This article was published in the Escape Artist Weekly Newsletter on December 20, 2017. If you would like to subscribe to the newsletter, please click here.

Can anyone else see the elephant in the room? Why aren’t people asking about it? Is everyone afraid to acknowledge this simple economic reality? Saying nothing won’t make the elephant disappear. Don’t you want to know who’s going to buy all the equities and bonds when the baby boomers cash out to fund retirement? I do.

According to CNBC, “Over the next 30 to 40 years, $30 trillion in financial and non-financial assets is expected to pass from the baby boomers.” They plan to sell these assets to fund their retirements. The grocery store wants cash, however, not shares in Amazon when you check out.

Why won’t anyone on Wall Street talk about this? They sort of did in the CNBC article I quoted above. But the issues they address in that article are that the boomer’s kids are using the internet to trade, and the brokers are worried about losing their livelihood from commissions as this wealth passes.

But for the wealth that’s sold off to buy groceries, medicine, doctor’s visits, vacations, RVs, etc…who will buy these stocks? The Chinese? The Arabs? The next generation? Why would they buy these soft assets when they are trying to dump dollars around the world buying mines, land, and farms?

Well, there’s always the Fed? They are the buyer of last resort and have proven this by the bailouts in 2009 and the QE money printed since. More on that later.

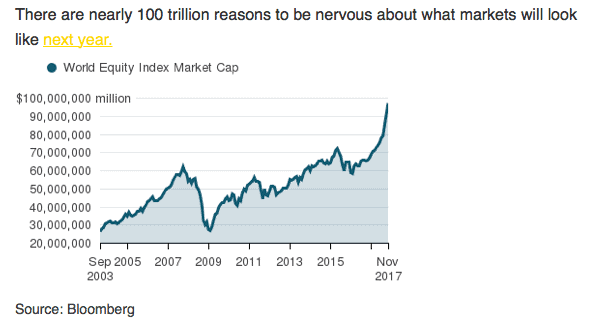

If you think stocks have been on sale in the past, just wait. Worldwide, the amount of assets in the markets is nearly $100 trillion. When a third of the global equities market goes into sell mode, the supply and demand curve is going to get whacky – unless there are huge buyers lined up (which there aren’t) and buyers who want to own these stocks at higher prices. That’s not likely.

If you think stocks have been on sale in the past, just wait. Worldwide, the amount of assets in the markets is nearly $100 trillion. When a third of the global equities market goes into sell mode, the supply and demand curve is going to get whacky – unless there are huge buyers lined up (which there aren’t) and buyers who want to own these stocks at higher prices. That’s not likely.

Is the new high mark for the DOW a bubble fueled by the Fed buying securities? Milton Friedman said, “Inflation is always and everywhere a monetary phenomenon.” Since 2008, over $12,000,000,000,000 in Quantitative Easing Cash has been created out of thin air by central banks around the world. That’s $12 trillion, in case all the zeros threw you off. And the U.S. accounts for $3.7 trillion of it. Another elephant in the room is that no one wants to talk about the Fed buying securities. But isn’t that what they did?

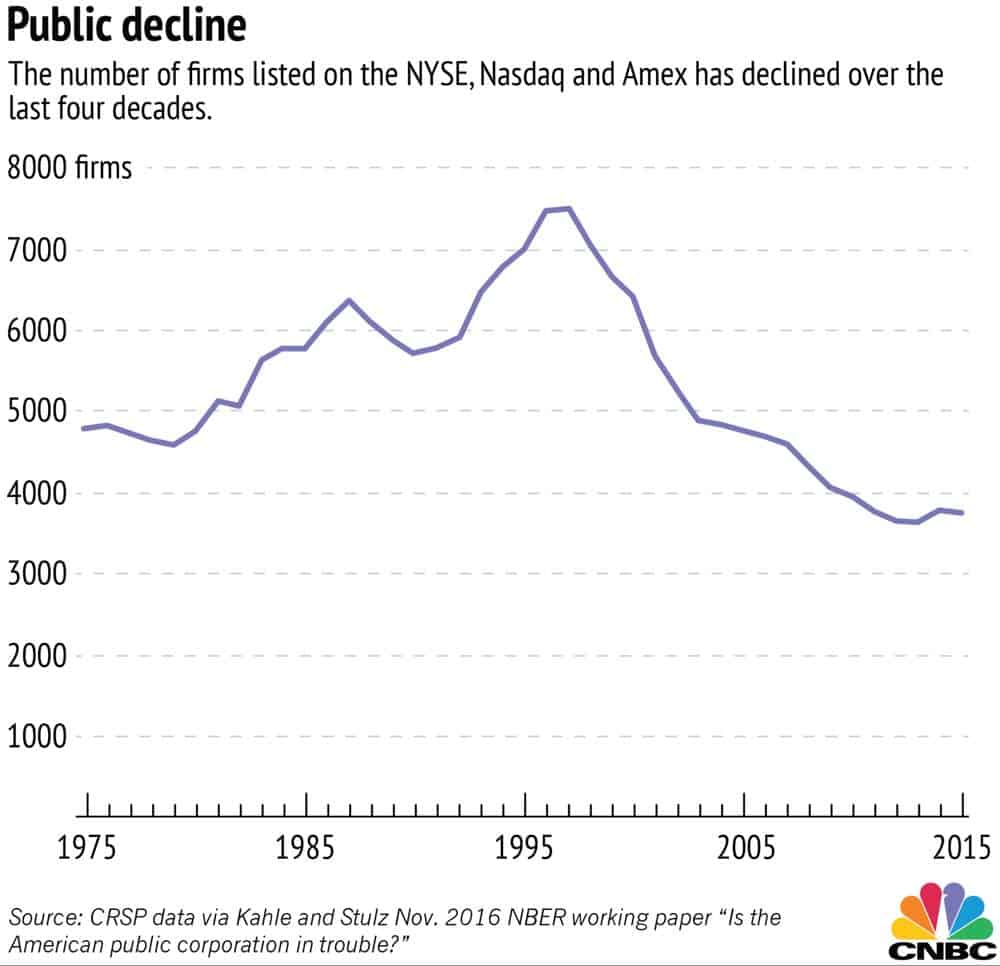

Drastic Decline in Public Companies

For a long time, this QE Cash went towards rescuing failing brokerage houses and propping up the balance sheets of insolvent banks. As long as the QE Cash was in a basement, locked in a vault and boosting the balance sheets, inflation didn’t happen. However, when those trillions were set loose on the market, chasing a fixed number of stocks, price inflation has occurred. In fact, it’s worse. The number of stocks available in the U.S. market is at the lowest level since 1975. The DOW has rocketed to all-time record highs with this easy money given to banks and brokerage houses and now set loose on the markets. Is what we are seeing a monetary phenomenon? Is this simple inflation, as Friedman suggests?

With over $12 trillion in QE money chasing a declining number of stocks, how high can this go? Is there room to ride the bubble up some more? Probably. No one ever predicts the exact top of the bubble. It’s impossible unless the system is rigged. But talk about risk.

“Honey, if we’d only sold on Feb 2, we’d be gazillionaires!”

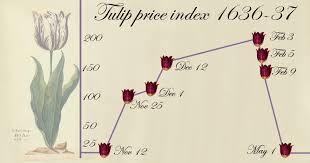

“Irrational exuberance” combined with $12 trillion in new money is driving the final phase of a tulip bulb… er … I mean a stock market frenzy. When I can’t see the tangible value to the stock owner, I have to wonder, “What am I paying for?” Exuberance?

I’d rather own the real stuff, things people need like food, water, and shelter, so I can provide those products and services across long time periods; generations even. Hard assets like real estate and timber have successful track records of centuries, because these commodities are intrinsically valuable and possess real, lasting worth.

The elephant in the room can only be ignored for so long. When the boomers really start to sell off the stocks to fund the fun, as well as the basic necessities of retirement, the deflation of the market will happen. It must, if we believe the most basic of economic tenants: the laws of supply and demand.Solutions to the pending meltdown are there, if we know where to look. Yes, gold and other metals are excellent hedges and excellent stores of value. Commodities and real estate are superb as well. Prudent investors have some of their portfolios in these asset classes. Diversification is wise.But a tough question we need to ask ourselves is, “What have you done to diversify your investments internationally?” Really internationally. Not owning some foreign stock on the NASDAQ or the hottest new Global Emerging Market Index Fund. No! Do you own hard assets outside of North America? Most folks don’t.

Please know this… Unless you have hard assets outside of North America, you still have all your eggs in one basket – the U.S. and/or Canadian basket. Nestle stock, yes, a Swiss company, owned on the NYSE, a U.S. regulated entity in U.S. dollars, is not international diversification.

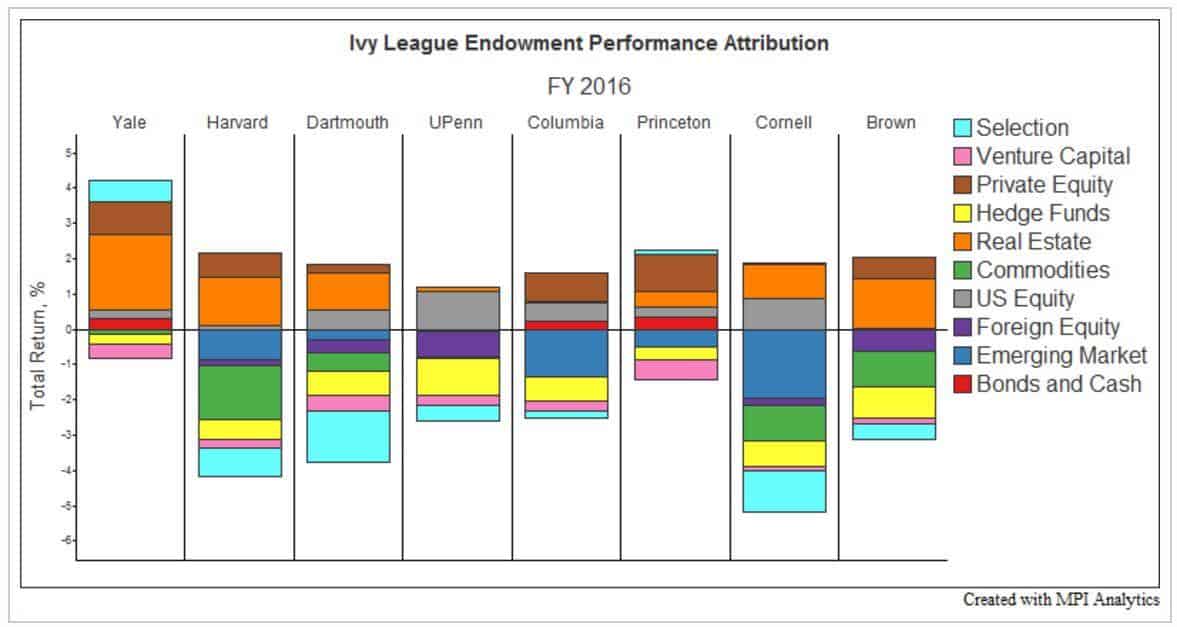

So what is true diversification? Look at the Ivy League School endowment funds as an example of excellent market, sector, and geographic diversification. Can you see how little they have invested in the U.S. stock market? Look at all the hard assets and alternative investments. Emerging markets. Real estate. Private Equity. Venture Capital. What do they know that the average investor doesn’t?

Ivy League Investment Allocations

Most folks only own traditional U.S. and Canadian equities, or perhaps the international index fund or two. When they are held on a domestic market, in dollars, it’s easy and it’s comfortable. And it’s what we know. Getting outside your comfort zone takes work.

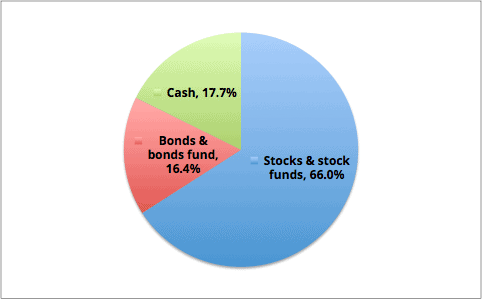

Average U.S. Investor Allocation

Does your portfolio diversification look anything like the Ivy League allocations, or is it more like the average? Be honest. Lying to yourself is like putting your head in the sand and hoping for the best. Hope is for people who play the lottery. Management is what people who are serious do to steward their wealth for long-term growth and ROI.

What if you could invest like these professionals without the millions they have? What if you could, with some small amount of effort, discover and execute on true international and asset class diversification?

With the markets at all-time highs, over 24,000 this week, wouldn’t it make sense to pull just a little off the table and hedge your bets? Or will you try and time the top of the market and ride the crash down? Wouldn’t it be great to use house money to hedge against economic, political, and social risk factors with some small part of your portfolio?

The challenge most people face when thinking about alternative investments is the fear of the unknown. In our comfort zone, we don’t have to do much work. The government regulators check it all out and make sure it’s safe for us, like they did with Madoff and Enron.

Only the facts tell us what is risky and what just feels risky. I recently sat next to a woman on a plane who, in some minor turbulence, was hysterically crying and had to be calmed by the flight attendant. She later admitted to the same attendant that she knows she’s overreacting, but can’t help it. Flying “feels” risky to her, even though driving is factually far more dangerous.

There’s no room for feeling when it comes to investing. The professional Ivy League investment teams are hard-calculating SOBs with one goal in mind, maximizing return. Risk is something to be measured and analyzed, not felt. John Kenneth Galbraith said, “Faced with the choice between changing one’s mind and proving that there is no need to do so, almost everyone gets busy on the proof.”

Are you everyone bumping along with the masses? Or are you an individual who will examine the facts and decide investment strategy with logic and rationality. Remember:

Strive to be outside the competition.

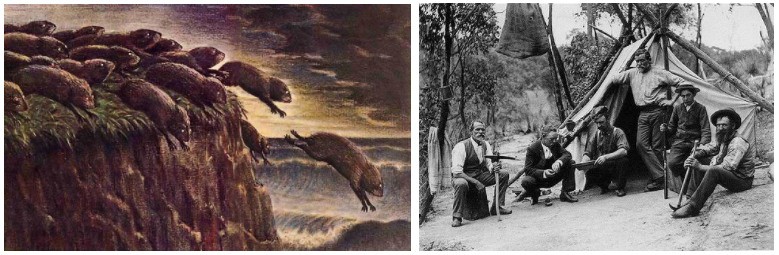

Walt Disney actually had to drive the lemmings off the cliff to produce the 1958 classic White Wilderness. For real. Check out the facts. There’s significance in this, because lemmings don’t willingly go to their deaths. Who in their right mind would? However, Wall Street seems to be driving the investment lemmings over a cliff yet again. Don’t look too far out. The elephant in the room is the cliff.

What cliff? It’s just ahead when the boomers start to sell off the $40 trillion in assets to fund retirement. You can see it from here. You know it’s coming. Are you going to keep running, being driven by market frenzy, greed, and the hopes of winning the wall street lottery? Are you going to be the person holding the tulip bulbs on Feb 3rd? It’s what the power brokers and financial mavens on the Street want you to do.

Are you a lemming or are you a pioneer?

What if a small amount of research could expose a gold nugget buried just below the surface? What if the facts and reality of a great investment lie just outside your current comfort zone? Are you willing to examine the facts? Can you get past irrational fear and let logic guide you to a place outside the masses? You owe it to yourself to try.

You may already know about investment opportunities outside of North America. Chances are, if you are reading this newsletter, you do. Well done. You are way ahead of the curve. Or perhaps, I should say, you can see the cliff in front of you and you will adjust your path and diversify globally.

Smart, forward-looking investors will put themselves in the path of progress in the same way that Levi Strauss did building hardware stores to serve the gold miners. Old Levi ran a boring business of selling shovels, boots, and jeans to miners. Boring, but exceptionally profitable. He served the needs of consumers and he got there first. You can too.

Levi Strauss Serving the Pioneers

Do you see how you can be a landlord to the millions of visitors coming south? Some are coming for short vacations, some the annual snowbird experience, and even full-time retirees rent homes when they move south of the border. You can own a rental property, serve these lifestyle pioneers, diversify globally into a tangible, hard asset, and earn a nice cash flow overseas.

Even one more step up the ladder is owning part of the company that makes the picks, shovels, and blue jeans. Did you know that accredited investors can actually own part of a business that serves these arriving consumers at a wholesale level? It’s like going back in time to 1850 and owning stock in Levi’s company. Wouldn’t that be great?

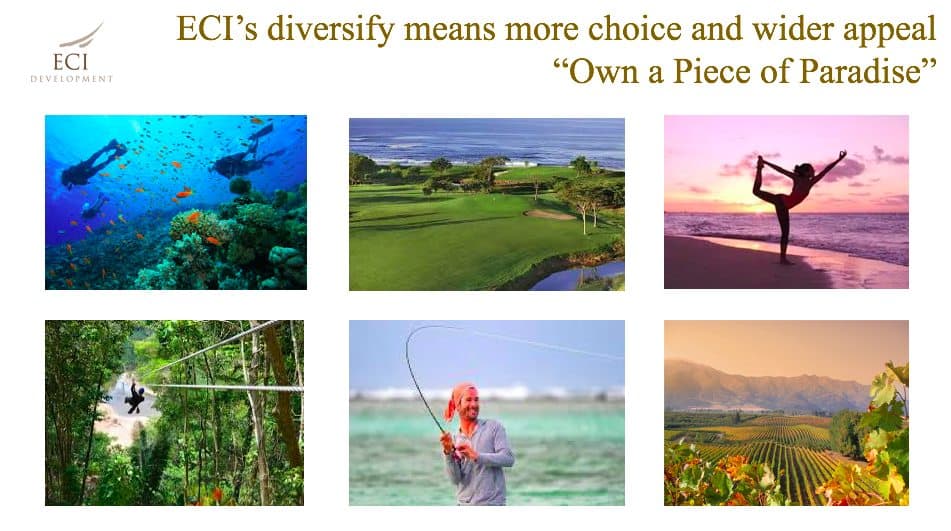

Our company, ECI Development, already serves these retiring baby boomers and vacationers to Latin America. We have for the past 17 years very successfully. Right now, we are growing our business and expanding into new countries of the region, so that we serve even more consumers with more geographic choice. If you are an accredited investor and would like to learn about how you can participate and own a part of our company, contact me. We’ll send you more information about investing in the business.

Own Shares of ECI and Serve the Greatest Number of Consumers

The megatrend of baby boomer retirement south of the border is real, huge, and growing. The road map and signals are clear. Path of progress investors will do very well for themselves. Jump in, look at the facts, and take action – because we are  what we do. Napoleon Hill said, “Action is the true measure of intelligence.” You are fortunate because you are one of the very few who can see the path ahead. Seize the opportunity and be glad that you did.

what we do. Napoleon Hill said, “Action is the true measure of intelligence.” You are fortunate because you are one of the very few who can see the path ahead. Seize the opportunity and be glad that you did.

Three Ideas You Should Consider:Because I absolutely believe in my company and my products, look at 3 things that might make sense for you if you need to diversify. Take some of the money off the table while the market is exuberantly high. Move it into global hard assets for a powerful re-balancing of your portfolio.

1. Own a cash-flow, beachfront condo at Gran Pacifica. Enjoy the oceanfront views a few weeks a year on vacation, and then rent it out to surfers who are looking for the best waves and some golf in their down time. ECI is keeping a third of these condos for its own inventory and cash-flow. We believe the story we tell and have our money where our mouth is.

2. Own a cash-flow condo in Belize. Enjoy a branded residence overlooking the Belize Barrier Reef a few weeks a year – and when you are not there, place it into the rental program if you desire. Ambergris Caye, the hub of tourism for Belize, generates 70% of all the tourism revenue for the country, because of the world-class diving and fishing. Only 40% of the units are being offered for sale. Claim yours now.

2. Own a cash-flow condo in Belize. Enjoy a branded residence overlooking the Belize Barrier Reef a few weeks a year – and when you are not there, place it into the rental program if you desire. Ambergris Caye, the hub of tourism for Belize, generates 70% of all the tourism revenue for the country, because of the world-class diving and fishing. Only 40% of the units are being offered for sale. Claim yours now.

3. For accredited investors only, own a pre-IPO stock with serious hard assets. 5 miles of beachfront property in Belize, Nicaragua, Costa Rica, and Panama. Homes, condos, a hotel, clubhouses, restaurants, a golf course, and services are in place today. A short video taken at a Stansberry Conference a few years ago highlights who we are and why you might want to take a deeper look. Contact me for the link.

3. For accredited investors only, own a pre-IPO stock with serious hard assets. 5 miles of beachfront property in Belize, Nicaragua, Costa Rica, and Panama. Homes, condos, a hotel, clubhouses, restaurants, a golf course, and services are in place today. A short video taken at a Stansberry Conference a few years ago highlights who we are and why you might want to take a deeper look. Contact me for the link.

If there’s something in our product offering that’s right for you, be in touch. We’d love to help you accomplish your goals in the new year and diversify globally for the uncertain future ahead. The wider the base in your portfolio, the more likely you are to survive and even thrive in the winds of change headed our way. More on that topic in 2018.

If there’s something in our product offering that’s right for you, be in touch. We’d love to help you accomplish your goals in the new year and diversify globally for the uncertain future ahead. The wider the base in your portfolio, the more likely you are to survive and even thrive in the winds of change headed our way. More on that topic in 2018.

In 1999, I planted 100 acres of teak in Panama for my family’s generational wealth stewardship planning. Now I learn that over 10% of Harvard’s endowment is in timber, making this investment seem even wiser in hindsight. Baby teak is being planted every year now at Gran Pacifica that you can own for your kids, grandkids, and generations beyond. Own timber as the ultimate long-term asset class.

In 1999, I planted 100 acres of teak in Panama for my family’s generational wealth stewardship planning. Now I learn that over 10% of Harvard’s endowment is in timber, making this investment seem even wiser in hindsight. Baby teak is being planted every year now at Gran Pacifica that you can own for your kids, grandkids, and generations beyond. Own timber as the ultimate long-term asset class.

This article was published in the Escape Artist Weekly Newsletter on December 20, 2017. If you would like to subscribe to the newsletter, please click here.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!