Where I live in Canada, “lake life” is a whole thing.

People here aspire to own a recreational lake property with a cabin, dock, boat, all the things.

There are lines of clothing dedicated to “lake life”.

There’s definitely a geographical element to it – we live in the Canadian prairies, far away from the coast and even the mountains, so if people want to vacation without flying or driving for 7+ hours, they head to the lake.

Because of this, it’s really ingrained in our culture here. That’s what people do in the summer – they go to the lake.

Their family and friends are there and it’s a great way for them to spend time together while enjoying the great outdoors.

I used to have a desire for “lake life” myself. But, as my eyes were opened to the overall direction Canada was heading in, I decided it was probably best to look for other places to invest my money.

I’m not sure a 1970s cabin in Northern Saskatchewan is the best real estate investment for my family.

Read on for a refresher on some of the issues that are prevalent in Canada right now that have caused me to feel this way, along with a fun contrast between a “lake life” property near me and an oceanfront property down in Nicaragua.

I’m pretty sure you’ll agree with my assessment of this situation!

Oh, Canada…

I know most of you are already familiar with the issues in Canada right now. They are serious and they are plentiful.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

I’ll just list out a few of them for you here.

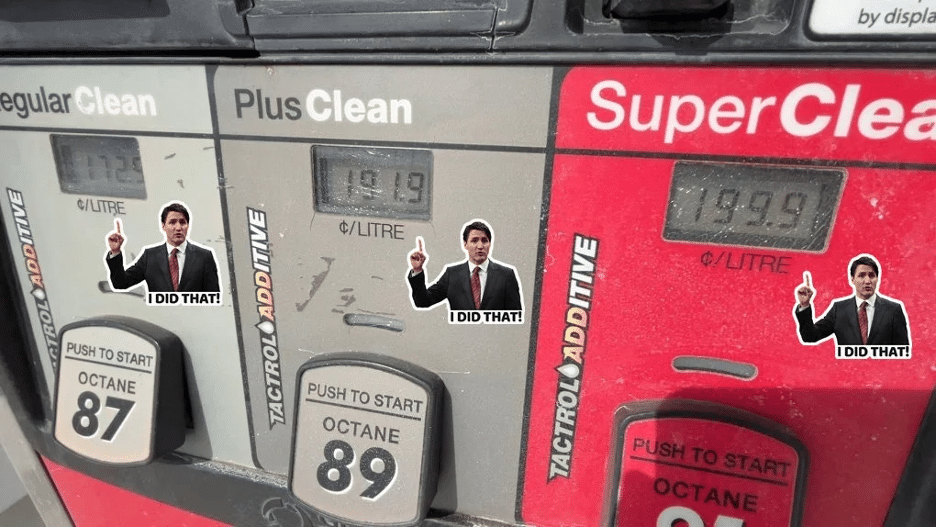

Inflation

Our cost of living has been relatively high for a long time, but with the inflation caused by government spending, it’s totally out of control. The cost is everything is going up, from housing to groceries to gas to insurance – all of it.

The government’s answer? More spending, which leads to more inflation, which further increases the cost of living. It’s a vicious cycle but it’s the only way the incompetents in charge know how to govern.

High taxes

Many Canadians are paying 50% of their income in taxes to pay for all this government spending. And it goes up every year.

The latest and greatest change has been an increase in the capital gains tax, further punishing Canadians with a demand that they pay their “fair share”.

This move will only serve to add to the productivity crisis here and result in continued decreases in GDP per capita.

According to Chrystia Freeland, our esteemed Minister of Finance, without this new capital gains tax Canada will fall into anarchy. The absolute gall of these people.

General societal decay

As is the case in many Western countries, Canada is experiencing a homelessness crisis, with tent cities popping up everywhere.

Drug use is rampant and promoted by the state via “safe supply”, creating new addicts daily.

Public transit has become unhygienic and unsafe, as has walking around in most cities’ downtown cores.

Citizens are increasingly polarized against one another. Churches are being burned down. Unemployment is on the rise. All major public services are collapsing in real time.

This is not the clean, safe, and prosperous Canada I used to know.

So, is this where I want to park more of my family’s hard-earned money? Hell, no!

Lake Life Here vs. Beach Life Abroad

Now that we’ve established some of the key reasons why it makes sense to look at investing overseas, let’s compare and contrast a couple of different properties to showcase the difference in value between how far your money goes up here in frozen Northern Saskatchewan vs. down in sunny, tropical Nicaragua.

It’s a face-off: Lake Life vs. Beach Life!

Northern Saskatchewan “Lake Life” property

This is a beautiful cabin – I could definitely see myself living the lake life in this! I almost chose one with carpet in the bathroom for this article but I decided to go with this one for a fairer comparison to the Nicaragua property we’ll get to next.

Here are the stats for this property:

- Listing price = C$774,900

- Size = 1696 sq ft

- Bedrooms = 2

- Bathrooms = 2

- Features: Lakefront with fire pit area, wraparound deck, dock, and double garage.

Located in a well-established lake community in Northern Saskatchewan, this property has fabulous outdoor space and a very classic Canadian design.

This isn’t actually THAT expensive for a lakefront property around here and I think it will probably sell relatively quickly. It’s a good-sized cabin with great outdoor space.

Shoot – I’m almost talking myself into this! The lake life is hard to resist! On to the next property, quick!

Nicaragua “Beach Life” property

I’ve said in previous articles – these BELA homes are my absolute favorite homes at Gran Pacifica in Nicaragua. Located right on the Pacific coast, these homes are the perfect size and give you a front seat to the beautiful ocean sunsets. I’ve chosen the Aquarius model for this comparison since it’s a 2 bed/2 bath as well.

Here are the stats for this property:

- Listing price (home only) = US$429,900 (approx. C$590,295.69 at today’s exchange rate of 1.37)

- Size = 893 sq ft

- Bedrooms = 2

- Bathrooms = 2

- Features: Oceanfront, community pool just steps away, hybrid solar system for power.

Located in the well-established and safe Gran Pacifica Resort, this BELA home is the ultimate in simplicity and luxury. It’s about as close to the ocean as you can get and I love that you have your choice of beach or pool when it’s time to cool down!

Can you think of a more serene place to enjoy your morning coffee or an evening cocktail? The sound of waves crashing just a few meters away?

That, my friends, is the sound of a Plan B!

Which would you choose?

While our Lake Life home definitely comes out on top in terms of size, that’s largely because it is cold here most of the year. We need a lot of indoor space because, when it’s -30°C, we spend most of our time inside.

But you definitely pay for the privilege – to the tune of around C$185,000 more than you would pay for the Beach Life property in Nicaragua.

And, I’ve just got to say it, when we are comparing lake front to ocean front – is there really any comparison? To me, ocean front wins by a landslide.

But here’s the real kicker: with the Beach Life property in Nicaragua, you are getting diversification. Meaning, you are getting some of your money out of Canada.

Which, if you’re bearish about Canada like I am, is a really good thing.

You are getting a Plan B as well – a landing pad outside of Canada so you have somewhere to go if you need to escape.

Worst case? You are getting a fabulous vacation home you can rent out when you are not using it.

When we are talking about sound real estate investments, I just don’t think it makes sense to park any more money in Canada. Especially when the prices are inflated so high that a three-quarters of a million dollar home on a lake in Northern Saskatchewan almost seems like a “good deal”.

It’s time to invest elsewhere

You’ve seen the news. Heck, you’re living it right now. Canada is not an investor-friendly place anymore. It’s becoming too expensive for people just trying to live their lives.

How bad does it have to get before the ship finally turns around? I don’t know. But I do know that I don’t plan on risking any more of my capital in this social experiment gone wrong.

And I suggest the same for you. Maybe Nicaragua’s not your jam, but this same case holds true in many other offshore destinations as well.

You see the writing on the wall and, even if you can’t move right away, you can still get to work on removing some of your risk by investing in real estate overseas.

This is a great step you can take towards building your Plan B and diversifying your investment portfolio into a more investor-friendly country.

Who would’ve thought that one day a Central American country like Nicaragua would be more investor-friendly than Canada? Strange times we are living in.

To conclude: Lake life may be great and all, but I think I’d prefer an ocean view a few thousand kilometers away from Trudeau and Freeland – wouldn’t you?

Stay on top of the latest trends in the offshore world by subscribing to Escape Artist Insiders magazine, where our experts share their on-the-ground experience to help you build your Plan B. This month’s issue is full of amazing stories and advice from real expats that you will find informative, aspirational, and entertaining – you definitely don’t want to miss it. Subscribe today!

Thanks for reading and have a great week!

——————————————————————–

Lisa is an aspiring expat from Canada who is working to put together her Plan B with a young family in tow. She is excited to pair her lifelong love of writing with her passion for offshore strategies and outside-the box investments in her weekly articles for Escape Artist readers. Follow this “rebel with a cause” as she walks the path less traveled and shares her experiences along the way.

Lisa is an aspiring expat from Canada who is working to put together her Plan B with a young family in tow. She is excited to pair her lifelong love of writing with her passion for offshore strategies and outside-the box investments in her weekly articles for Escape Artist readers. Follow this “rebel with a cause” as she walks the path less traveled and shares her experiences along the way.Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!