My Retirement Dreams…? Get Real

Sorry for the depressing article title. But, seriously, I was a bit disappointed recently when I watched a commercial for the Charles Schwab brokerage firm. There sat a stately looking, white-haired gentleman who seemed like he could be the poster child for the AARP. He was talking about his experiences with some brokers who discussed things like the enjoyment of a vineyard in retirement. As the commercial ends, the tagline is, “A vineyard? Give me a break.”

OK. I do understand the message. Many retirement planners like to talk about pipe dreams and other unachievable goals. It’s what motivates people to save. And that’s a good thing, especially for the vast majority of baby boomers headed into retirement right now – because they are not saving.

Ernst and Young conducted a study back in 2008 and it showed that retirees will have to cut back, on average, by about 25% to avoid outliving their assets. This is a tough economic reality, one that begs serious examination.

In the commercial, we get to hear the man talking to himself about being responsible and having enough money for retirement. He expressed the concerns that I guess most of us have, like: Do I really have enough for retirement? How can I make it last? What are my sensible choices?

These are, in fact, great questions to be asking. Taking responsibility is the hallmark of excellent character. However, if we keep our thoughts “inside the box,” our choices are, in fact, very limited. Must cutting back equate to suffering?

Maybe. Maybe not.

It all depends on our perspective and willingness to explore beyond the boundaries a little bit. By the way, Maybe. Maybe Not is also the title of a short and wonderful book by Robert Fulghum, the same author who wrote All I Really Needed to Know I learned in Kindergarten. Both are easy to read and mind-expanding in meaningful ways at junctures like these.

Now, a little closer look at the savings statistics mentioned above. The news is bad. I warn you now. We have good news to cover too, though. After the sad statistics, we’ll watch another commercial with a message of hope and examine some outside-the-box options for a better retirement than the statistics would suggest is possible. Let’s start with the bad news.

Listen to this, right out of Forbes:

“The viability of the retirement income mechanisms depends on the assumptions made about returns on assets and liabilities – like health and longevity. The U.S. savings gap – $7.7 trillion in 2013 – is a train wreck ready to happen.”

What’s going on here? The stock markets are at all-time highs. The Dow is up over 300% from the March 2009 low of 6,626, bouncing around the 24,000 mark recently.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

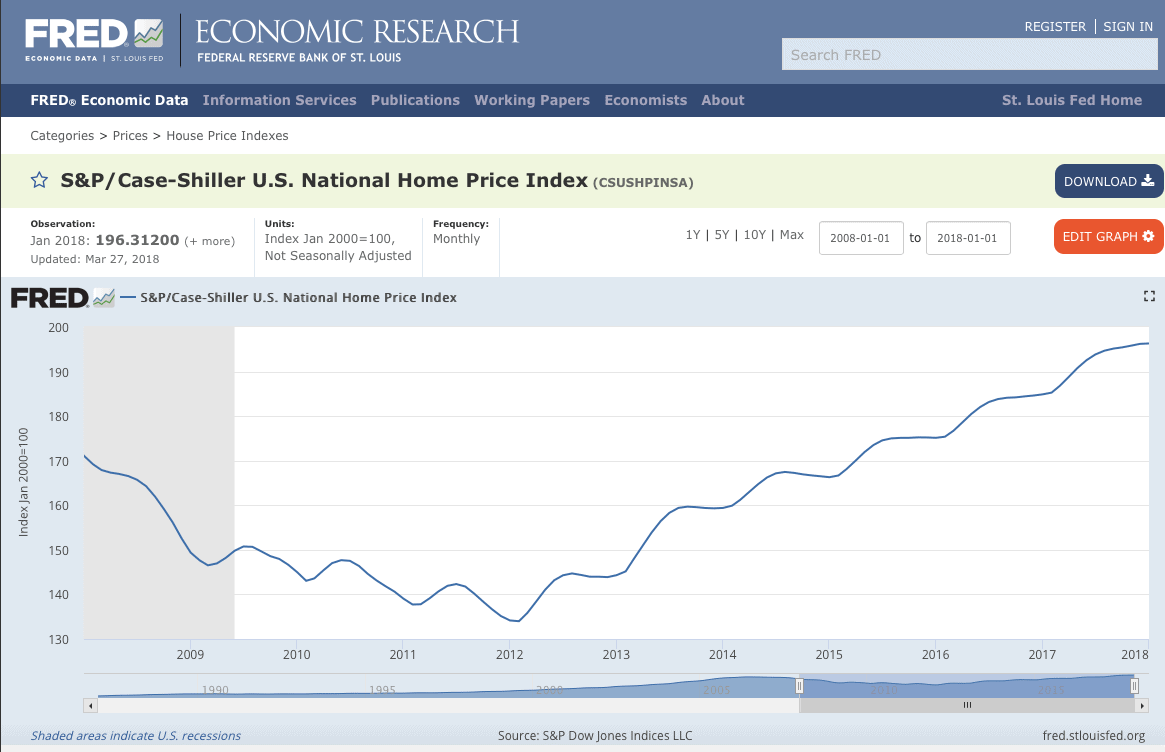

Real estate values are up, too – over 30% higher today than the lows in 2012. Homeowners should be in as good a position as ever when they get ready to sell and downsize.

Unfortunately, this great macroeconomic data hasn’t really pushed into the savings pocketbooks of most baby boomers yet. Will it? Can it? A column I wrote last year Who’s going to buy them. suggests that there may not be enough new owners for all these homes when they resale and far too few investors for the stocks and bonds at current valuations. If this is true, then even current portfolios may be at risk.

For now, though, let’s stay with the present and look at some recent data on the financial status of this huge baby boomer demographic.

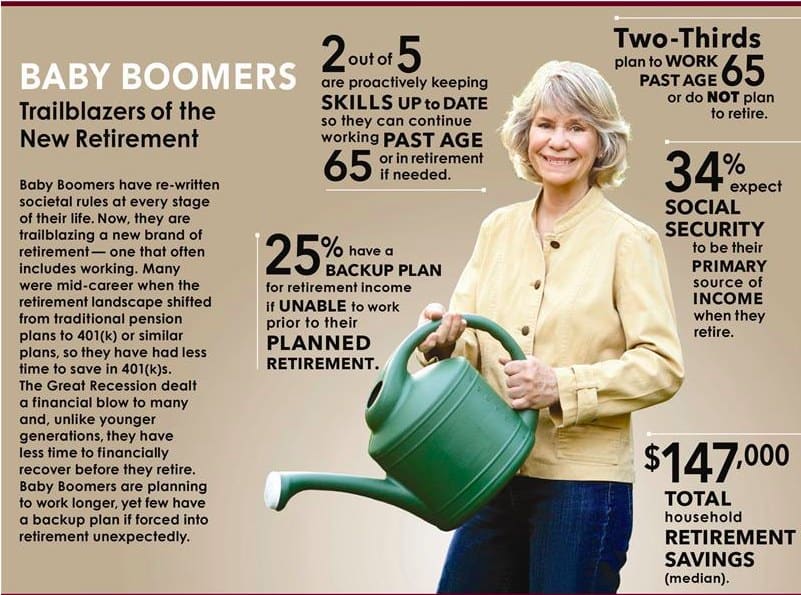

In January, The Fool reported that:

“As the baby boomers retire in large numbers, they’re finally getting the chance to see how well their retirement planning (or lack thereof) has paid off. Unfortunately, many boomers aren’t happy with the results: 68% wish they’d saved more, and only 24% are confident that they have enough money to last throughout their retirement, according to a study by the Insured Retirement Institute.”

A March 2018 report says:

“It used to be that having $1 million was what you needed to retire. It sounds like a lot of money, but financial guru Dave Ramsey says it still might not carry you all the way through. If you’re a baby boomer who has just retired or is about to and you don’t have $1 million sitting around, don’t worry — you’re not alone. In fact, most boomers aren’t even close. According to PwC, 62% of all boomers have less than $200,000 stashed away for retirement. Only 17% have $500,000 or more.”

And here’s the data at a glance:

OK. At some level, the comment about not buying a vineyard makes sense. Based on hard economic realities, many of us may not be able to afford many of the things we’d hoped for in retirement. However, the tougher question is, “Will the amount I have saved be enough to supply me the basics of life throughout my entire retirement?”

Forget about luxury. I just want my money to last as long as I do. This, of course, is a very valid concern no matter how much money you have saved.

But circling back to where we started, something about the brokerage ad really bothered me. The tagline “Give me a break” just seems so glib. As if trashing 50 years of hopes and dreams by a generation of Americans and Canadians is simply like tossing out yesterday’s newspaper. How very sad, indeed, if millions of boomers headed into retirement are thinking this way. And it seems like most are.

But there is good news for folks open-minded enough to see and hear it. You are probably one of them because you are reading this article. You know there’s more than one way to “skin a cat.” Likewise, there are some strong, wonderful alternatives to throwing away your lifelong retirement dreams.

Please do me and a friend or two a favor. If you enjoyed it when you finish reading, post this article on your Facebook page. Forward it to some worried colleagues who may be wondering how they are going to enjoy retirement. Take the proverbial horse to water and let them decide if they want to drink. Those that do will surely thank you deeply for opening their eyes to opportunities for a golden retirement on what they have saved for it right now.

Think Outside the Box

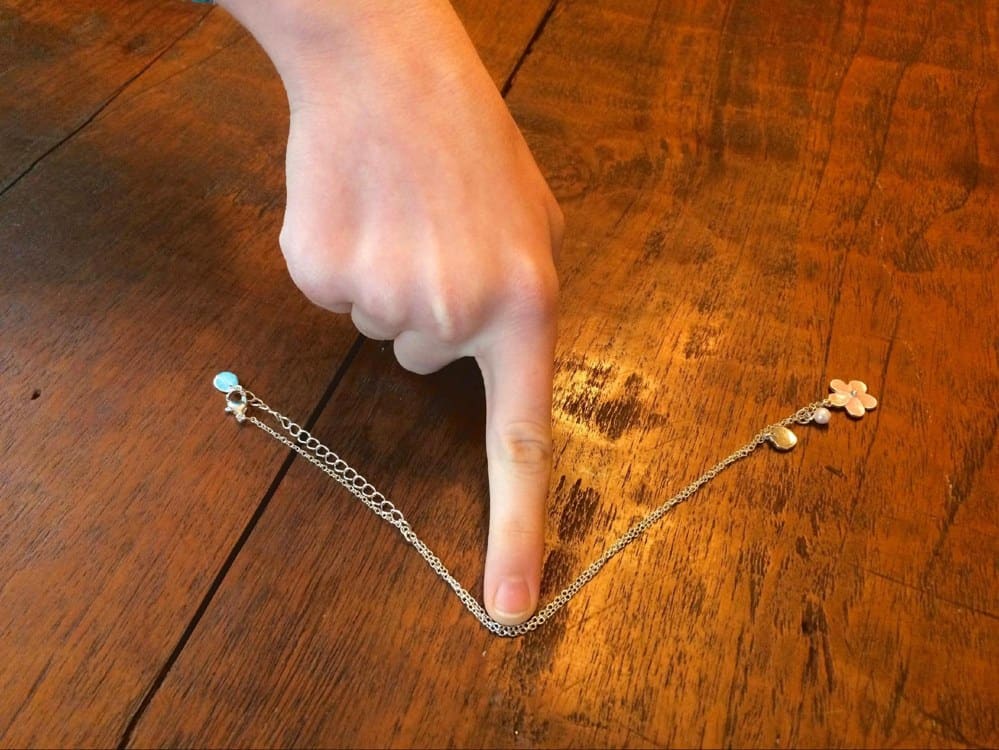

My daughter and I were talking one morning and the subject of pushing a rope came up. I told her that something I was working on felt like “pushing a rope,” an impossible task. I explained that ropes have to be pulled along, just like some problems, or in many cases, managing people.

Without missing a beat, however, she looks up at me and says that she can push a rope. I must admit, I raised a skeptical eyebrow and then went on to say, “OK. Show me.”

Not having a rope handy, she reaches up and unclasps her necklace. She proceeds to lay her necklace on the table in a straight line. She then puts her finger in the middle of it and pushes it towards me. “See, Daddy. I pushed a rope.”

I just sat there for a second and realized how short-sighted I had been, taking that saying at face value for my whole life. This is like assuming I’ll retire in the U.S. or Canada just because I never bothered to challenge the assumption.

A powerful advertisement that gets to the heart of breaking assumptions is the 1984 Macintosh Superbowl ad. It’s about a radical idea that we don’t all have to accept the “norm,” whatever that is. Watch it again now. It’s great.

The great news is that there are lots of solutions when we think outside the box. My daughter clearly saw an innovative solution to push a rope and rolled with it, just like the heroine in the TV commercial saw a way to break the stupor of mindless conformity.

There are almost always multiple solutions that we don’t easily see when it relates to our lives. This is especially true with highly emotionally-charged issues, like when we are faced with less income and savings than we had planned for in retirement. But necessity is the mother of invention, as they say.

When staring down seemingly impossible situations, like not having enough to live on in retirement, we can imagine the worst and become paralyzed with fear. We may feel like our backs are against the wall and there’s no hope. We may despair our choices, or lack of choices, because we don’t have enough saved. We may see ourselves sitting on benches, dressed in drab robes, accepting our fate dutifully like the millions of folks like us who have not saved enough for retirement – hopeful that social security and Big Brother’s safety net will be there to catch us.

Or we may not…

The Apple/Macintosh commercial asks us to break the boundaries of what we think is possible and challenges us to expand our horizons. Incredibly, just like how you really can push a rope (and, yes, wetting it and freezing it is another way) there are multiple ways to face the reality of a limited financial situation and still enjoy many of your hopes and dreams in spectacular ways. Certainly, one of my suggestions is to look overseas for a retirement location.

Living internationally is an outside-the-box solution that more and more folks are considering. The paradox is startling. You can live overseas for cheaper than a third or more and have a higher quality of life. That’s quite something, isn’t it? It’s a paradox like the Mobius strip which only has one side.

Pick a side and trace it around. Kind of mind-bending, isn’t it?

The reason many folks don’t initially think of leaving North America is that it simply lies just outside their radar screen and comfort zone. This is something you can change. Just by simply doing some online research, it is possible to get a feeling for life overseas. Planning a trip to visit and then rent a place by a tropical beach for a month or two to test-drive the scene makes sense.

Pacific Golf

Pacific Golf

Caribbean Pleasures

For many people, the option of moving overseas is very real and taking on greater importance every day. If you are reading this, then you probably already know that it is possible to have an oceanfront beach condo for less than $200,000, a home on a golf course for less than $150,000, and, yes, even a vineyard estate for about 10% of what you’d pay in Napa Valley. That’s 90% less. Yes. 10 cents on the dollar.

Incredible.

On the flip side, however, people do sometimes send me a critical note saying that prices of real estate in Latin America are now the same or, in some cases, even greater than in the U.S. And this can be true depending on the comparison. The least expensive homes in the U.S. are far less than most homes you’d want to own overseas. But, really, do you honestly want to own the least expensive home in the U.S.? I don’t.

But the main factor is where overseas living breaks from the crowd and gets its running legs. This is especially true in the developing world, where a modest income produces a phenomenal standard of living.

And please, don’t be deceived by the words “developing world.” I lived in Nicaragua for 14 years and it’s the 2nd poorest country in the Western Hemisphere. That said, my family’s quality of life would have been hard to duplicate in the U.S. on anything less than mid-six-figures.

The reality is that a budget of $2,000 per month delivers a luxury lifestyle in many countries of the world. Living nicely on less is easily possible. Pictures can only say so much, but whether it’s shopping malls, theaters with English movies, eating organic and free-range food for pennies, enjoying outdoor activities year-round, or giving back in so many meaningful ways, life overseas can be rich without costing a fortune.

Fixing Schools and Teaching English

Conservation and Baby Turtle Release

Shopping Locally for Organic Produce

Shopping at the Mall

Life overseas can be a mix of many things. See yourself having a maid and domestic help for just a couple hundred dollars a month? What a nice thought.

Imagine… No more chores.

Perhaps we’d see this as a luxury at first. But in the future, it’s a real necessity. As we age, having help around the house that we can afford will save us tens of thousands of additional dollars we might spend moving into assisted living long before we actually need nursing care. And overseas we can have that care right in our own home. Affordably.

Medical care is excellent, too. While there might not be as many hospitals as in North America, the care and technology are first-world. Johns Hopkins, the Mayo Clinic, and many other JCI accredited facilities are spread across the developing world. Medical tourism is growing leaps and bounds. The simple reason is that care is equal to most U.S. facilities, while the costs are usually less than deductibles and copays. Also, no waiting. How nice is that?

Lifestyle savings also apply to ongoing property ownership over 10-20 years. Just the HOA/COA fees, insurance, and property taxes can be hundreds of thousands of dollars more costly in the U.S. over a 10-year period. Most of us imagine living for 20 years or more after retirement. In that case, the savings of living overseas becomes phenomenal.

In life, there are no perfect answers, just trade-offs. Are you going to really be able to have the absolute best of both worlds, everything from North America just 2,000 miles south in Latin America? No, of course not. But to not explore the options and see what choices we really have is just plain silly. Especially when the research is free.

Choices, and the trade-offs associated with them, are a reality of life – just as having a smaller nest egg is an unfortunate reality for most of us today. The real bottom line is that if we are open to new ideas like living south of the border, we don’t have to just write off and then toss aside 50 years of dreams and hopes with a glib “Give me a break.”

These retirement dreams are part of who we are. Trashing them is tantamount to killing part of ourselves. We can still live these dreams if they are important to us, they may just come packaged with a 6-month dose of initial culture shock. But then, after you settle in, you can enjoy 20 or more years of living the paradox of a higher quality of life…for a lot less.

So, I’m sorry Mr. Stockbroker. I don’t buy it. If I want a vineyard, there are still ways to have it within the fiscal constraints of my new reality. I’m not staying in your box and your limited worldview. In my colorful world of opportunities, it’s, “A Vineyard? Give me one!”

A Vineyard Lifestyle for Under $350,000

The mind of a child is a wonderful thing. Seeing a simple outside-the-box solution to “you can’t push a rope” was as natural to my daughter as you and I seeing an outside-the-box solution to, “How do I still realize my hopes, dreams, and ambitions on the limited resources I have for retirement?” We just have to willing to explore the possibility.

Your outside-the-box solution is here, right now, and waiting to be discovered and created in your mind. Free yourself from the limits of thinking in only North American terms and see just how big the world is for you. Click here to begin researching ideas, options, and opportunities for a truly golden retirement. The research is free. The results could be priceless.

Here is probably the most extensive ebook on Everything You Ever Wanted To Know About Eliminating Your Taxes, Protecting Your Assets And Regaining Privacy Over Your Life And Investments. It is called The Ultimate Guide To Going Offshore.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!