Today’s technology advances at a faster rate than law does. This was never more true than with fintech and blockchain in the financial industry. This article will consider how banking is using and abusing blockchain and where it may take the industry. .

Let me start by stating my premis: Blockchain and cryptocurrency are the future of offshore banking. I believe that blockchain and fintech are the key to “offshore” banking. I hope that blockchain and crypto will allow offshore banks to complete on a level playing field with the much larger domestic banks.

Note that I am not focused on Bitcoin or any particular cryptocurrency. I’m looking at the underlying technology and how it might impact various industries. For example, see: How to Setup an Offshore Bank for the Marijuana Industry.

And these thoughts are nothing new. Cryptocurrency and blockchain developments have already created enormous value in the offshore banking industry. Crypto friendly offshore banks have nearly doubled in value over the last 12 months and a few are cashing out. For example, see: Cryptocurrency Banks for Sale.

The major hurdle the industry will face will occur when the legal constructs catch up with technology. We already saw this in the United States where the SEC has pushed out all ICOs to support the IPO party donors, and the IRS is about to wage war on crypto investors.

There are “experts”, left and right, trying to market the notion of legal transactions through cryptocurrency. Concept of legally blending fintech services with traditional international banking is not too far from reality, but we are not there yet.

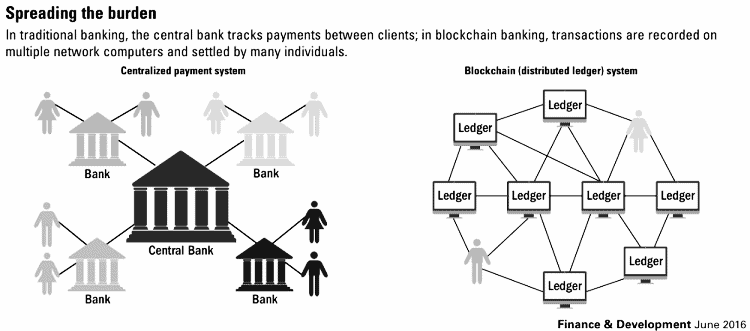

To start, we must identify separate concepts; blockchain and cryptocurrency. Blockchain is the technology used as decentralized digital ledger, whereas cryptocurrency is simply the object of transactions. Clearly, blockchain technology will make traditional banking and monetary transactions more efficient.

Blockchain technology could be classified as “innovative” or “disruptive” depending on your where it you sit in the industry. Traditional banking relies heavily on financial intermediaries, which operate through centralized systems, leaving much room for human error and human procrastination.

Having autonomous decentralized systems that register transactions instantly would replace such intermediaries. Blockchain is a viable, cost effective solution to for International banking systems. The benefits would include but be not limited to; flash efficiency in payment systems, overnight international responses, more control for the customer on their transactions, and payments be made on time.

Blockchain is not exclusive to the banking industry, digital ledgers could be used in a numerous amount of situations. It would do for banking what machines did for the car industry.

Sounds great, but what’s the catch: According to RICHARD SCOTT CARNELL ET AL., THE LAW OF FINANCIAL INSTITUTIONS 56-57 (5th ed. 2013) banks are defined by main 3 factors:

- Legal form;

- The services offered; and

- Economic function to society (identified as being a financial intermediation and transactions service)

On point 1, fintech services, such as blockchains have yet to comport with traditional legal standards for banking. To satisfy an intrusive government, the US standards for banking holds an inordinate amount of statues for compliance. There is nothing in the rules that digital ledgers are not allowed. However, there are tons regulations over the rules, which must be met of a Blockchain Banking System.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

On point 2, blockchain technology can be used internationally. So long as you are connected to internet, transactions could be held from almost anywhere in the world. Products and services would be offered by the financial institution using a blockchain to create its transactions.

On point 3, see point 2. Without a legal form blockchain posses a threat to the financial industry.

History of the Watchmen

The US government and the endless acronymic agencies are best described by the late political philosopher Thomas Hobbes. According to Hobbes and the US gov, we are naughty by nature, also bound by a social contract and we need a Leviathan Monster (law enforcement agencies) to bring peace and order.

The US took this 17th century social contract concept a little too far obligating us, US citizens, to social security numbers and passports. These birthright identifications have become essential in tracking our transactions. So basically, as a US person you can do what you like as long as it’s traceable and taxable. And the IRS just announced it will begin revoking passports of those who have not filed their taxes or have not paid their taxes.

Blockchain transactions need no id, why do online transactions need ID?

In 2005, the FFIEC the board of Federal Financial Institutions Examination Council (aka FFIEC) published a guide called Authentications in an Internet Banking Environment. The publication focuses on Risk Management for financial institutions that would offer internet- based products and services. According to these standards, the customer has the burden of providing multiple forms of ID. The financial institution would have the burden of creating a system with layered security for customer authentication.

Blockchain can potentially offer internet based financial services. Moreover, it does not need to follow such guidance from FFIEC, when dealing with coin to coin transactions. Nonetheless, if you want to stir the hive and do FX exchange, i.e. coin to fiat or visa versa, well that’s new treacherous territory.

How to incorporate blockchain?

First, if you’re a fintech company and want to use blockchain technology for financial transactions, you would need a flexible jurisdiction or a “hungry” offshore jurisdiction. My suggestion is to obtain a banking license or a money service business license.

A popular jurisdiction that does not report to US under FATCA or CRS rules is Puerto Rico. There are other places like; Mexico, Panama, Dominica, Belize, Cayman, Switzerland, etc. which may be a bit more less restrictive on their banking sectors, but still, must report all US people to the US government. For more, see: Best offshore bank jurisdictions.

Why the US? The US hosts the highest number of cryptocurrency users and Bitcoin trading volumes in the world. Cryptocurrency users would be more proud of using an International Blockchain based bank.

Second, the integration of your blockchain technology would mean following online internet banking rules. Your blockchain operation have to comply with AML/BSA/CTF and KYC regulations. Those acronyms are; anti-money laundering, bank secrecy act, counter terrorism financing and know your customer. You thought mining bitcoins was difficult.

Thirdly, the key to a successful operation is the interface of blockchain with a certified risk management tool that could; follow OFAC, identify PEPs, and generate SARs. That is just the beginning.

For more on building an offshore bank, see: Offshore Banking and a Great Money Transfer Service Provider

For more on starting a bank through an ICO, see: Cryptocurrency and Bitcoin in Offshore Banking

I hope you’ve found this musing on blockchain in the financial industry helpful. For assistance in building or buying an international financial entity, please contact HERE. We’ll be happy to work with you to structure and launch a fintech bank offshore.

Here are some additional articles that I know you’ll love reading:

The Ultimate Guide To Going Offshore

Where to Start Operating your ICO from?

Startup Bank for Interfacing With Cryptocurrencies

The Resurgence of Private Offshore Banking

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!