Four Steps to Building a Diversified Investment Portfolio

The goal to enhance and preserve your investment portfolio’s value.

Four Steps to Building a Diversified Investment Portfolio

Diversification is a cornerstone of today’s approach to successful long-term investment. For investors, one of the most important considerations is how to manage portfolio risk.

Diversification is the practice of building a portfolio with a variety of investments that have different expected risks and returns.

Our experts look forward to discussing all options you have for your specific needs!

Most people tend to see investing as merely stock trading, since stocks usually get the most flashing headlines in the news. Nevertheless, in practice, financial advisors and money managers approach the art of investing by combining different assets to properly diversify their holdings.

It is important to note that the benefits of diversification extend beyond the common phrase “don’t put all your eggs in one basket” as an adequately diversified portfolio doesn’t just minimize risk, but it also produces an optimal combination of risk and return by incorporating various types of financial assets.

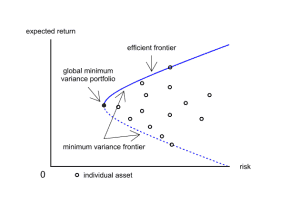

The theoretical foundation of diversification for investments is known as modern portfolio theory (MPT) and it was first presented by Nobel prize winner Harry Markowitz back in 1952 in an article known as “Portfolio selection”.

This theory states that there’s a certain combination of financial assets that produces the optimal risk/return relationship, after which any additional unit of return must be earned by taking an extra measure of risk.

In order to estimate this, Markowitz proposed that investors should evaluate the potential return of an investment by analyzing its historical performance, while also determining its risk, which can be quantified as the standard deviation of these results during that same time frame.

As a result, investors can calculate the risk/return produced by each financial asset they intend to incorporate into their portfolio and they can ultimately design the portfolio by determining the exact combination of assets that produces the highest return at the lowest risk possible.

As a result, investors can calculate the risk/return produced by each financial asset they intend to incorporate into their portfolio and they can ultimately design the portfolio by determining the exact combination of assets that produces the highest return at the lowest risk possible.

Even though this all sounds fairly technical, the essence of this theory can be applied to your investments, at least to some extent, without having to run multiple scenarios and combinations of different assets in an excel spreadsheet, as the broad concept of diversification can benefit your portfolio even if you don’t go into the technicalities of modern portfolio theory.

To assist you in this endeavor, the following article provides 4 recommendations that should help you in diversifying your investment portfolio to cushion the impact that a bad performing asset class may have on your investment returns.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

1. Diversify Your Asset Classes

Financial instruments have evolved from simply stock and bonds to a wide range of securities that are classified into asset classes. This is the backbone of a well-balanced and diversified portfolio.

These assets have very unique characteristics and this is the primary reason why they are classified separately.

The most common asset classes in modern financial markets are:

- Cash

- Stocks (small-cap, large-caps, etc)

- Bonds (short-term, long-term, etc)

- Real estate investment trusts (REITs)

- Derivatives (options, futures, warrants, etc)

- Cryptocurrencies

Each of these asset classes carries an individual risk and yields a certain return and investors should at least understand the degree of risk they are exposed too, along with the potential return they can earn from investing in such assets.

While risk is technically defined by variances and Betas in the financial world, it can also be understood in scales. For example, an investor could rate financial assets in a 1 to 5 scale of risk with large-cap stocks being a 3 (average risk) and cryptocurrencies being a 5 (high risk).

In this regard, one initial step to diversify your portfolio is to analyze the returns that each of your investment alternatives has generated in the past and qualify their risk based on that scale. If there is an asset class that yields the same return with a lower risk, then you should choose that alternative over others that are riskier. Meanwhile, you can incorporate riskier asset classes into your portfolio as long as the additional risk you are taking is accompanied by a higher return.

2. Incorporate Assets With Negative Correlation

Correlation is a term used in statistics to identify the behavior of one variable vs. another under similar circumstances. If a given variable evolves in line with another then it is classified as a highly-correlated variable. Meanwhile, if the variable evolves in the opposite direction of the other, then it can be classified as a negatively correlated variable.

A negative correlation is beneficial for a portfolio, as it can bring stability to it. Let’s say you have found that gold (the commodity) is negatively correlated with the S&P 500 index. This means that whenever the S&P 500 goes up, gold tends to go down.

Even though you may not quantify the exact degree of this inverse relationship, you know that by incorporating gold to your portfolio you can cushion any losses caused by a drop in the S&P 500, which is a fairly good index for stocks as a whole.

A hypothetical portfolio comprised of 80% stocks and 20% gold should enjoy the benefits of a bull stock market, while also offsetting the losses of a bear market with the gains obtained from gold.

3. Rebalance Your Portfolio as Needed

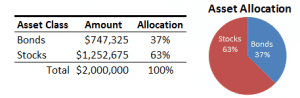

If your risk tolerance has dropped, you may need to reduce the number of equities held. Or perhaps you’re now ready to take on greater risk and your asset allocation requires that a small proportion of your assets be held in more volatile small-cap stocks.

To rebalance, determine which of your positions are overweighted and underweighted. For example, say you are holding 30% of your current assets in small-cap equities, while your asset allocation suggests you should only have 15% of your assets in that class. Rebalancing involves determining how much of this position you need to reduce and allocate to other classes.

Once you have determined the exact composition of your portfolio, which means the percentage of each asset class you will be incorporating into it, you have to monitor the portfolio to make sure the weights remain the same over time as your financial assets appreciate or decline in value.

This means that you have to periodically check the value of your positions to make sure your exposure to each asset class continues to follow the percentage you initially set for them.

4. Evaluate the Composition of Your Portfolio Periodically

![Wander Wisely]()

Many things can change over time in terms of performance, risk, and even in terms of the correlation between your financial assets.

That said, it is important for investors to periodically reassess the composition of their portfolios to make sure the fundamentals that initially drove them to choose that set up remain the same.

A change in the statistical relationship, performance, or risk associated of any of the financial assets in the portfolio should prompt the investor to take immediate action to protect the performance of the portfolio from any unforeseen deviations from the goal.

If you have experienced major life changes, you may also want to adjust your strategy and target asset mix. For example, getting married may mean you want to consider your asset allocation as a couple, versus 2 separate individuals. Having a baby may mean you want to devote more money toward a college savings and investment plan. Getting a new job might mean adjusting for more stock awards from your employer. Planning to retire might mean dialing back your allocation to stocks and building a retirement income plan.

Bottom Line

Diversification is a concept that investors should understand in order to improve and protect the performance of their portfolios. It is designed to help your investment portfolio generate more consistent returns over time. Review your portfolio to determine if it’s appropriately diversified for your financial goals, risk tolerance and time horizon.

While it is impossible to predict when losses will occur, diversification provides a cushion that investors can rely on to at least limit the extent of such losses by incorporating asset classes that behave differently under the same circumstances.

Reach out to us here so we can assist with your portfolio.

If you liked this article, you may find these interesting as well:

How Offshore Investing Helps Diversify Your Assets

3 Offshore Resources That Should Be Part of Your Financial Planning

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!