Why Retiring In Portugal Is So Attractive

Retirees from all over the world choose Portugal as their retirement place. Many reasons make Portugal a desirable option, such as high quality of life, excellent year-round weather, and the friendliness of the locals.

However, there are also questions revolving around the idea of becoming an expat in another country. This guide is here to answer all the questions about retiring in Portugal.

1. Why Retire in Portugal?

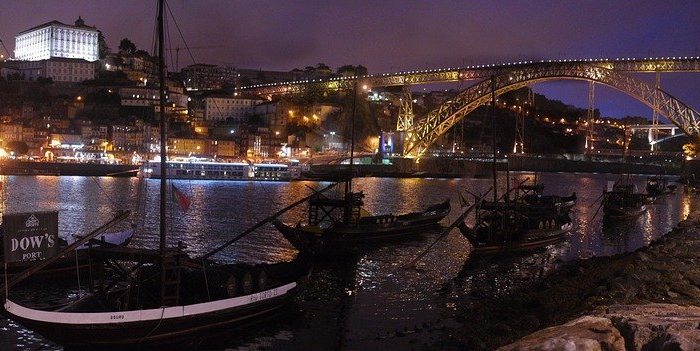

Before going into financial details, it is a good idea to discuss why Portugal is a wonderful country for retirement. To start with, the country is stunningly beautiful, and it has a very rich historical background. Traces of this vast historical heritage can be found all over Portugal. Even in the capital Lisbon, it is possible to walk between districts with a vibrant nightlife and Medieval fishing towns.

Furthermore, Portugal receives sunshine almost all year round. With more than 300 days of sunshine per year, the coastline surrounding the country becomes an incredible attraction. Portugal’s long coastline also shapes its rich cuisine, and its culinary appeal brims with fantastic seafood options.

Portugal is also a top contender on every safety, security, education, and healthcare index. The country provides its citizens and residents with the highest quality of life options. Often regarded as one of the most peaceful European countries, no wonder Portugal is so popular among retirees.

Moreover, all of the above come at very affordable costs. In the countryside of Portugal, it is possible to live comfortably on $1,500-1,700 per month. In metropoles like Porto and Lisbon, this amount goes up to $2,000-2,200. Expats from the USA, for instance, report that in Portugal, they spend around one-third of what they were spending in the States.

Finally, Portugal’s tax laws and programs like the non-habitual tax regime (NHR) cut costs drastically. Retirees aiming for tax reduction also consider Portugal a great option. Both Forbes and CNN leaned on this topic in 2020. Both publishers regarded the Algarve region of Portugal as the best relocation spot for retirement.

2. How to Retire in Portugal, and Who Can Do It?

Retiring in Portugal is not as complicated as in some other countries. As long as they meet the selected route requirements and have a clean criminal record with clean sources of income, almost anyone can retire in Portugal. There are several options for different groups, such as EU citizens, US citizens, and non-EU citizens. Most retirees prefer Algarve as their desired location. More than 100,000 retirees reside in the region.

3. EU Citizens

For EU citizens, it is very easy to retire in Portugal. EU citizens already have most of the rights that locals have. A simple application to SEF (Servico de Estrangeiros e Fronteiras) is enough to become a retiree in Portugal.

4. Non-EU Citizens

Non-EU citizens may directly apply for a Portuguese residence permit. This process is done at Portuguese consular offices. The required documents are a valid passport, proof of income, health insurance, and a clean criminal record.

Another popular option for non-EU citizens is the Portugal Golden Visa Program. The scheme grants residence permits to investors who successfully invest in Portugal using one of the program’s routes. The possible routes are:

- Investment of a minimum of €500,000 in Portuguese real estate,

- Investment of a minimum of €350,000 in Portuguese real estate that must be older than 30 years and deemed in need of renovation by the city hall,

- Creation of at least ten full-time jobs for Portuguese citizens,

- Capital transfer of a minimum of €1 million,

- Investment of a minimum of €350,000 into an investment fund in Portugal,

- Investment of a minimum of €350,000 in designated research and development projects in Portugal,

- Donation of a minimum of €350,000 to arts, culture, or the national heritage of Portugal.

Portuguese Golden Visa grants its holder the right to live, work, and study in Portugal for five years. After this period, successful residents may apply for naturalization.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

5. US Citizens

US citizens may establish residency in Portugal through a 120-day stay visa. To obtain this visa, applicants must prove an income of at least $1,070 per month. After this period, US citizens may apply for a one-year residence permit. After two two-year renewals (five years in total), US citizens can apply for permanent residency.

6. Sephardic Jews

Jews of Sephardic ancestry can easily receive Portuguese citizenship if they submit the necessary documents.

7. What are the Laws and Taxes Applied for Retirees in Portugal?

Portugal started a program in 2009 called the NHR (non-habitual tax residency). Thanks to the NHR, retirees may be exempt from flat tax rates that may reach 48%. Retirees who were not tax residents in Portugal for five years before the application may benefit from the NHR.

The NHR allows retirees to be exempt from taxation for their international income for ten years. For that period, their wealth is also not subject to taxation. In these ten years, income generated in Portugal is taxed at 20%. Outside the NHR, these rates may climb up to 48%.

The NHR also prevents double taxation due to the international treaties of Portugal.

8. How Do Pensions and Social Security Contributions from Other Countries Translate into Portugal?

EU citizens may directly move their pension from their home country to Portugal. Their social security contributions count towards the Portuguese state pension. Currently, Portugal grants contribution-based state pensions to retirees. To receive this pension, residents must prove a minimum of 15 years of social security contributions.

On the other hand, it is not as easy for non-EU citizens to move pensions and contributions. To do so, the non-EU country must have mutual taxation and social security agreements with Portugal. Some countries have such agreements. So, applicants must check if such agreements exist between their country and Portugal.

Worldwide income is subject to taxation in Portugal. However, retirees might reduce these taxes or avoid them altogether through the NHR.

9. How Does Inheritance Work in Portugal?

According to the Portuguese Civic Code, the deceased’s inheritance is subject to their home country’s laws. If the spouses are from different countries and the permanent residency is in Portugal, then the Portuguese laws apply.

Portugal does not impose taxes on inherited property. Yet, there are some administrational fees and a 10% stamp duty. First-degree relatives are exempt from this fee.

Portuguese inheritance law states that all first-degree family members have rights to the property inherited. It can only be prevented if it’s otherwise stated in the will. Thus, it is best to create a detailed will for each country of residence. This way, the country’s laws cannot interfere with the deceased’s wishes.

10. How Much Does Living and Housing Cost in Portugal?

Portugal’s low cost of living is quite attractive to retirees. Although more expensive than a few years ago, Portugal still offers a lot for little expenditure. Compared to the US, the UK, or other Western European countries, Portugal’s cost of living is a bargain.

A couple living just outside the urban centers can comfortably live on €1,600-1,800. If the residence is in a metropolis, this amount may go up to €2,000-2,200. It includes accommodation, groceries, home utilities, bills for communication and internet, and social activities of a moderate degree.

It is also a good idea to keep some money as a safety net. Having some savings on the side against the sudden shifts in currency rates protects retirees from unpleasant surprises.

About the GET Golden Visa

The process of retiring abroad might get cumbersome. The GET Golden Visa guides investors through all the obstacles along the way. Offering its services throughout the planning and processing of international retirement, the professional staff of the GET Golden Visa is always ready for help. Both in guidance and consultancy, the company is highly competent and experienced.

I hope you enjoyed reading: Why Retiring In Portugal Is So Attractive

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!