Wall Street and Crypto Currencies – Volatility in Common.

Over the past year, many of you have seen modest but steady returns on your stock portfolio. People who owned Bitcoin for the year 2017 also saw great gains, even if some of those gains fell off at the beginning of 2018. This article looks at the possible bubbles in both the stock and crypto markets. The parallels are striking, especially when it comes to volatility. We examine this aspect of both here. First, the traditional stock markets.

Wall Street Bull Market – How Much Longer?

At the beginning of 2017, the Dow Jones was hovering just below 20k. An optimistic market vaulted this index, topping 26k towards the end of this past January. The media craze and chaos surrounding Washington, DC, over the past year has had little effect on the markets, except to perhaps be an outlet for excess cash in the system.

Many have seen me write about the QE bubble in the past. The trillions printed after the 2008 crash went in to prop up the balance sheets of banks. Now it seems that some of that money is hitting the streets, too. Unemployment is down. Consumers are earning more. They are spending more, too. Business owners were patiently awaiting new tax laws that would contribute to a fatter bottom line. And now they have them.

But were businesses really doing as well as the markets were showing?

Share prices highlight more than just how successful a company is. “Irrational exuberance” can push stocks higher. A rumor, whether true or false, can cripple a company’s share price overnight. All of the variables that contribute to public perception show why markets can be so volatile.

Volatility – A Powerful Indicator

It is easy to forget about market volatilities when CNBC reports every morning how the DOW and other indexes are hitting record highs month after month. But just like the human body that needs to breathe in and breathe out on a periodic basis, the markets cycle too. They have their ups and downs and those that forget this fact can face some tough “surprises” when the cycle moves down – unless you are a bear, of course, and expect a market drop. But bears are wrong too at times when the bull roars ahead.

Market volatility is harsh. The public saw its first slap in the face of reality two weeks ago. The last week of January saw the DOW drop 4%, the largest weekly drop since early 2016. One of the days posted a 2.5% loss – the largest individual day loss since the 2008 Financial Crisis. Is this a sign of things to come?

Who knows? The market rebounded this past week. But we should all wake up to market realities. The smart investors know that market drops are the best times to get a bargain. The emotional investors will sell shares on the slightest rumor of a missed earnings report. The wisest investors know when to take some of their winnings off the table and tuck those funds away for a stronger buying opportunity in the future. For when the next downturn happens, and it will, they will have the cash to pick up the best bargains.

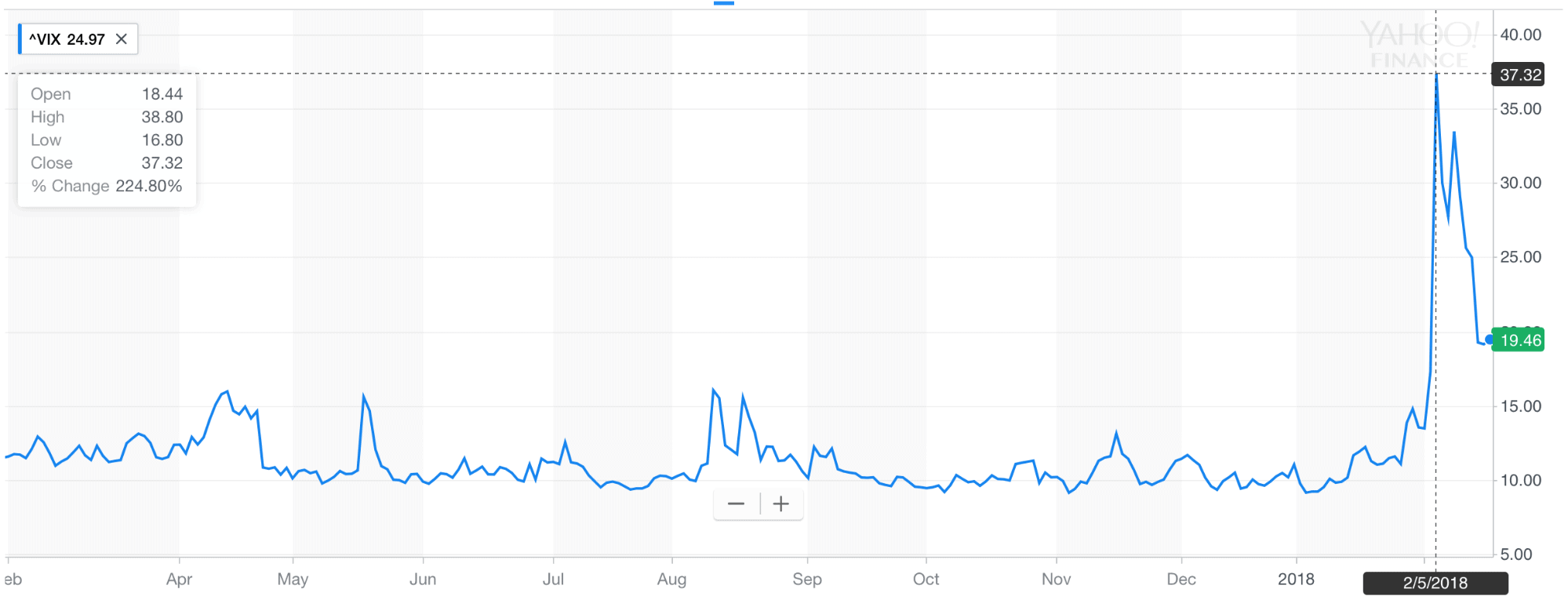

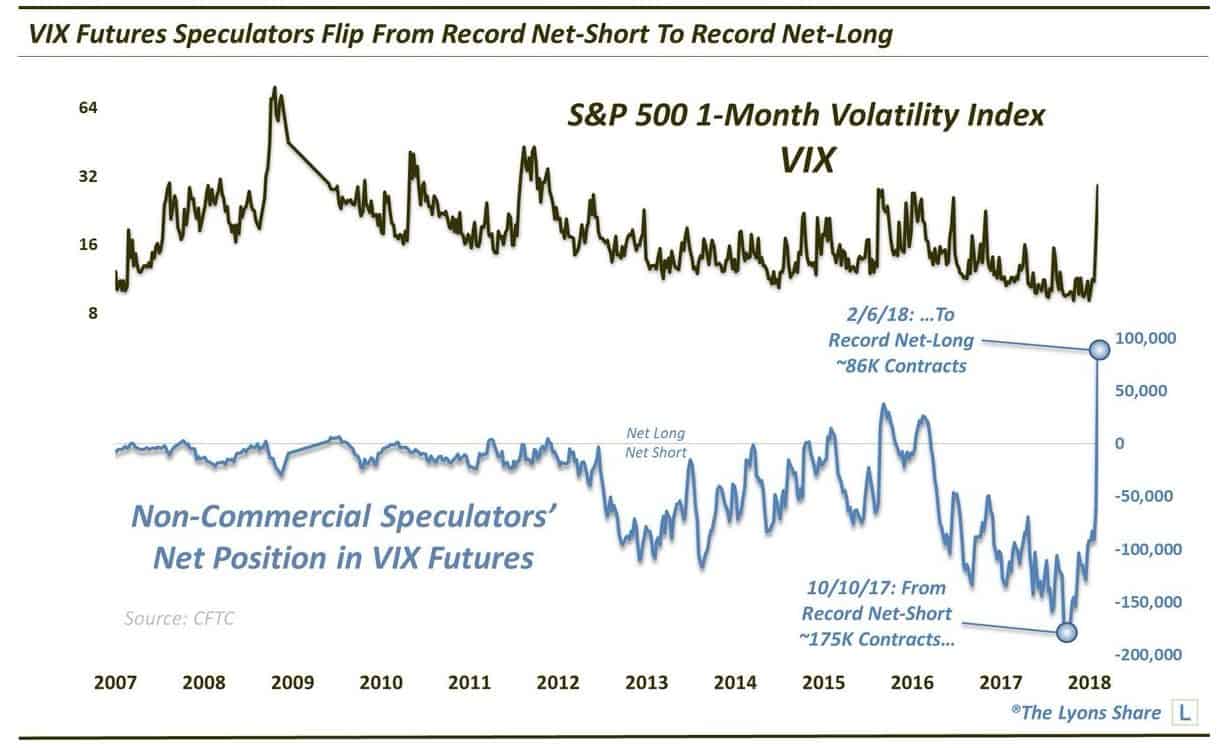

An index that is quickly becoming a reliable market predictor is the VIX. The VIX is essentially a volatility index. The higher the index is, the more volatile the market is, and vice versa. Futures trading on the VIX has become equally as popular. People are willing to bet…. (or is it invest) in almost anything.

As of February 6th, futures trading on the VIX was at a record high. This basically says to the public that traders are betting that the VIX will be jittery for the foreseeable future, as uncertainty becomes the new normal for stocks.

I do believe it’s betting. I just can’t help myself, because unless one or many of them have a crystal ball, the future remains uncertain. Therefore, any prediction is really just a bet. An informed bet, perhaps, but a bet.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

For the last year, the index hovered between $10 and $15.

On February 6th, the index hit $37.32.

We did see the market recover in the past week, but there are a record number of futures contracts placing long bets on the VIX. Even with the week’s market recovery, people are more “bullish” on volatility than ever before. Bullish on volatility…sounds funny, doesn’t it?

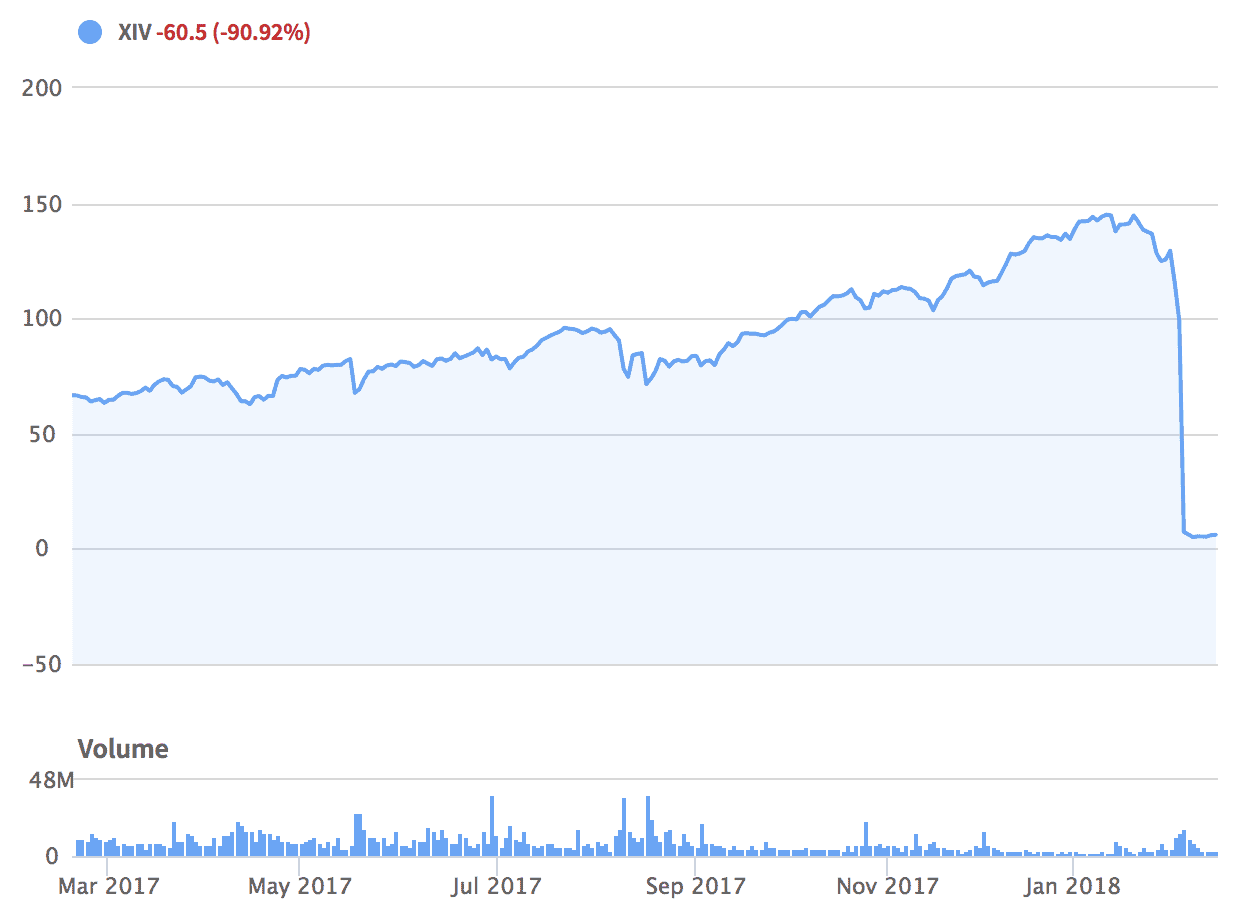

The XIV, which bets against market volatility, actually halted trading this past week after losing billions. Volatility fever can be seen across the board in markets, especially for those invested in cryptocurrencies. The chart below is an almost inverse of the charts above. For every winner, there’s a loser.

I know many of the traditional stock market readers will stop here. So, the next couple sentences will be repeated now and at the end of the Crypto section as well.

All of this talk on volatility brings me back to the importance of diversifying your assets. Diversification is wise. Many baskets for your golden eggs. Taking some money out of the markets while the getting is good makes a lot of sense. But what to do with the funds you pull out?

Certainly, gold and other physical metals are excellent hedges and strong stores of value. Commodities and real estate are superb as well. Prudent investors all have some of their portfolios in these asset classes.

Diversifying your investments internationally is another level of safety. Do you own hard assets outside North America? Unless you own hard assets outside North America, you still have all your eggs in one basket…the U.S. and/or Canadian basket.

Investing outside your home country is investing outside the box. Hard assets like real estate outside North America, even more so. There is no competition outside the masses. Strive to be outside the competition.

To learn more about hard assets ownership outside North America, click here.

The Crypto Market – Wild Swings but Settling Down?

Let’s move to cryptocurrencies and specifically Bitcoin as an example. After topping at $19.3k in December, Bitcoin nosedived to $6.9k on February 6th, before rebounding back up to $11k this weekend. That’s nearly a 50% gain in a week. 50% in a week!!!! Talk about volatile.

Most of those invested in crypto will bear through the volatility in hopes of larger paydays. They expect it as that market matures, with winners identified and losers lost. But there are those who simply do not want to risk another 65% drop in value and will exit the currency. The biggest number of folks that are exiting are taking profit off the table.

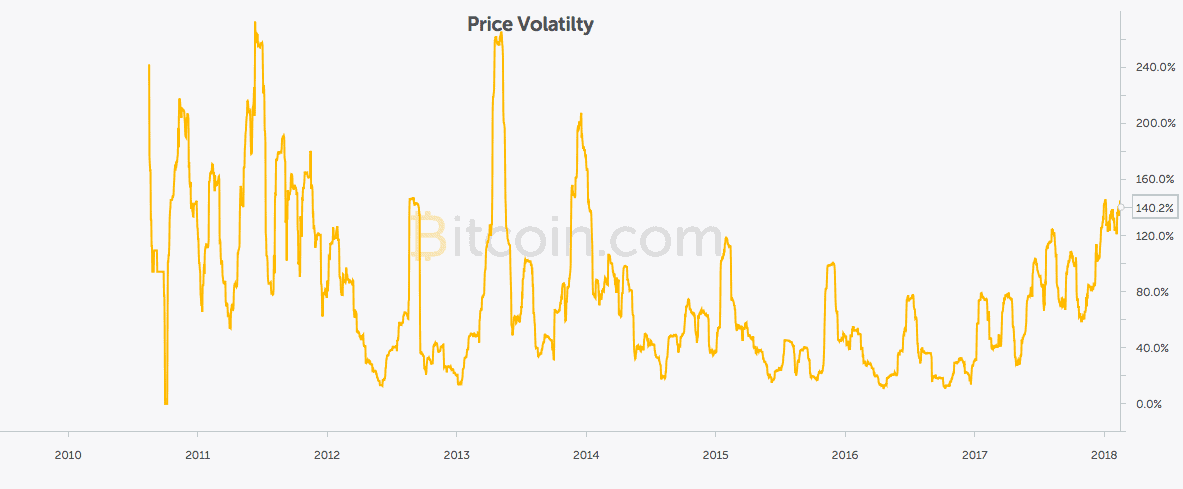

Of all the “cryptos,” Bitcoin is the most stable with some of the lowest volatility. The chart below shows the volatility of the currency dropping over the last 8 years, as the price swings become less and less. A maturing of the market and the entry by hundreds of thousands of new owners has stabilized the value in important ways.

However, the long-term value of Bitcoin or any cryptocurrency will be in its use by consumers and acceptance by merchants. When a currency moves from a speculative product to a means of transaction, swings in the value and overall volatility will reduce even further. However, as long as the cryptos remain a speculative “investment,” wild swings in value are likely to continue.

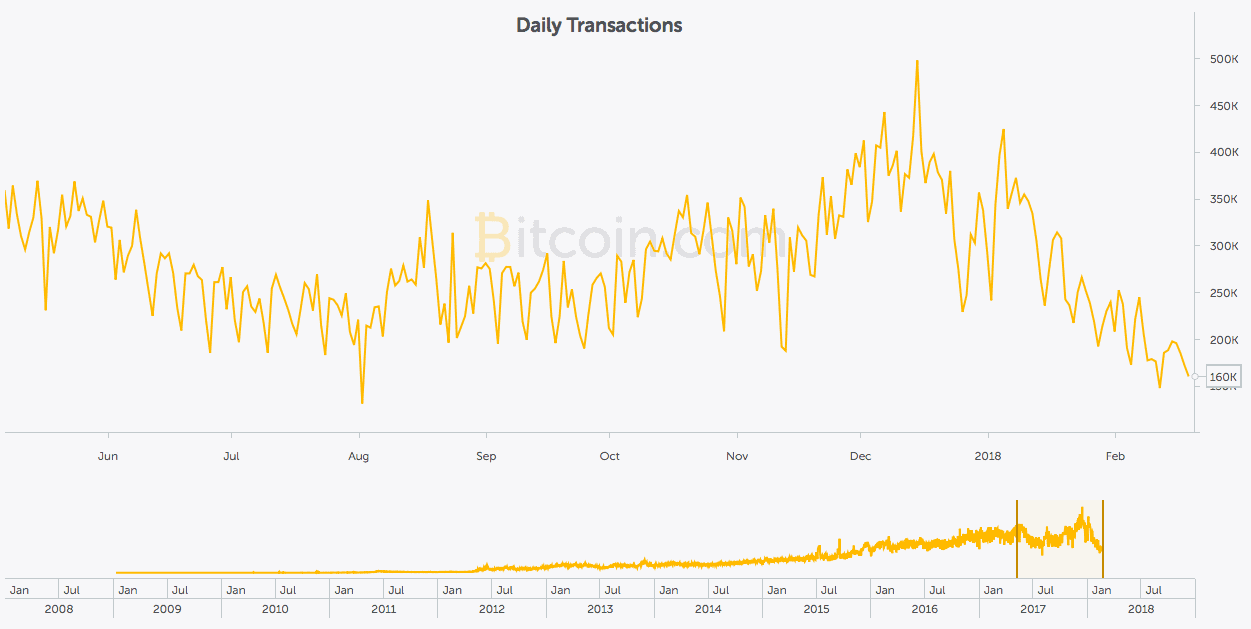

The one positive trend is the reduction of transactions, interestingly enough. The daily transactions chart below shows transactions climbing fairly steadily over the last 9 years, spiking in late 2017 and dropping back to 2015 levels since. Speculators are typically in and out of markets to capture gains (or stop losses) quickly and frequently. Think day traders.

So, what does this mean for people who are investing/betting in and on the cryptos? How do these macro indicators impact the traders of the currency? At a recent crypto conference at which I spoke, the bulls had the floor. But as I spoke with many of these folks, they also understood that the wild price fluctuations were driven largely by speculation at this time.

Many of these traders are cashing out with part of their winnings while they have some enormous profits on the table. I heard one gentleman say he purchased an island in Belize for $8 million. It could be true. He’s a “Bitcoin Billionaire.”

Savvy crypto investors are wisely diversifying into other assets. They want to lock in some of the gains made in the wild, wild west of the current crypto marketplace. The forward-thinking leaders in the crypto industry already are. Many more will follow as the wisdom of investing some of their profits in less volatile assets becomes heard. Hard assets like physical metals and real estate are two popular investments being made by traders in the crypto space. Hard assets outside North America are an even better way to protect and lock in value.

Despite the bullish fever at the conference, the word in the mainstream markets say that public confidence in crypto has been taking a hit lately.

…China is implementing a ban on all websites that relate to ICOs and crypto trading.

…Facebook has banned crypto advertisements.

…The Indian Prime Minister of Finance stated that the Indian government “does not consider cryptocurrencies legal tender or coin and will take all measures to eliminate the use of these crypto-assets in financing illegitimate activities, or as part of the payment system.”

Just like rumors on Wall Street can lead to market swings, negative news from China, India, the U.S. Fed, and others will keep volatility high for the time being. Bitcoin and other cryptos are sure to go through their highs and lows. Yet, the price rebound in the last few weeks indicates that many in the marketplace still believe in the value and worth of many cryptocurrencies.

Ultimately, these currencies must become a means of transaction if they are to survive long-term. Many companies are frantically trying to figure out the best way to accept cryptocurrency without taking on the risk of the currency crashing on any given day.

Conversion to a physical currency like dollars is a key element of the process for merchants to accept crypto. Fortunately, this is becoming easier and faster all the time. For many companies, ours included, downstream suppliers don’t take cryptocurrencies (yet) and, therefore, the hard costs of production and labor must be covered in physical currency.

Another solution emerging for companies that want to accept crypto is hedging futures contracts on Bitcoin, for example. Companies with low-profit margins cannot absorb the price volatility of cryptocurrencies on a daily basis. The emergence of futures contracts on cryptocurrencies will surely lead to a large influx in merchants that accept crypto over years to come.

A company like Starbucks, for instance, would surely be worried about its revenues being subjected to the crypto market volatility. By hedging the crypto, a company can protect against potential losses. By being one of the first major companies to accept Bitcoin, Starbucks would surely reap the benefits of the valuable publicity around the move.

At ECI, we have prided ourselves on being at the forefront of the cryptocurrency trend. We are one of the first developers in Latin America to accept Bitcoin for real estate purchases. While we can’t assure you that investing in Bitcoin will be a profitable and safe investment in the long-term, we are confident enough in the market to accept it as payment for ECI property. If you would like to trade in your cryptocurrency for secure hard assets, inquire with us here.

All of this talk on volatility brings me back to the importance of diversifying your assets. Diversification is wise. Many baskets for your golden eggs. Taking some money out of the markets while the getting is good makes a lot of sense. But what to do with the funds you pull out?

Certainly, gold and other physical metals are excellent hedges and strong stores of value. Commodities and real estate are superb as well. Prudent investors all have some of their portfolios in these asset classes.

Diversifying your investments internationally is another level of safety. Do you own hard assets outside North America? Unless you own hard assets outside North America, you still have all your eggs in one basket…the U.S. and/or Canadian basket.

Investing outside your home country is investing outside the box. Hard assets like real estate outside North America, even more so. There is no competition outside the masses. Strive to be outside the competition.

To learn more about hard assets ownership outside North America, click here.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!