Unless you are living under a rock, you are probably aware of the rampant inflation happening the world over. And you likely are also aware that whatever inflation number your government is throwing at you – 2%, 3%, 4%, 5% – is completely out of whack with what you are seeing on your weekly grocery shopping trip. So, what the heck is going on? And what can you do about it? Let’s discuss.

A little history on inflation

Inflation didn’t used to be a thing. That is because, once upon a time when our money was based on physical gold, in order to “create” more money, you needed to have the physical gold to back it. You could not just create money out of nothing. However, this constrained the ability of economies to grow as it did not allow for the desired monetary expansion, ultimately causing countries to abandon the gold standard altogether.

In Canada, the gold standard was “officially” abandoned in 1931, however it was essentially gone by at least 1929, as dominion notes were no longer backed by gold. In the United States, the gold standard was officially abandoned in 1971, when the Bretton Woods system was ended. At that point, all world currencies officially lost their connection to gold and we entered the fiat currency era.

What’s funny is when you start reading up on the history of our monetary system, you start to see that while we supposedly had all these standards, there were workarounds and loopholes governments used in order to increase the currency supply, even when the currency was backed by the gold standard. I think it is fair to say that, for most currencies, the gold standard was there in theory but not necessarily in practice, long before they actually officially moved away from it.

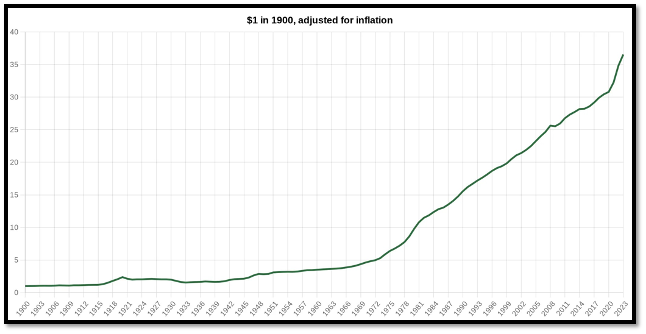

But, check out what happened to the value of $1 in the United States once the currency was “officially” decoupled from gold:

Notice in the graph that, even though there were inflationary periods prior to 1971, it did not have a massive effect on the value of $1. However, once the gold standard was abandoned, the number of dollars in circulation increased dramatically. This caused purchasing power to decrease dramatically. In fact, the buying power of $1 in 1971 is equal to $7.58 in 2023.

(Source: https://www.officialdata.org/us/inflation/)

In Canada, we see a virtually identical trend, with exponential growth occurring after 1971. The buying power of $1 in 1971 is equal to $7.77 in 2023.

(Source: https://www.officialdata.org/Canada-inflation)

Since moving to a fiat system, governments have targeted an inflation rate of around 2% per year. The actual average rate of inflation since 1971 is more like 4%. How do you think things are going so far?

The effects in 2023 and beyond

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

Even though most of us are aware that the government is gaming the CPI (Consumer Price Index) and not giving us the true inflation numbers to make themselves look better, of course, things are still looking pretty grim with the numbers they provide. The amount of money printing that happened from 2020-2022 to pay people to stay home sent inflation into overdrive, which naturally meant it had to be bludgeoned back down with the fastest interest rate hikes in 40 years.

The interest rate hikes, ironically, have also served to drive inflation because they make everything so much more expensive. This is especially true when it comes to housing in Canada, where we were already sitting on the biggest real estate bubble in the world. How long until it pops and brings down the whole house of cards along with it?

We also see that wage hikes not only do not keep up with inflation, but they themselves are also inflationary, increasing business costs which are then passed along to consumers. Wage hikes can also push workers into higher tax brackets, which can actually cause their after-tax earnings to be lower than they were before.

So, we’ve got debt payments exploding while daily essentials like housing, food, and gas get more expensive. Wages can’t keep up and the government continues to spend like drunken sailors and adding additional taxes on, to boot.

Things are clearly not headed in the right direction. Many people speculate they will continue on this course until everything breaks, and then use that event as the impetus to bring in CDBCs, Universal Basic Income, and all the other gremlins that tend to go along with those things. I tend to agree with those people.

What can you do about it?

At Escape Artist, when we bring to light some of the issues going on in the world, such as inflation, we also like to present you with helpful solutions so that, if things go badly, you are prepared with your Plan B. Let’s discuss some of the things you can do to mitigate your risk and prepare for the future in the midst of these challenging times. It all revolves around hard assets and – say it with me – diversification.

Precious Metals

Silver and gold are tremendous stores of value and a great hedge against inflation. Rich Checkan, our resident previous metals expert, is always sure to emphasize that gold and silver are meant to be used as wealth insurance. They enable you to store purchasing power in the event of a financial crisis, and they are perfect for that role, not matter when or at what price your purchase them at. As Rich says in this month’s issue of Escape Artist Insiders magazine: “I am a firm believer that if you are buying gold for the right reasons, there is no such thing as the wrong price or the wrong time.”

Agriculture and Forestry

With an ever-increasing world population, it is clear we will continue to see a growing demand for both food and timber. Due to being real tangible assets, both of these sectors tend to grow steadily in value over time and keep pace with inflation. Much like gold and silver, they are a great store of purchasing power, with the added benefit of being able to earn some great investment returns. See our Teak Resource Guide on how you can start investing in timber today!

Real Estate

Like agriculture and forestry, real estate is a real tangible asset that generally holds its value well. But, and it’s a big but, it is very dependent on your location, financing, the rental market, etc. With interest rates as high as they are, it is crucial to do your research and know your numbers first before buying any real estate property, no matter where you are looking. Consider the long-term economic outlook both globally and locally.

With real estate markets in Canada and some parts of the US being so over-inflated, many investors are finding themselves vulnerable to rapid shifts in the market, as with the aggressive interest rate hikes since 2022. But if you choose wisely in a healthy market with a strong economic outlook, you’ll be in good shape. And maybe beachfront, too!

Diversification

No matter what you invest in, make sure you are diversified. Stocks, precious metals, commodities, real estate; they can all have a place in your portfolio, depending on what mix you prefer and how diversified you want to be.

In addition to diversifying your asset classes, you also want to diversify the locations of your assets and investments. Yes, the actual physical locations. Not only that, but you want to diversify your currencies, too. Look at what is going on with a currency like the Argentine peso as an example of inflation rapidly eating your currency away. You do not want all of your eggs in any particular basket, whether it be asset class, location, or currency.

Start doing your research (perhaps by reading Escape Artist Insiders magazine!) and figure out where you may want to open a bank account or buy some land. Start looking into other currencies and investments. If things get bad in your home country, you will have assets in other places, safe from whatever is going on at home. Do you really want Trudeau or Biden have full reign over all your investments? I didn’t think so.

Start hedging your bets, folks!

Seriously, you need to start thinking about this. It’s so easy to complain on social media and to our friends and family. But, if you are reading this, you are one of the few people who is actually thinking outside the box and moving to take action to protect yourself from whatever tricks and treats may be coming. We have tons of resources here at Escape Artist, including hundreds of informative articles on a variety of offshore and investment topics to help you start building your portfolio and your Plan B.

Additionally, here are some other resources you should definitely check out:

Escape Artist Insiders magazine – A monthly magazine packed with informative content from our very own offshore experts.

Teak Resource Guide – Learn all about why teak is a low-risk, high-return investment that can both help you earn a Plan B residency and build generational wealth for your family.

Gold 2023: Investment Strategies for the Global Nomad – Learn more about the state of the global economy and how you can use gold to diversify your assets and maintain purchasing power.

Offshore Banking: How Privacy and Control Can Protect What’s Yours – Understand what an offshore bank is, where you should look for one, and how to keep your money safe while enjoying the benefits of financial diversification.

Webinar: 5 Fatal Flaws When Purchasing a Property Overseas – If you are interested in purchasing real estate overseas, this webinar by our partners, Development Advisors, will help you to ensure you make a good financial decision and avoid some of the most common pitfalls. This is definitely a must-watch!

I hope you found this article helpful! See you next week!

——————————————————————–

Lisa is an aspiring expat from Canada who is working to put together her Plan B with a young family in tow. She is excited to pair her lifelong love of writing with her passion for offshore strategies and outside-the box investments in her weekly articles for Escape Artist readers. Follow this “rebel with a cause” as she walks the path less traveled and shares her experiences along the way.

Lisa is an aspiring expat from Canada who is working to put together her Plan B with a young family in tow. She is excited to pair her lifelong love of writing with her passion for offshore strategies and outside-the box investments in her weekly articles for Escape Artist readers. Follow this “rebel with a cause” as she walks the path less traveled and shares her experiences along the way.Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!