Top Travel and Real Estate Trends for Millennials

This article was published in the Escape Artist Weekly Newsletter on October 10, 2018. If you would like to subscribe to the newsletter, please click here.

Because so many of the readers of this column are purchasing real estate overseas with an eye toward rentals, it makes a lot of sense to know who many of our future customers are going to be. We need to locate and market our properties to this demographic.

Last week, we covered some general data on the millennial generation. This week, we will look at specific elements and preferences as they relate to travel, real estate ownership, and investments.

But first, a story. A story of my first real understanding of one millennial’s mindset. Perhaps this was a specific mindset not common to all, or even many, but it’s one that I found interesting and telling about a way of thinking very different from my own as a baby boomer.

Let me go back to the year 2009. One year after the Great Recession hit the U.S. and the real estate market in Central America was in a tailspin. I was living in Managua, Nicaragua, at the time building the Gran Pacifica resort community on the Pacific. Our company frequently recruits interns for a semester. At that time, we had two young ladies who were working in the office as marketing and business development interns.

Because of the economic realities, we had just let our Chief Operating Officer go. We had laid off about 1/3 of our staff and asked the remaining employees to take a significant pay cut. I cut my salary to zero. We were finding every single savings opportunity we could to keep the company open and operating with few sales of property.

Needless to say, times were tough. Many of my competitors had already folded up shop by 2009. Many more simply disappeared, and many more developers like me would close in the coming year or two. However, I knew we were going to survive, and we did. But in the meantime, it was going to be a thin season.

So back to the interns. It was May of 2009 and their semester was up. I pulled the two young ladies into my office for an exit interview. I always did that to get some feedback on the company, the internship program, and any other comments of advice these young folks would like to offer.

We had survived seven very difficult months with extreme challenges to retain staff and stay in business. They had been part of this team for 5 of those months. When I asked if they had any improvement suggestions for the company or me, here’s what they said:

“You could get a cappuccino machine.”

I’m not speechless very often, but I was that day. Looking back, I see that this was a powerful lesson in culture shock. Generational culture. Certainly as “foreign” as anything I’d experienced living in Nicaragua for 7 years at that point.

The takeaway here for me was to see this generation, three removed from myself, as a culture to be understood and appreciated for what it is. Especially if I am to serve them with properties, vacation experiences, and products of any kind.

So, for that reason, this week, we focus again on the millennials, who they are, and what they like as best as any generalization can capture it. If rental properties are your thing, be ready for this up-and-coming demographic. They will become a larger and larger share of your business.

Real Estate & Investments

“The housing market now seems so unaffordable that many millennials

are setting their sights overseas when it comes to buying a property.”

—Stuart Marsh for 9Finance, 2017

Demographics

Demographics

- By 2025, millennials will make up 75% of the global workforce.

Other Statistics

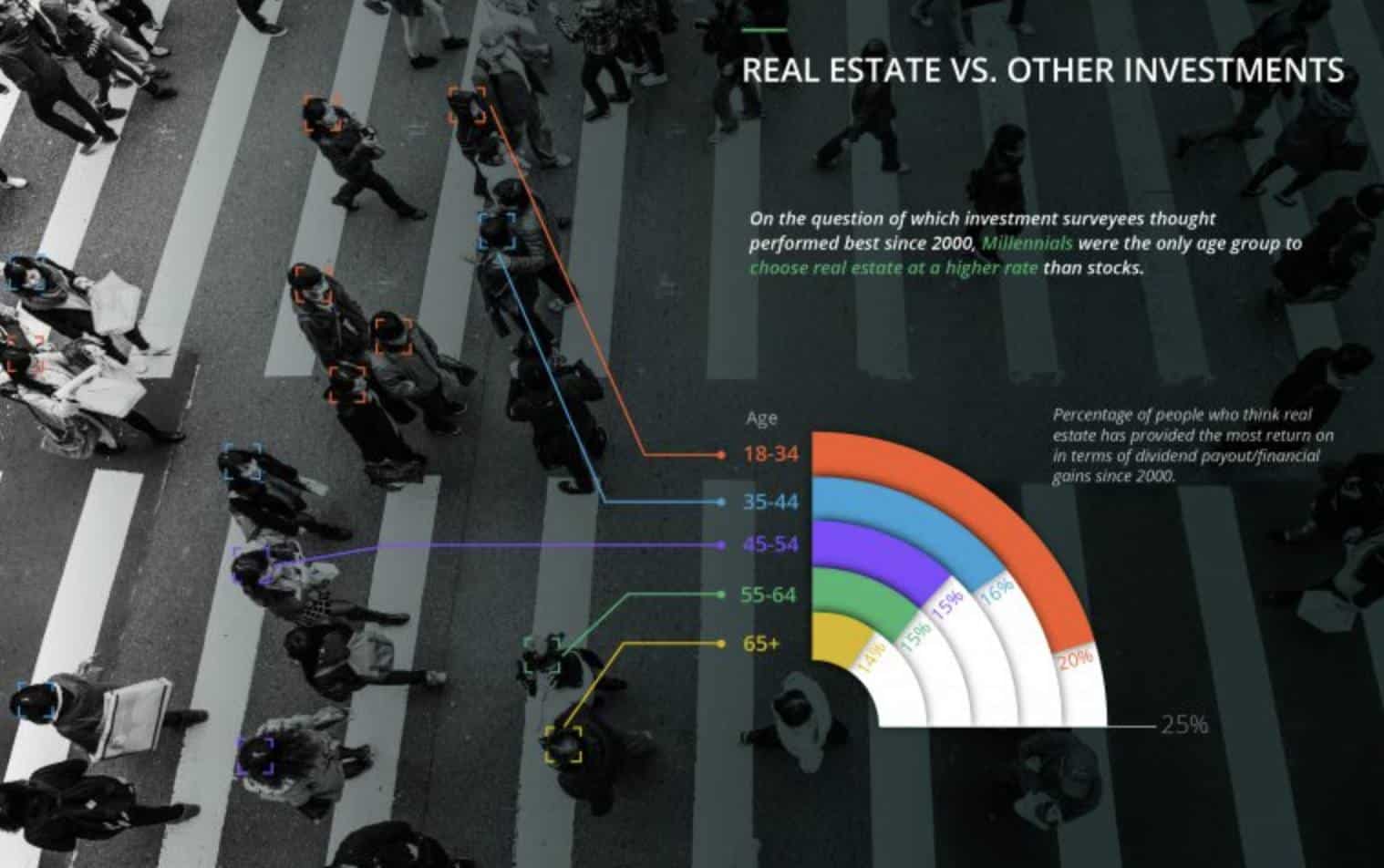

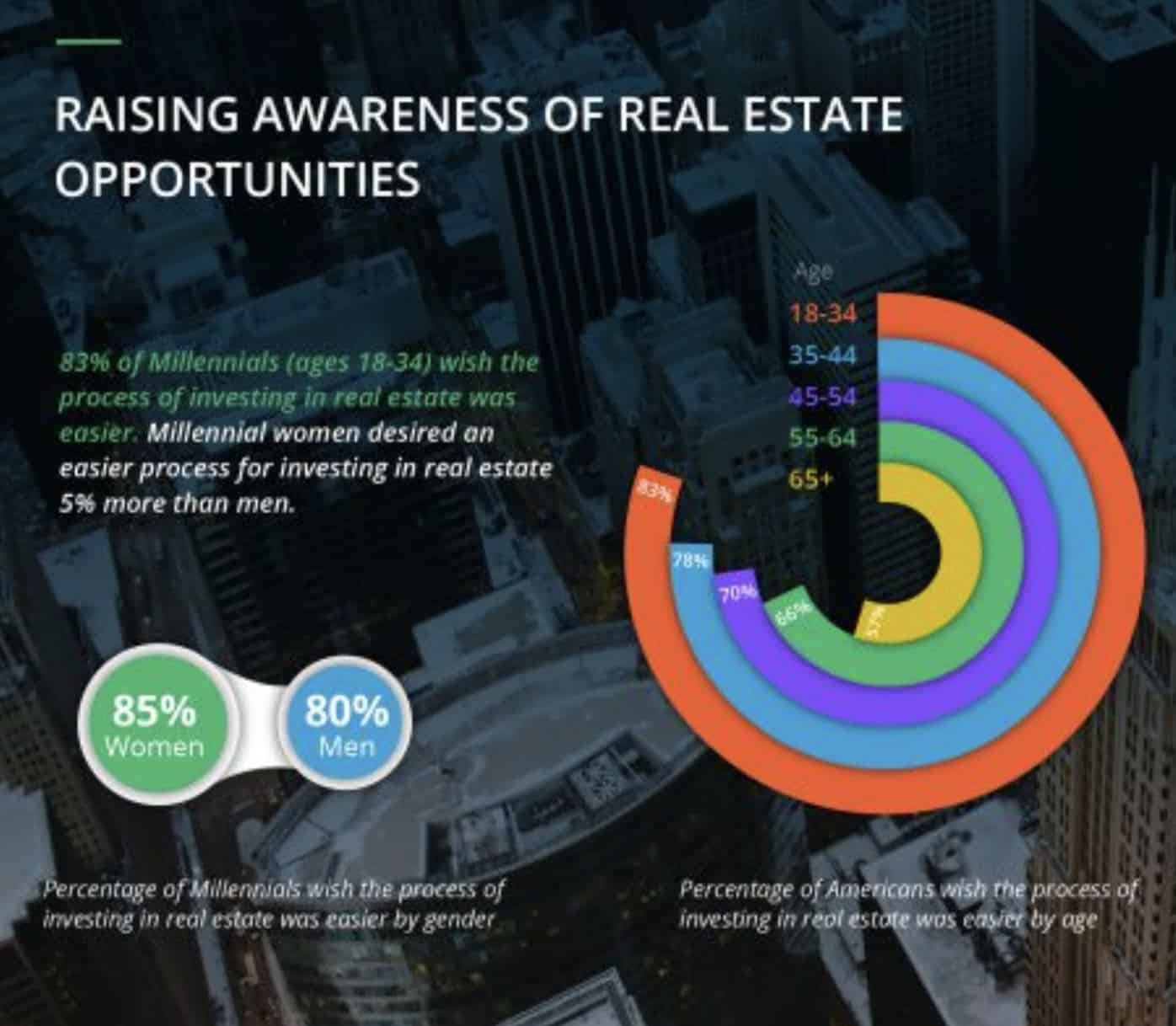

- 72% of millennials believe that investing in real estate other than their primary residence is a good way to make money.

- 2/3 of Americans think investing in real estate, whether for a flip or a renovation, is just too hard, too costly, and too far out of their expertise.

- 50% of millennials would “invest in property other than their primary residence.”

- 85% of millennials said they’d prefer to meet and communicate face-to-face when making real estate purchases.

- 81% of millennials reported they would be more likely to invest in real estate if there were technology available to make the process easier.

- TV shows depicting real estate agents, house flippers, etc. are extremely popular and consumed largely by the younger generations.

- The strength of the U.S. dollar has led to a rise in overseas investments in countries with deflated property prices or deflated currencies.

Overall Travel Trends

Overall Travel Trends

“In 5-10 years, millennials will comprise the majority of airline, hotel, and

travel company core customers.” —The Boston Consulting Group (2013)

The Boston Consulting Group, Service Management Group, and Barkley surveyed the brand preferences and buying habits relating to business and leisure travel of 4,000 millennials (ages 20 to 38) and 1,000 non-millennials (ages 39 to 78) in the U.S.

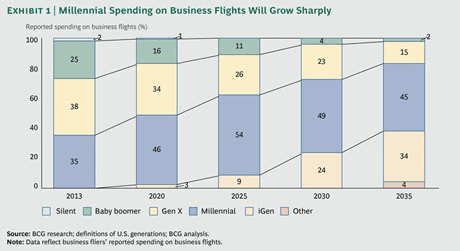

- By 2020, 50% of business flights will be purchased by millennials.

- By 2020, baby boomers will make up 16% of purchased business flights, dropping to 11% by 2025.

- Millennials express more interest in traveling internationally.

- Millennials report less overall fatigue and frustration with airports and the flying experience in general than non-millennials.

- Millennials are not a homogenous group of spenders. There are two distinct groups that inform trends: Business & Leisure travelers.

Millennial Business Travelers

Millennial Business Travelers

Demographics

- 60% more Hispanics in millennial business travelers than in non-millennial business travelers.

- 50% more Asians than in non-millennials business travelers.

- 40% more females than in non-millennials business travelers.

Frequency of Travel

- 28% of millennials reported flying for business purposes 4+ times per year, compared to 45% of non-millennials.

Spending Compared to Non-Millennials

- Greater % on international travel.

- Greater % on refundable, non-upgradable tickets.

- Book tickets later than non-millennial counterparts.

- Make more itinerary changes than non-millennials.

- More likely to buy frequent-flier points or miles.

- 60% more likely to upgrade for extra legroom.

- 4x more likely to purchase WiFi in-flight.

- 2x more likely to watch downloads on a mobile device.

- 60% more likely to purchase in-flight entertainment.

- Millennials pay 13% more per ticket than the average non-millennial business flier due to these habits.

Loyalty Programs

- Greater dissatisfaction with frequent-flier benefits such as miles, elite status, rewards, and their expirations.

- Prefer to earn free or discounted travel.

- Millennials report greater willingness to switch from one airline or loyalty program to another.

Implications: Either their brand loyalty has not yet solidified or this will not be a characteristic of their travel (unlike non-millennials). However, millennials report extremely high levels of brand loyalty in other economic purchases (coffee, technology).

Other Habits

- Use airport amenities such as WiFi, charging stations, and ATMs more than non-millennials.

- More apt to add on one leisure trip per year than average business flier (an indicator for cross-promotional, loyalty reward, and comarketing potential).

Millennial Leisure Travelers

Contextualizing Data: Millennials are at a very different life stage than non-millennials. Fewer millennials are married and have children. Their careers have varying levels of demand with less vacation time.

Demographics

- High-income millennials travel for leisure as much as non-millennials.

- Millennial women report more leisure trips per year than men who travel primarily for leisure.

- Hispanic millennials report the least amount of leisure air travel on average.

- Men of both generation groups report greater solo leisure travel than women.

Frequency of Travel

- 75% of non-millennials report taking 4+ overnight leisure trips per year, compared to 50% of millennials.

Loyalty Programs

- Fewer younger millennials are currently members of airline rewards programs.

- Favor low-cost options and getting discounts to apply to planned travel.

Other Habits

- Book trips further in advance.

- Book fewer but longer trips.

- Seek out “good deals” more than non-millennials.

- 50% more likely than non-millennials to travel for a hobby.

- Most reported reasons for travel: outdoor adventures, shopping, and special events such as weddings, entertainment, and food and wine festivals.

- They are more likely to travel in organized groups, with extended family, or with adult friends, a trend in keeping with the social nature of the millennial generation (indicating greater opportunities for group promotions and services).

- Male millennials travel more for gambling and personal hobbies than non-male millennials.

- Female millennials travel more for special occasions, to visit family and friends, and for cultural enrichment and sightseeing.

- The second most cited travel reason for both genders is “relaxation and rejuvenation.”

- Use fewer amenities than non-millennial leisure travelers and millennial business travelers.

- Focus on free services, fast food, WiFi, and charging stations.

Preferences

“Overall, millennials are more diverse as a group than

non-millennials and more interested in international travel and

global cultural experiences.” —The Boston Consulting Group (2013)

Millennials’ Preferences

- Require reliable, high-speed internet.

- Prefer touchscreen technology.

- Need charging stations for their many electronic devices.

- Favor organic and exotic foods.

Other Habits

- 70% of millennials report a desire to visit every continent, versus 48% of non-millennials.

- They do more research and comparisons prior to travel (in all modes of consumption, not just travel) and utilize more search engines (Google, Yelp, blogs).

- More likely to book through an online travel agency such as Kayak or Expedia.

- Most likely to use a mobile device to make travel arrangements.

- 75% of millennials use travel apps (Amazon, Google Maps, Yelp, Hotels.com, Expedia, Kayak, Orbitz) versus 47% of non-millennials.

- 50% more likely to use cell phones to share pictures with friends, on social media, and in blogs/travel reviews online.

- More likely to broadcast negative experiences than positive ones.

- Less cautious about sharing personal preferences online, such as brand preferences, where they live, household composition, loyalty status, frequent destinations, preferred airports, and personal hobbies.

- Currently less willing to pay more for travel that supports a cause.

![Consumer Resource Guide]()

I hope this 2-part series on millennials has been helpful. It was for us while writing it. Gaining a deeper understanding of clients and future clients always pays off. If you have any stories and/or insights into the millennial generation, drop me a note. It’s always fun to hear from you.

This article was published in the Escape Artist Weekly Newsletter on October 10, 2018. If you would like to subscribe to the newsletter, please click here.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!