Today, we bring you a special series from our guest author, Brian June.

Brian is an author, adventurer, and serial entrepreneur. For more than 40 years, he’s been a student of humanity, markets, and empires. He’s a principal of two crypto OTC trading firms (iBuyTezos and The Coin Trading Company) and loves to explore life and the planet with his wife, Val.

![Brian June]() Crypto Wars: 2019 – A Series to Educate and Amuse

Crypto Wars: 2019 – A Series to Educate and Amuse

In this multi-part series, we’ll be exploring the business case and pricing of blockchain in general and Bitcoin specifically.

Part 1: Is Bitcoin Dead?

It’s been asked hundreds (perhaps thousands) of times. Is it? Since the inception of Bitcoin in October 2008, many pundits and prognosticators of all stripes have read Bitcoin its last rights. But if it’s so bad, why is it still around? In fact, as I write this, it’s trading around $3,384. And if my math is correct, that’s way more than the average price over the life of Bitcoin, which is, well, way way less.

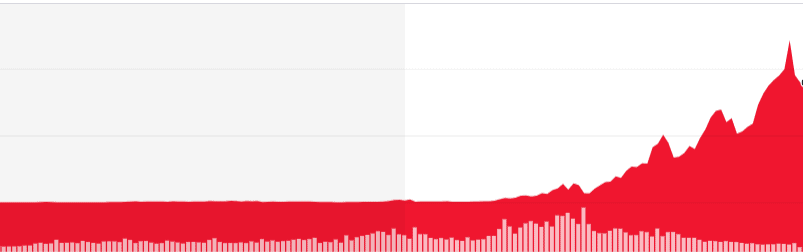

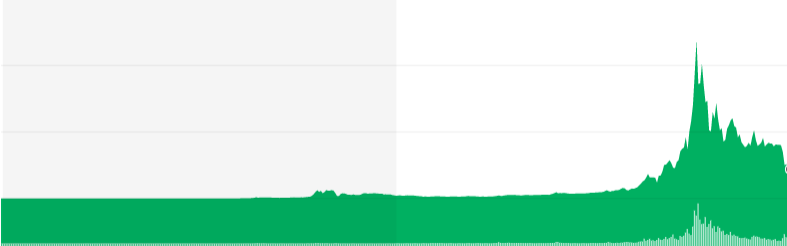

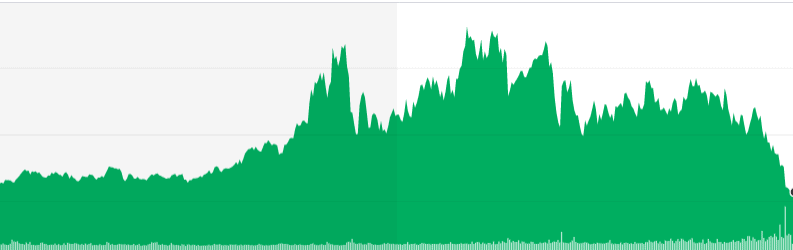

Just for fun, let’s take a look at the three charts below, one is Bitcoin, the other two are (or were) darlings of the stock market. I deliberately removed any identifying information to make the game a bit of a challenge. So which is BTC (Bitcoin) and which are/were in almost every hedgie portfolio past? Is it door chart #1, door chart #2, or door chart #3?

Chart 1 – (Yahoo Finance)

Chart 2 – (Yahoo Finance)

Chart 2 – (Yahoo Finance)

Chart 3 – (Yahoo Finance)

Chart 3 – (Yahoo Finance)

If you’re like most folks, it’s not so easy to tell at first glance! Especially if you’re not watching markets daily. To help you out just a bit, one of these is an NYSE stock, one is a NASDAQ stock, and the other is, of course, crypto. The listed companies are both in technology sectors. See the answers at the end of this article.

If you’re like most folks, it’s not so easy to tell at first glance! Especially if you’re not watching markets daily. To help you out just a bit, one of these is an NYSE stock, one is a NASDAQ stock, and the other is, of course, crypto. The listed companies are both in technology sectors. See the answers at the end of this article.

My premise is, of course, that virtually all financial instruments are volatile, and predicting if they will go up, down, or sideways is easy: yes. But when and by how much they will move is a much more difficult task. Some say it’s impossible – which brings us back to the initial question: Is BTC dead?

Bitcoin “bears” drive home three points when talking about its demise.

First: “Look how much it’s fallen! It can never recover from that! It was just a bubble!”

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

To this I say, see the charts above. And I’ll add I could find scores or even hundreds of stocks whose charts would look the same or even “worse,” and those same stocks have gone on to be market leaders. Probably the best example is Amazon (AMZN).

Second: As the price falls, miners’ profit margins (miners produce the coin) drop until it costs more to make a (bit)coin than the sale of the coin generates in revenue.

Taken at face, this is true. But it ignores the fact that as prices drop, it becomes ever easier to mine, using less electricity. Mining costs drop accordingly. Note that for several years, BTC sold for pennies and that did not stop or even slow down bitcoin production. I don’t expect mining to stop. Innovation is constant. The best miners are finding ever more innovative ways to produce coin for less. This includes finding electricity at very low cost and building newer mining machines (specialized computers) that are much more efficient and produce more bitcoin per KwH.

Third: “Bitcoin is a solution looking for a problem. It solves nothing.”

I hear this repeated over and over by “experts” who understand neither the technology nor the broader issues faced by those using blockchain/bitcoin.

Well, Bitcoin (blockchain 1.0) does indeed attempt to solve some real-world problems. And that is the first metric in determining the long-term success of any company or technology. But Bitcoin is not a company, it is a protocol. The first wide-scale use of blockchain technology.

And what is blockchain’s most compelling feature? It allows transferring any type of digital asset from any location to any other location on planet earth. It does this without anyone’s permission and at very little cost. Bottom line, Bitcoin allows moving fungible assets from one person or location without limitation, to any other person or location. Without permission. That is the big game changer. And that is what Bitcoin Wars 2019 (and beyond) is really all about.

Stay tuned! We’re going to learn and have some fun!

Answers: Chart 1 – Apple, Inc. AAPL – Nasdaq. Chart 2 – BTC. Chart 3 – Diebold Nixdorf DBD – NYSE

If you haven’t read part 2 here it is:

Crypto Wars: 2019 (Part 2) The Axis Against Crypto

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!

Crypto Wars: 2019 – A Series to Educate and Amuse

Crypto Wars: 2019 – A Series to Educate and Amuse