Offshore Corporations in 2018

After all the news of President Trump’s tax plan, you may want to see this review of offshore corporations for 2018. You’ll also see a specific focus on the benefits of the Foreign Earned Income Exclusion (FEIE). Thirdly, as an example, you’ll see outlined one specific offshore business for anyone who loves horses. This is an equestrian business that holds the ultimate “Time Machine” opportunity for anyone who wishes they could go back to California 50 years ago, knowing what they know now.

I wish I could go back in time 50 years ago with my checkbook. Don’t you? Imagine the possibilities. All those “coulda/shoulda” moments that we let pass by. If you love horses, or know someone who does, be sure to check this out or pass this article along.

But first, the tax stuff. This is kind of like eating your Brussels sprouts before you eat the steak.

While multinationals received all kinds of tax benefits under the new system, not much has changed for international small businesses or offshore corporations this year. Had individuals moved from a worldwide tax system to a territorial system and received the same benefits as multinationals, they would not pay any U.S. tax on foreign-sourced profits nor would they pay U.S. tax on capital gains or passive income. We would not be penalized for holding a U.S. passport.

But there are benefits under the old tax code for individuals, and they usually involve setting up an offshore corporation. There are many kinds, but a common form in Common Law jurisdictions is an International Business Company. This form of company is commonly referred to as an “IBC,” a term that is thrown around a lot in the international circles.

So, here’s what you need to know about setting up an offshore corporation in 2018 and how to best take advantage of tax savings when you live and work abroad.

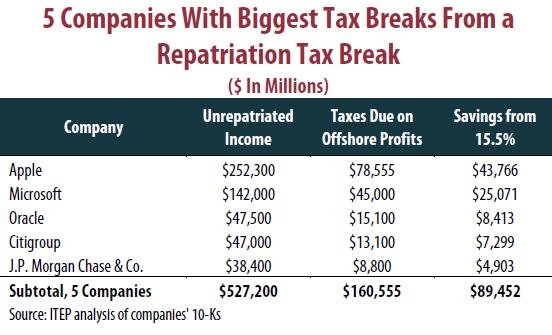

First, let’s consider multinational offshore corporations. The big guys (you can read big donors) got major tax benefits. Offshore divisions of U.S. companies have historically been taxed in the United States on their worldwide income… that’s changed under President Trump.

Offshore corporations which operate outside of the United States pay U.S. tax on U.S. sales only. They no longer pay U.S. tax on foreign sales. No need to hold those retained earnings offshore to defer U.S. tax. This is a major change and huge benefit for corporations.

To put this another way, U.S. multinationals moved from a worldwide tax system to a territorial tax system. Trump closed loopholes that allowed U.S. companies to move U.S. source income offshore and eliminated U.S. taxation of foreign-sourced profits. No more tax breaks on U.S. source profits balanced against zero U.S. tax on foreign-sourced profits.

Apple is bringing back about $30 billion, which is great, but they saved over $47 billion in taxes they would have had to pay under the old tax rules. But let’s be real here. Chances are they would not have brought that money back for decades, if ever. So, despite the hand wringing by Bernie and others, the benefit to the U.S. is significant.

It pays to be a big player. Because this change, unfortunately, doesn’t make much of a difference for Americans living and operating a business abroad. It also doesn’t help small business owners that are living in the United States and operating through an offshore corporation.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

Unlike multinational corporations, U.S. citizens remain taxed on their worldwide income. So long as you hold a U.S. passport, you must pay U.S. tax on your worldwide capital gains and business profits.

Unfortunately, the move to a territorial tax system doesn’t apply to individuals. We had hope for a time that both small and big business would move to a territorial tax system (which is the case for ALL other major nations on the planet), but that didn’t happen.

However, there is one huge tax break for an individual living and working offshore. It can be a savings of over $30,000 for a single and more than $60,000 for a couple. There’s one catch, though. Actually, there are 3 parts to the puzzle that you must have to enjoy this tax break:

- You have to live and work outside of the U.S.

- You must earn foreign-sourced, active income.

- You must be a foreign resident.

Live and Work Offshore. Save Taxes and Enjoy the View.

So, when a U.S. person living abroad operates a business through an offshore corporation, they must qualify for the Foreign Earned Income Exclusion for 2018. If you qualify for the FEIE, you can exclude up to $104,200 of business income from your personal income tax return.

If you withdraw more than the FEIE amount from your corporation, you pay U.S. tax on the excess. Also, the FEIE doesn’t apply to capital gains or passive income, which are fully taxable in the U.S. so long as you have a blue passport.

In future articles, I plan to offer up a long list of Joint Venture (JV) ideas for people looking to move, live, and work offshore. Our company is always looking to partner with entrepreneurial folks looking for a new opportunity offshore. It just makes sense to find people with a passion for something that dovetails into a need for ECI Development. We build our business and serve consumers with a product or service they want without the time and cost of developing that model internally.

For the partnering person or group, the benefits are great, too. The main advantage of partnering with an existing organization offshore like ECI is that you don’t have to worry about many of the in-country learning curve hassles, like how to file your bi-weekly taxes, legal issues, cultural and hiring challenges, and other not-so-fun parts about operating a business.

Also, importantly, Joint Venture Partners do not need to invest the tens of millions of dollars to run electricity, build water systems, construct roads, etc….just to get to the starting line. They can build on an existing platform and then focus on the fun parts of the business and invest standing on the shoulders of ECI in this case.

Equestrian Joint Venture Case Study

For example, our Gran Pacifica business unit has stables and a few horses. They are there for guests to enjoy a ride up the beach at sunset or to visit the teak plantation on the “back 40.”

Gran Pacifica: “The golf and horseback riding were fantastic. Loretta says it was the best horseback riding we have ever experienced!” Don Hosmer, CEO Royal Energy.

But there is so much more that can be done with the horses, stables, equestrian center, and even an equestrian neighborhood. Gran Pacifica has over 2,500 acres of rolling rangeland and 3.5 miles of Pacific oceanfront property. Think Orange County 50 years ago and you get the idea. A JV partner who can actualize the equestrian opportunity stands to profit from the business certainly, but also depending on how we partner, from the appreciation of the real estate over time as well.

This is just one example of JV partnerships. Later this year, I will write an article specifically focused on opportunities to partner with ECI in Belize, Nicaragua, Costa Rica, and in our future locations of Argentina and Ecuador as well. If you want to receive a special notification of the opportunities when the list is complete, click here and we’ll be sure to add you to an insider list to receive the ideas ahead of everyone else.

The opportunity to live and work overseas is as big as people have ideas to offer. This is especially true now with the advent and growing population of “Digital Nomads.” Anyone who has a job or profession that they can do from anywhere is a potential expat living and working overseas. The key is to make sure that you meet all parts of the 3-part test listed above. More on part 3 of the test below, the residency requirement which can be a challenge for many looking to qualify for the FEIE.

Not all jobs would fit the criteria needed to qualify for the FEIE, but many will. With this in mind, when we consider offshore corporations in 2018, we note two categories. Those are:

- Offshore corporations operated by U.S. citizens living and working abroad, and

- Offshore corporations operated by persons living in the United States.

The second category is simple enough. If you’re living in and working in the United States, an offshore corporation provides no tax benefit. An offshore structure can give you access to international banks, asset protection, and privacy, but not tax savings. Income earned from work performed in the U.S. is always taxable in the United States.

And the first category has remained the same. A U.S. citizen living abroad can use the FEIE to eliminate U.S. tax on his or her first $100,000 of ordinary business income, and the rest is taxable. In most cases, you can retain earnings in your offshore corporation and hold those profits tax-deferred.

Note that, if you are operating a business abroad, you must form an offshore corporation. You will then draw a salary from that corporation reporting the FEIE on IRS Form 2555 attached to your personal return. The corporation will also file Form 5471.

If you do not have a corporation, you’ll pay Self Employment tax on your profits. That’s a 15% penalty for those who don’t plan properly.

Adding to the pain, you’ll be forced to report your business on Schedule C rather than 5471 and 2555. As a result, you’ll lose a big chunk of the Foreign Earned Income Exclusion. This is because the FEIE will be applied to both your income and expenses when reported on Schedule C.

So, if your net business profits are 50% (your expenses are 50% of gross sales), then you lose 50% of your FEIE. If expenses are 75% (a 25% margin), you lose 75% of the FEIE.

Bottom line, operating a business offshore without an offshore corporation is crazy.

In order to maximize the benefits of the Foreign Earned Income Exclusion, you should form an offshore corporation in a zero-tax jurisdiction. I suggest Nevis, Belize, and Panama as first options for tax planning and asset protection. However, everyone’s situation is different and there are many different countries that can be a good fit. Belize and Nevis offer Common Law structures which may be easier and more familiar to English-speaking North Americans. Panama structures will be based in Civil Law and documents will be in Spanish.

Also, what many people fail to realize is that just having an offshore corporation, living overseas, and earing active source foreign income doesn’t meet the 3-part test for the Foreign Earned Income Exclusion. You must also be a resident of another country.

This works if you plan to live stationary in one country for a long period of time. You’ll need to have a residency to remain there unless you want to do the “border run” every time your tourist visa expires, which is usually either 30 days or 90 days. By the way, this is a practical strategy employed by many expats, even full-time retirees who own property, but it has its limitations and dangers that can be significant. You could be a “dreamer” in a foreign country. That wouldn’t be good.

The better solution is to obtain a legal residency in the country where you reside. It’s usually simple, easy, and painless when you hire a lawyer. You can always do this on your own, and many people do, but I generally don’t try and fix my car engine even though I can get some books from the library to tell me how. Hire an expert.

But I wander from the main point here. In order to meet the 3-part test, you must be a resident of a foreign country.

What if you want to live in many places? What if you are a ship captain who travels the world but is a resident of nowhere? What if you want to be a PT (perpetual traveler) and move from one exciting place to another, living a few months a year in many locations? How can you pass this third part of the test?

One answer, and the best I’ve seen to date is the Special Nations Visa in Panama. Unlike many residency programs that require a minimum stay in the country, sometimes 6 months, and sometimes a full year or more, Panama allows you to maintain a permanent residency by spending 1 day every 2 years in-country.

Let me repeat that. You can be a permanent resident of Panama if you spend one day every two years there. This is the perfect residency for a PT or Digital Nomad. Rachel Jensen has some great ways to become a resident of Panama under the special nations visa, where you can receive back all you invest in a few years – literally making the 2nd residency in Panama free. Reach out to her here if you’d like more details.

Here is probably the most extensive ebook on Everything You Ever Wanted To Know About Eliminating Your Taxes, Protecting Your Assets And Regaining Privacy Over Your Life And Investments. It is called The Ultimate Guide To Going Offshore. Visit our bookstore to purchase it today!

I hope you enjoyed reading this article: Offshore Corporations in 2018. If you have any questions, please contact our office HERE.

I’ve included some great articles for you to read, enjoy!

Guide to Foreign Tax Credit, Foreign Tax Treaties and Foreign Housing Exclusion

7 Ways to Effectively Manage Your Finances as You Plan to Settle Abroad

The risks of offshore tax deferral

What are the ways to go about getting a second passport and why is a second passport good to have?

Characteristics and Legal Status of Offshore Incorporated Companies

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!