many of you who have read my column throughout the years know that I am a huge fan of reporting and paying what is owed. But I am also a huge fan of the famous quote by Justice Learned Hand who said,

“Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one’s taxes. Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.”

This seems right and fair, doesn’t it? If you want to pay more, then by all means, go right ahead and write the IRS an extra check.

But what about all this indignation over the Paradise Papers? Would it change how people felt if they knew that the U.S. is the largest tax haven in the world? How about that the U.S. won’t cooperate with the rest of the world on tax schemes that allow foreigners from everywhere else to hide their money here? Did you know that according to the Financial Transparency Coalition in Delaware, you actually need to provide more information to obtain a library card than to start a company?

Hmmmm. More on the U.S. government’s hypocrisy regarding tax havens after a brief description of the “Paradise Papers” and the reality behind the media hype.

Defining a Tax Haven

The term “tax haven” usually refers to countries or regions that have favorable tax regulations for foreign nationals. These countries allow people or companies from all over the world to pay less money in taxes than if they were only operating out of their home country. To qualify, people may need to establish a connection to the country, such as opening bank accounts, purchasing property, or incorporating their businesses in the tax haven country.

The demand for international tax planning has spiked in popularity over the last half decade. According to The Guardian, “Over the past 40 years, offshore tax regimes have grown exponentially; back in the 1970s, they were a way for individuals to hide their money from corrupt and predatory governments in unstable countries, or for banks to move cash around to avoid fluctuations in currency rates.”

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

Tax Avoidance vs. Tax Evasion

Despite media scrutiny, the real issue here is that most of these structures and tax plans are completely legal, both in the tax haven country and the client’s home country.

While some involved in the leaked documents are being cast in a negative light, the overwhelming majority of the data shows no sign of foul play or illegal activity. Instead, it shows resourceful individuals playing within the rules in order to maximize their wealth. It is this kind of big-picture thinking that achieved success for these people in the first place.

There is a big distinction between Tax Avoidance and Tax Evasion. It is in this distinction that we separate law-abiding ingenuity from illicit activity.

Tax Avoidance

Tax avoidance is a legal method in which people reduce their worldwide tax rate by planting flags abroad to take advantage of loopholes and offshore tax havens. There may be a stigma associated with international tax planning, but that’s only because the majority of people don’t fully understand it. When done properly, tax avoidance is an intelligent and legal way to protect your money. Currently, it has only been reported that the Paradise Papers show examples of solid and legal international tax planning.

Tax Evasion

On the contrary, tax evasion is an illicit and usually illegal act of bypassing the tax obligations of the country in which you earn or store your money. Evasion involves conscious deception, manifested in such acts as failing to file returns or declaring your full taxable income, or hiding taxable assets. This is a major offense, resulting in large fines and possible jail time, and is to be avoided at all costs.

Criticism and Concerns

While the Appleby Firm is at the center of the Paradise Papers talk, this isn’t the first time they’ve been the subject of scrutiny. The Bermuda Monetary Authority (BMA) had, in recent years, flagged the firm for what they saw as flawed compliance procedures and forced changes to their anti-money-laundering and know-your-client procedures.

As the BBC recently detailed of a consultant to Appleby:

“James O’Toole, a British lawyer who has made his own fortune by advising the wealthy how to dodge tax….

He was an “investment advisor” to a Mauritian company which owns his mansion in Northumberland.

He has also “not owned” two Aston Martins, a BMW, a Range Rover, luxury watches including a Rolex, and a Harley Davidson motorbike – which were all kept at his home.

Some of the cash came from the huge fees he charges clients.

One British couple were charged £960,000 for tax advice by Mr O’Toole’s company – £827,000 of that cash was paid straight into the offshore bank account connected to Mr. O’Toole’s company.”

There are three primary concerns for international tax planning advocates such as Appleby:

- The Paradise Papers will further hurt the reputation of offshore financial centers

- Publicity will invite more hackers looking to access records and leak documents

- Global authorities will push for tighter tax rules onshore, as well as for greater transparency offshore. (Financial Times)

While the second concern will result in more money being allocated to strengthen the web security of these firms, and the third concern is a bit of a call/response waiting game, the first concern is interestingly viewed in the data post-2016’s Panama Papers leak.

While the Panama Papers uncovered some illegal dealings, the majority of the transactions described in the Paradise Papers show overwhelmingly legal and high quality international tax planning.

And while the Panama Papers look a bit unsavory compared to the Paradise Papers, the primary law firm at the center of the Panama Papers, Mossack Fonseca, has somehow survived what many believed to be a death sentence to the company.

Appleby feels they can overcome this setback. Fionnuala Lynch, a tax partner with McCarthy Denning, said of the matter, “When the Panama Papers came out, a lot of corruption was exposed. With the Paradise Papers, you see a lot of tax planning but not much dirty money.”

Key Names Linked to the Paradise Papers

- Apple

- The documents show that Apple had moved its tax home from Ireland in 2014 to the island of Jersey in the UK, outside of the EU’s regulation, after Ireland was pressured to close tax loopholes that allowed Apple to pay a rate of just 0.005%.

- Jersey, on the other hand, doesn’t charge tax on foreign profits.

- According to CNN, Apple has responded to this leak by saying, “Apple’s subsidiary which holds overseas cash became resident in the U.K. Crown dependency of Jersey, specifically to ensure that tax obligations and payments to the U.S. were not reduced….There was no tax benefit for Apple from this change and, importantly, this did not reduce Apple’s tax payments or tax liability in any country.” The company claims it “pays every dollar it owes in every country around the world.”

- Queen Elizabeth

- It is reported that a portion of the Queen’s private funds (estimated at £10 million) are stored in the Cayman Islands and Bermuda. A statement from the Queen’s spokesperson claims that all of the monarch’s funds have been legal and audited, and that the Queen even voluntary chooses to pay income tax in England.

- Wilbur Ross

- Commerce Secretary to Donald Trump, Ross has been financially linked to a Russian shipping company whose closest business ally is an energy firm owned by Vladimir Putin’s son-in-law.

- This comes amid the Trump administration’s plan to overhaul the tax bill, reducing the federal tax rate from 35% to 20% and freeing overseas profits from U.S. taxation.

The Queen and Wilbur Ross

- Stephen R. Bronfman

- Canadian PM Justin Trudeau’s chief fundraising aid has been linked to offshore holdings that would have amounted to millions in Canadian taxes. This comes in stark contrast to Trudeau’s active campaigning against such tax havens.

- Bono

- The U2 front man reportedly used a Malta-based company to invest in a shopping center in Lithuania. Malta is famous for its low tax jurisdiction.

- According to Bono, “I’ve been assured by those running the company that it is fully tax compliant, but if that is not the case I want to know as much as the tax office does, and so I also welcome the audit they have said they will undertake.”

Bono at the Economic Forum

Bronfman Supporting higher taxes for all but himself

Bono, worth more than $500 million, said in a 2012 Speech to Georgetown University students, “Aid is just a stop-gap. Commerce, entrepreneurial capitalism takes more people out of poverty than aid.” Maybe he gets it at one level, but he also advocates higher taxes.

It seems that many on the left want someone (not them) to pay more taxes to take care of the poor. It seems like a good thing on the surface, but how about we dig a little deeper. In the left/right debate on taxes, what emerges is a gulf between words and action, a gap that distinguishes real care from mere platitudes.

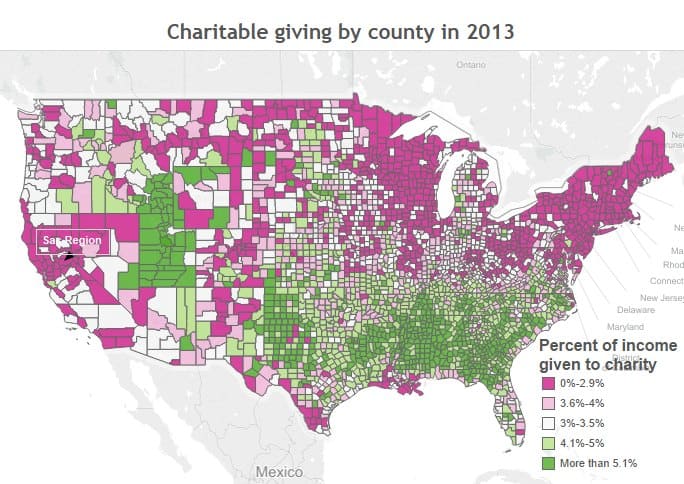

According to Arthur Brooks, who wrote a book entitled, Who Really Cares, Conservatives donate 30% more than liberals on an annual basis. Further, in a 2015 article by Robert Gehl,

“Republican states are more generous than Democratic states by a wide margin. In GOP states like Utah and Mississippi, families donate more than seven percent of their income to charity. In liberal New England states like Massachusetts, the number is less than half that.”

Interestingly, the GDP per capita in Massachusetts is $65,545…over $15,000 higher than the national average. The GDP per capita in Mississippi is only $31,881…nearly $20,000 under the national average and half that of Massachusetts. Despite being half as rich, these red state citizens give freely twice as much to charity. So, who really cares more?

Look at all that “Green” coming out of “Red” States

But the ethical question of taxes muddies the waters here. Tax compliance is not an issue of fairness or compassion. Compassion is not what the government forces you to “donate” through tax collection and redistribution. Compassion is the additional amount you freely choose to donate after all your taxes are paid. Tax compliance, on the other hand, is simply a matter of following the law.

Back to Learned Hand. Why should we pay more than we are legally obliged to pay? Especially when many of those who favor big government and higher taxes to help the poor, don’t seem to actually care as much as the folks advocating lower taxes who give far more to charity. The map above speaks volumes.

But the hypocrisy doesn’t end there. According to Bloomberg.com, the U.S. is effectively the biggest tax haven in the world. After years of criticizing tax havens and now imposing draconian banking and financial legislation like FATCA onto the backs of other nations and financial institutions around the world, presumably to prevent money laundering, the U.S. is now the leading tax haven for every rich person around the globe (except U.S. citizens) looking to hide their money outside the reach of their home governments. How is that possible? Better question, where’s the outrage and indignation from the media?

Incredibly, and with no shame, the U.S. is actively resisting and effectively thwarting the OECD and other international institutions who want to establish global standards for tax avoidance and monetary tracking. They want to impose these rules on the U.S., but the U.S. won’t play ball. The Unites States is now the go-to place for the overseas rich to hide their money. Brazenly, U.S. financial advisers flaunt the fact that foreigners can stash their wealth here and avoid scrutiny from their home country’s authorities.

The U.S. is Cleaning Up, Hiding Money for Who Knows Who

In fact, according to the Naked Capitalist,

“The U.S. is one of the largest recipients of illicit financial flows from developing countries—money often smuggled out by corrupt politicians, drug dealers, or everyday criminals…” The story goes on to say that “the tiny state of Delaware, called an ‘on-shore tax haven’ by critics, garners more than a quarter of its public revenue, over $1 billion, from its business registry.”

Where’s the moral outrage? Why isn’t the media reporting this? The silence is deafening.

How about this? According to the World Bank, “The U.S. is one of the worst offenders when it comes to corporate secrecy.” Another study found that the U.S. is the second easiest place in the world to set up a shell company…right after Kenya. Kenya! And the best states to ensure privacy from prying eyes back home? You guessed it. Delaware and Nevada, both states making it super easy for rich people overseas to set up a shell company and hide their wealth here. Wow.

A Brief Takeaway

Tax avoidance is legal. Tax avoidance is also ethical. Especially if you apply the standard the U.S. Government applies to citizens from the rest of the world. It’s the media hype that wants to shame people who are following the law. Don’t fall for it.

There are right and wrong ways to enter the world of offshore tax schemes. If you go into the world of offshore with competent legal counsel and expert advice, you’ll be safe, even if your transaction is uncovered. So long as you are compliant with your reporting requirements, and follow the letter of the law, you will find significant tax planning options are available offshore.

Our governments are encouraging high net worth individuals to lower their tax rates through international tax planning, through the tax laws on the books. Just like the middle class uses mortgage deductions, IRAs, and retirement accounts to reduce taxes, the top 1% uses international structures.

There’s no moral issue here right now…only the law as it’s written today. It’s Congress’ duty to weigh the fairness and ethical issues of the tax laws and change them when necessary. The moral issue must be addressed there.

How This Affects You

Despite nearly all the financial transactions in the Paradise Papers being legal, certain government officials are taking this opportunity to tighten the grip on offshore tax havens. The UK has budgeted around £800 million to fund the efforts to thwart tax avoidance and evasion.

Conversely, some governments are trying to make their own tax laws more favorable to lessen the incentive of going offshore, while still providing the freedom to do so.

While some are arguing that the leak of the Paradise Papers further shows the privilege of the ultra-wealthy in avoiding taxes, others may look at it more optimistically. The data shows that it is entirely legal and favorable to diversify your money overseas. Thinking globally and putting in the due diligence to better protect and strengthen your assets isn’t a sign of ethical depravity, it is more indicative of a drive to be resourceful and further one’s prosperity within the framework of the law.

To say that another way, the task of an offshore planner is to combine your country’s tax laws with those of the offshore jurisdiction to get you to the lowest worldwide tax rate possible. For this reason, you must always use an expert from your home country as the quarterback of your offshore team.

International tax planning is not only reserved for the top one-percenters of the world, but can be implemented by anyone who is willing to think outside of the box (and their country’s borders) in order to better secure their personal freedom.

The bottom line: Report, file, and disclose. Tax avoidance is legal even if some of the hypocrites “question the ethics of it.” Bone up on how you can legally protect your wealth offshore with the tax guide below, or one of many others like it. Then reach out and find a tax advisor who can guide you through the steps to keep you on the straight and narrow.

__________________

165-page international tax and business guide for Americans living, working, and investing abroad. This is the 9th edition of our bestselling offshore tax and business guide, updated for 2018. The objectives of this international tax guide are to:

1. Give you the tools to minimize your taxes.

2. Provide a road map to forms and reporting requirements.

3. Point out the landmines of international tax compliance.

International Tax & Business Guide 2018: Expert Legal Guide for Americans Living, Working, Investing, and Doing Business Abroad. Armed with this guide, you will be able to structure your business and plan your life abroad to your advantage. Purchase on Amazon for $9.75 (Kindle version) or download for free with the links above.

Table of Contents:

– The Rules for Americans Overseas

– Tax Advantages for Americans Overseas

– Foreign Earned Income Exclusion

– Second Citizenships and Passports

– Low Cost Residency Programs 2018

+ 81 more fact-filled chapters designed to keep you in compliance with the ever-changing U.S. Tax laws.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!