1920 and 2020—Drawing the Parallels Between the Precursors of the Worst Recessions in Human History

I think I might be entering the conversation a little later than I intended considering the purpose of this piece. Despite its tardiness, I think, this article is no less important because the purpose is to provide some perspective on how we should look at the economic events unfolding in light of the coronavirus pandemic. The IMF has already forecasted a global recession that will be worse than the great depression of the 1920s. The global economy is going to shrink by 3% throughout the year, with no clear indication for when recovery will set in.

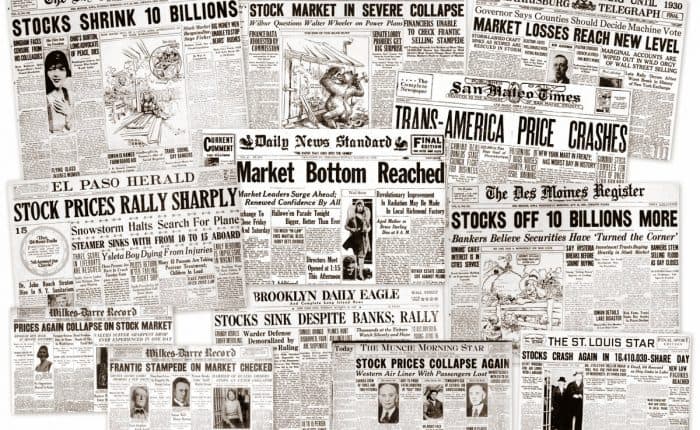

In many ways, this recession is going to be far worse than the one we hit in 2008 and the great depression of 1920. During the 2007 GFC, the global economy shrank by 2.7% and during the great depression, it shrunk by 0.1%—making this recession one of the worst in recent history. None of this is really surprising considering the economic dynamics that we have seen so far. 80% of the world’s workforce has been impacted in some way by the pandemic, unemployment in the US is at its highest in history and global trade has come to a stock-still. There is no economic sector that is currently spiraling, the stock markets having finally given up their 10-year bull rise to lose trillions within weeks and the fiscal stimuli introduced by central banks around the world have yet to take effect.

While this chain of events seems quite similar to the ones we saw in previous recessions, we still need to look at this particular recession in a different light. This recession was not caused by bad lending practices or housing crashes or stock market crashes alone—this time we had an exogenous trigger that has had persistent effects for as long as the recent crash has lasted. It is also because of the persistence of this exogenous trigger (the coronavirus) that the recovery from this recession might take longer and we might need to use different methods to overcome it.

Most of these questions should be addressed by the economic policy makers who have so far failed to come up with a solid strategy on how to cope with the economic effects of Covid-19. I’m not really surprised at their lack of direction, but I am concerned about what this means for individual investors who’re trying to stay safe during this uncertain time.

What is a Recession and How is it Caused?

The concept of a recession isn’t very difficult to understand—mathematically, it’s an economic period where the GDP shrinks rather than growing. When an economy is going through a recession, you’ll witness lower economic activity, falling profit, higher unemployment, crashing stock markets—basically everything that you see that is happening in the global economy right now. We should do well to remember that events like unemployment, deflation, lower demand and falling stock markets do not cause a recession but rather they are the symptoms of one. The reason why people worry about recessions is that they are usually caused by exogenous factors that lie outside the control of economic policy. Thus, economic policy cannot guarantee overcoming the recession.

This idea is particularly important while we try to analyze the recession brought on by the coronavirus. See, when I think of the 2007 GFC or the great depression—I see problems originating within the structure of the economy that led to an economic crash. Unsustainable lending practices led to the crash in 2007 and something similar happened to the economy in the 1920’s—there exists a certain degree of overlap between economic practices and the crash. However in either situation, in the past the exogenous factor that led to a recession was that there wasn’t enough money in the economy to account for the debt generated in it. It was possible to fix those problems through shrewd economic policy that allowed stakeholders in the market to contain the situation.

This recession cannot be fixed through any economic policy or law-making because it is fundamentally a non-economic issue that has disrupted economic activity. This thought can be summarized in the following way—what economic policy is supposed to eliminate the coronavirus which is actually causing all of the supply chain and production hold-ups? While governments around the world can keep injecting cash into the economy, buy up bonds, send out unemployment checks to keep demand up—there is no way for them to fix the production side problems which are the root cause this recession.

Similarities Between 1920 and 2020

I find it particularly interesting, from an intellectual standpoint at least, that even though the causes of recessions are different—the symptoms seem quite uniform. At this moment, both the 1920s and the 2020s show similar macroeconomic indication—high unemployment, crashing stock markets, trade has slowed down, currency is devaluing and people are investing heavily in gold.

Based on these economic events, everything indicates that a recession is due and it’s going to be pretty bad. The unemployment will persist, producer profits will continue to decline, incomes will fall and this will introduce deflationary pressures on the economy and we will continue facing these circumstances for a while. However, these similarities only extend insofar as the symptoms of the recession are concerned. I keep repeating this because I am wondering if the economic policy makers recognize the need of the hour—I doubt they will recognize it since, so far at least, their response has been to keep the economy afloat without realizing that the recovery this time is not guaranteed until a vaccine is found.

See, in the past, governments kept the economy afloat because the business cycle could be relied on to bring the cycle round to improve the economy. This required proper supply chains and uninterrupted production that could support economic activity—this covid-19 recession has basically destroyed the supply chain and thus the support for economic activity. The question for us is, can the global economic order keep the market afloat through artificial capital injections for long enough until a cure for the coronavirus is found? Until then, the structural impact of the coronavirus will require us to resume economic activity in a drastically different environment than the one we had before the epidemic—a situation that no one flesh out for now.

Conclusion

The Covid-19 pandemic is a scary time for everyone, but its also a very interesting one for anyone looking to learn from it. This is a once-in-a-lifetime event that can teach us a lot of lessons on how we ought to view the world economy, politics and manage our personal finances. How this whole episode in human history will turn out is really anyone’s guess—but one thing is for certain—it has changed the way we practice economics and finance forever, possibly for the worst.

I hope you got value from this article: 1920 and 2020—Drawing the Parallels Between the Precursors of the Worst Recessions in Human History. For additional information on moving overseas, please contact our office HERE.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

Also, I’ve added some great articles for you to read, I know you’ll love them!

Always Have a Plan B: You’re Never Safe from State-Sanctioned Encroachment

What Does the Coronavirus Epidemic Tell Us About The Failures of Modern Government?

Quantitative Easing Around The World—The Impacts On Currency Values And Alternative Investments

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!