Go for the Gold

This article was published in the Escape Artist Weekly Newsletter on August 21, 2018. If you would like to subscribe to the newsletter, please click here.

One of the most exciting birthday parties I went to as a child was not bowling or ice skating, but rather gem mining. The venue contained a small, mock-cave that, at the time, actually felt authentic. Stalagmites and stalactites rose from floor to ceiling and there was a cool chill when entering through the arches into the dark space.

Our goal was to fill our empty buckets with as many gemstones as we could find in the allotted time period. With our headlamps on and buckets in hand, a handful of 10-year-old girls sifted through piles of dirt and silt, overturned “large” boulders, and scoured around each groove to find the prettiest gems.

When the searching period was up, we exited the cave and were back under the lights. We emptied our buckets into sifting trays to analyze our findings. There was one stone in particular that stuck out to me because of the way it shined under the light, unlike any of the gems. I took the rock home with me, and my parents informed me it was fool’s gold. “Hopefully that’s the only kind of gold you like,” my mom said to me with a smirk on her face, “Otherwise, you’re going to have really expensive taste.” Not understanding her reference at the time, I kept the fool’s gold on my dresser as a decorative item. And, to this day, the stone still sits on the same dresser, but a little less shiny and with little increase in value.

Fast forward a couple of decades to today, and gold (the real one, not the fool’s gold) is a constant topic of conversation in the industry I am in. Folks are always talking about ownership of precious metals as a means of insurance in case fiat currency falls by the wayside. Most folks agree that it is prudent to be diversified across all asset classes, while others are quick to stick to what they know. So to drill down on this topic, I’ve invited a couple of gold gurus to join us for an exciting webinar (Tuesday, August 21st at 7pm) titled “Gold: Hated Asset or Golden Opportunity,” In the meantime, let’s prep you.

Fast forward a couple of decades to today, and gold (the real one, not the fool’s gold) is a constant topic of conversation in the industry I am in. Folks are always talking about ownership of precious metals as a means of insurance in case fiat currency falls by the wayside. Most folks agree that it is prudent to be diversified across all asset classes, while others are quick to stick to what they know. So to drill down on this topic, I’ve invited a couple of gold gurus to join us for an exciting webinar (Tuesday, August 21st at 7pm) titled “Gold: Hated Asset or Golden Opportunity,” In the meantime, let’s prep you.

Below, you’ll find a compelling piece written by my friend, Michael K. Cobb, covering this controversial, yet valuable asset. Enjoy the read and remember to register for the session tonight.

(If you’re unable to attend the session or are reading this after the fact, please still register for a copy of the recording.)

Take it away, Mike.

—

4 Reasons Why Gold is a Bargain Right Now

By Michael K. Cobb

I’ve always wanted to travel to Australia, but the country-continent has thus far escaped my visit. Not that I haven’t been invited. Michael Checkan, a long time dear friend has invited me numerous times to join him on his “walkabouts” across the continent. Once, he even invited me to accompany him on a coast-to-coast train ride, ending up in Perth to view the actual mines and mint. Any of these would have been great trips, and I would have loved to go, being a hobbyist gold panner myself.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

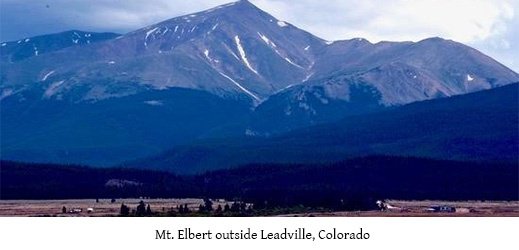

When we pan for gold, the claim we explore is held by another friend, Dainis, who runs the Colorado Gold Camp just outside Leadville, Colorado. If I take him a bottle of Nicaraguan rum, 25-year-old Flor de Caña Reserve, specifically, he’ll even loan me a sluice to use to process even more dirt in the fast-moving water. The claim is a small tributary to the Arkansas River at the base of Mt. Elbert, the highest mountain in Colorado, and a “fourteener.” A fourteener is a mountain in Colorado that is over 14,000 feet. There are 58 of them, and a goal for many hikers is to summit all of them.

When we pan for gold, the claim we explore is held by another friend, Dainis, who runs the Colorado Gold Camp just outside Leadville, Colorado. If I take him a bottle of Nicaraguan rum, 25-year-old Flor de Caña Reserve, specifically, he’ll even loan me a sluice to use to process even more dirt in the fast-moving water. The claim is a small tributary to the Arkansas River at the base of Mt. Elbert, the highest mountain in Colorado, and a “fourteener.” A fourteener is a mountain in Colorado that is over 14,000 feet. There are 58 of them, and a goal for many hikers is to summit all of them.

I’m just happy to hang out in the snow-melt runoff stream and look for placer gold with my daughters once in awhile, and we do find some. Usually, a few flecks that now grace the bottom of a small bottle, but in reality, not very much. Big fun, little gold. There are easier ways to get gold for sure. Maybe not as fun, but certainly easier than shoveling rock out of the banks of a creek and running it through the sluice.

I’m just happy to hang out in the snow-melt runoff stream and look for placer gold with my daughters once in awhile, and we do find some. Usually, a few flecks that now grace the bottom of a small bottle, but in reality, not very much. Big fun, little gold. There are easier ways to get gold for sure. Maybe not as fun, but certainly easier than shoveling rock out of the banks of a creek and running it through the sluice.

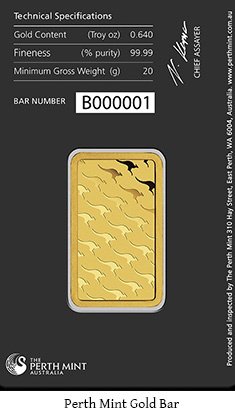

This brings me back to the point of the article and the analysis that it contains. Michael Checkan, and his nephew Rich, run a great outfit in Rockville, MD, Asset Strategies International, and have long provided the hard asset crowd new and innovative products and ways to own gold and other precious metals. They helped the Perth Mint in Australia develop and market the first true metal-backed certificate program from a government of the world. I guess the “Silver Certificate” U.S. dollar predated the Perth program, but Perth was unique for its time and revolutionary in the metals business.

Basically, the program that the Checkans and Perth created was one whereby you could take possession of a certificate backed by physical gold, stored in the Perth Mint in your name. Your precious metals could be held in three different ways: allocated, pooled allocated, or unallocated. These three methods of storage are all slightly different and have slightly different premiums and storage fees associated with them.

Most importantly, regardless of the type of storage you choose at Perth Mint, all your precious metals come with a government guarantee from the State of Western Australia stating:

1. Your precious metals holdings are backed 100% at all times and held under Perth Mint’s control on your behalf.

2. Your precious metals will never be leased to third parties.

3. Your precious metals will never be used as backing for derivatives.

4. Your precious metals will be insured at 100% of current market value at all times… at Perth Mint’s expense.

I’ll let the non-commissioned Preferred Client Relations Representatives at Asset Strategies explain the difference in types of storage, but suffice it to say that allocated is segregated storage and comes with the highest costs. Unallocated is commingled storage and comes with no fabrication or storage fees.

And, at the Perth Mint, given their guarantee, all are extremely safe options, and all can be stored, sold, or delivered when you choose to do so.

If not for this particular government guarantee, I would always opt for allocated storage. With the Perth Mint and their unique guarantee, all storage options are open to me. In fact, most of the Asset Strategies clients choose the unallocated option.

The common thread at Perth Mint is…your gold is your gold.

As time passes and new technologies emerge, the need to keep up with the times has propelled Perth Mint to launch a new product, the Depository Distributor Online. The desire on the part of consumers to reach out 24 hours a day, to buy, sell, monitor, and transact led to a new product for the new times. It comes with the same, all-important government guarantee. Very important. Now just in real time.

As time passes and new technologies emerge, the need to keep up with the times has propelled Perth Mint to launch a new product, the Depository Distributor Online. The desire on the part of consumers to reach out 24 hours a day, to buy, sell, monitor, and transact led to a new product for the new times. It comes with the same, all-important government guarantee. Very important. Now just in real time.

Later in this column, we’ll share details of the program and provide a link where you can get more information, but for now, I want to pass along some critical analysis of the metals market that is timely and relevant to everyone who already owns or is considering a precious metals purchase. Michael, Rich, and the Asset Strategies team do incredible research, and here’s the latest from them written specifically for you in this week’s column.

4 Reasons Why Gold is a Bargain Right Now

By Rich Checkan

For the past two decades, I have bought and sold a significant amount of gold, silver, platinum, palladium, rare coins, and rare stamps. I have delivered it to clients and have arranged for domestic and international storage on behalf of clients. I have seen robust bull markets and staggering bear markets.

And, right now, I believe a fledgling bull market in gold is beginning to get underway. Further, I believe you should consider taking advantage of it.

But, here are some disclaimers before I get going…

1. If you like buying investments when prices are at their peak, this won’t interest you.

2. If you like buying investments after the masses have caught-on and bought-in, this won’t interest you.

3. If you like buying investments only when the technical suggest you shouldn’t, this won’t interest you.

4. If you like missing opportunities to have your dollar go further, this won’t interest you.

All the “disclaimers” above are suggesting that prudent investors should be considering gold right now. So, if you are a prudent investor, this will interest you.

Let’s look at each one in turn…

Peaks, Valleys, and Sweet Spots

I was speaking with one of our valued clients the other day. His view is one shared by many. He was absolutely convinced that gold, at current price levels around $1,280 per ounce, was high.

Now, I am a believer that gold, bought for the right reason (long-term wealth insurance), can never be purchased at the wrong time or at the wrong price. But, not everyone sees things my way. Regardless of whether or not you believe in that statement, I don’t think you can make a case for gold being expensive here.

Gold’s all-time high was achieved in September of 2011. Gold peaked then at around $1,900 per ounce.

Gold’s recent lows occurred in December of 2015. At that time, gold’s valley was near $1,050 per ounce.

From peak to valley, gold fell (in U.S. dollar terms – more on that later) nearly $800 per ounce. That’s a 42% correction in gold’s price.

From the valley, we currently stand roughly 22% higher.

This is important. One of the most successful investors of all times, Bernard Baruch, wouldn’t commit to a particular investment until it appreciated 20%. He also wouldn’t stay invested in any particular investment for the last 20% of appreciation. All Bernard Baruch wanted was his safe and profitable 60% appreciation in the middle.

He waited out the first 20% to make sure the investment wasn’t experiencing a false start. He sold the investment and chose to miss out on the final 20% of appreciation, so as not to get caught reaching for and missing the highs. All he cared about was the 60% in the middle… the safe “Sweet Spot.”

Gold has just entered the “Sweet Spot”…up 225% from the recent lows.

The Herd

Contrarians tend to avoid the herd mentality at all costs. Typically, by the time the masses have entered an investment, it is too late.

Not to worry, as far as gold is concerned.

Right now, sentiment for gold is as low as it has been in my more than two decades in the industry. Out of favor does not even begin to describe gold sentiment right now. Production floors at major mints are almost indiscernible from a funeral.

The reason is quite simple to grasp. Money is flowing where it is treated best. For the past 8 years, that has been the stock market. If you want to find the herd, that’s where they are. This is confirmed almost daily by new record levels for the equities markets.

I sense greed at work here. Greed is at play for those who got a taste of paper profits and want more. They are starting to believe the stock market can only go up. How did that work out in the past? Desperation is also at work here. Think of all the people who planned to retire in 2008, and the years to follow, but are still working today in 2018. They lost 40% to 50% of their retirement assets from 2008 to 2009, and they have been desperately fighting to win it back so they can finally retire. They are hoping the bull market lasts long enough for them to do so.

Equities will revert from these highs. Gold is already starting to revert from these lows…but the masses aren’t paying attention to it yet.

What History Can Tell Us

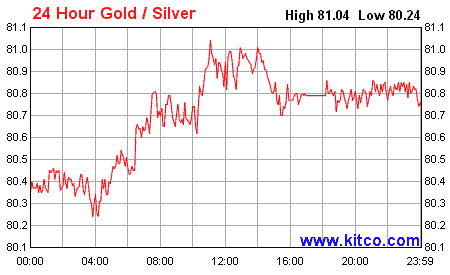

One useful technical chart we can consider to determine whether gold (and silver) prices are high or low is the Gold/Silver Ratio (GSR). Simply put, this plots the number of ounces of silver you can buy for one ounce of gold.

Take a look at the GSR Chart below…

Historically, when the GSR is high – and a reading of 80+ signifies this – gold and silver prices are both at lows. And, this time is no different. The GSR touched 80 in August of 2015. It touched 84 in March of 2016. Almost directly in the middle of those two readings, gold hit its recent low of $1,050 in December of 2015.

Historically, when the GSR is high – and a reading of 80+ signifies this – gold and silver prices are both at lows. And, this time is no different. The GSR touched 80 in August of 2015. It touched 84 in March of 2016. Almost directly in the middle of those two readings, gold hit its recent low of $1,050 in December of 2015.

From that point, gold and silver have historically appreciated…with silver appreciating faster than gold and lowering the GSR as they climb higher. They tend to settle at a GSR reading of between 35 and 50.

As I write, the high for GSR is 81.04.

If this chart holds to form as it has in the past, the trend is toward higher gold and silver prices from here, and most of the appreciation is ahead of us.

Temporary U.S. Dollar Opportunity

For U.S. dollar-based investors, the dollar is giving you a short-term opportunity to get more gold for your buck.

Thus far this year, the U.S. dollar has been under pressure. The dollar has undergone a bit of a rebound rally. However, many analysts believe this rebound to be counter to the longer-term trend of U.S. dollar decline.

If they are correct, this period of dollar strength will not last. Consider taking advantage of this short-term dollar strength to buy gold. After all, the time to hedge the dollar is when it is stronger, not when it is weaker.

What’s a Prudent Investor to Do?

Prudent investors invest when…

1. Their investment is in the “Sweet Spot”…Bernard Baruch’s 60% in the middle.

2. Their investment is out of favor…not wrapped up in herd-induced mania.

3. Their investment is favorable from a technical standpoint.

4. Their investment can be purchased under opportune conditions.

Right now, gold may be out of favor, but it is extremely desirable for the prudent investor. If you are a prudent investor, consider starting – or adding to – your gold position now. It’s one of the best ways I know at present to keep what’s yours!

—

Rich and Michael know the value of gold and precious metals. Many of you do, too. Many of the indicators are lining up that this could be the beginning of another run. If you agree that now might be a good time to take some money off the table in the markets like you’ve seen me write about recently, perhaps owning some metals makes sense. Consider joining us tonight (Tuesday, August 21) at 7pm ET for a live webinar with gold guru, Rich Checkan, to review your options. Register here.

Gold is attractive right now. Check out the webinar to see if the metals program is right for you.

—

If you are NOT able to join us for the live session, or you read this message after the session, PLEASE STILL REGISTER HERE! You will receive a copy of the recording afterward.

This offer ends Sunday!

Don’t miss out!

This article was published in the Escape Artist Weekly Newsletter on August 21, 2018. If you would like to subscribe to the newsletter, please click here.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!