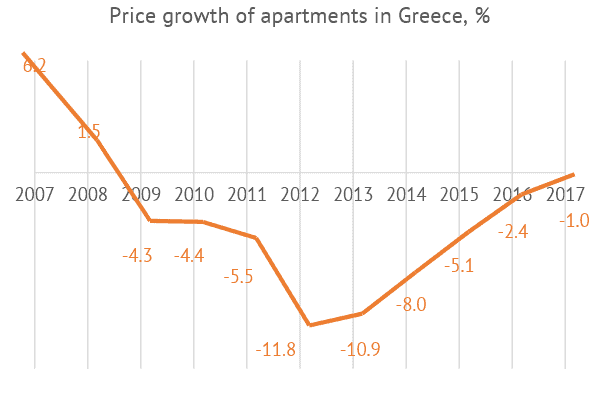

The Greek property market is showing signs of recovery. According to the Bank of Greece, in 2017, property prices fell by 1% from the year before, the lowest in the past decade, which saw prices falling by an average of 6.5% annually for the past eight years.

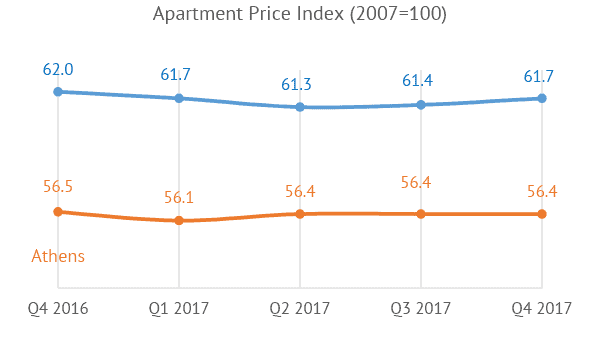

In Q1 2017, residential property prices were on average 1.9% cheaper than the year before, but in Q4 2017, average prices were only 0.3% cheaper than the year before. The difference in Athens was even smaller – in Q4 2017, prices fell by only 0.1% compared to the same period the year before. Between Q2 and Q4 2017, prices of property in Athens remained stable and even grew in other cities.

Source: Bank of Greece

Why the Situation Will Improve

- Since 2010, the Greek government has taken many measures to reduce public debt and its budget deficit. This has produced results – the International Monetary Fund (IMF) has forecast Greece to achieve 1.8% GDP growth in 2017, and 2.6% in 2018.

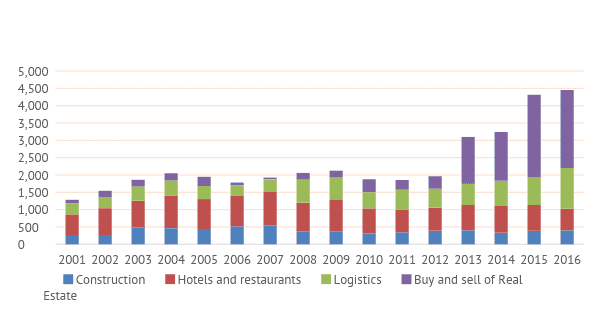

- A strong fall in the value of Greek assets (along with an ease in social tension) is making them more attractive to foreign investors. According to a press release from the Greek Ministry of Economy, foreign direct investment is expected to reach €4 billion in 2017, which is 42% more than in 2016.

- Austerity measures adopted by the Greek government yielded dividends in the form of a surplus in the state budget, even though this exacerbated the decline in demand at the height of the crisis several years ago. The parallel development of privatisation programs allowed the state to receive additional revenue and also attracted large foreign investors to participate in the development of transport and energy infrastructure in Greece. For example, Chinese company COSCO acquired 51% of the Port of Piraeus, the Italian company Ferrovie dello Stato Italiane bought out Greek railway operator TrainOSE, and the joint venture Fraport Greece began managing 14 state airports.

![]()

![]()

Source: Bank of Greece

- According to the World Tourism and Travel Council, the number of international tourists grew from 14.9 million in 2009 to 24.8 million in 2016. This has caused an increase in demand for short-term rental properties, despite higher taxes. This makes residential property more attractive for investment. In October 2017, media published news about a Chinese investor who acquired more than 100 apartments in the Exarchia neighborhood in Athens in one transaction.

- Greece’s “Golden Visa” program, launched in 2013, is attracting private investors to the country’s residential and commercial real estate market. As of September 2017, 2,014 primary applicants have received a Greek residency permit.

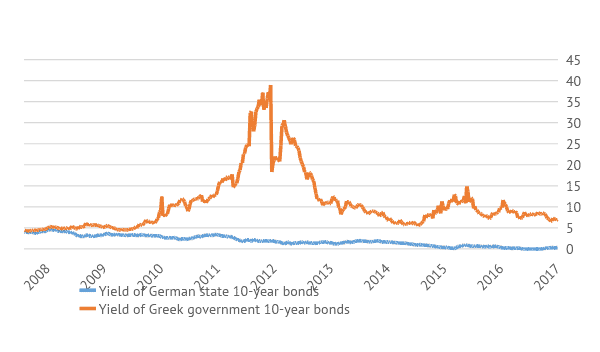

- Greek government bonds have stabilised at 2-6%, depending on maturity. In July 2017 the country has managed to place five-year government bonds on the market with a 4.5-5% yield for the first time in three years. As such, Greece has restored access to low-cost external financing, which is having a positive effect on private and corporate lending.

![Is the Greek Property Market Poised for Growth?]()

![]()

Data: investing.com

- The unemployment rate improved from 27.8% in 2013 to 20.6% in 2017. Although the Greek labour market cannot be called positive, the peak of the employment crisis has passed.

- In 2014 the Greek government adopted amendments to legislation relating to how it deals with non-performing loans (NPL). The amendments simplify the procedure for selling NPL and protect borrowers from the forced sale of collateral. The amendments also allowed the Greek government to set up specialised institutions to purchase and manage portfolios with bad debts. In the future, this will allow private banks to “clear” their balance sheets and reduce the required reserves to further reduce the cost of financing loans.

The measures taken by the Greek government under the pressure of its EU creditors have helped the country avoid bankruptcy. Greece has moved on from resolving issues related to its creditors and avoiding bankruptcy and is now looking for sources of economic growth. The stage is set for a rapid recovery, and an increase in property prices should soon follow.

According to Tranio, the local property market has already hit its lowest, and prices will begin to rise this year. This is an ideal time to invest in Greek property, as prices are almost twice cheaper than before the crisis. Tranio offers three investment options in Greece, which have euro-denominated yields:

- Buying short-term tourist rentals in central Athens. Investors can get a yield of 7% per annum and a European residence permit with property purchases from €250,000.

- Taking out a property-secured loan at 8% per annum for the purchase, renovation, and resale of apartments.

- Investing in a project company as a partner. The return on investment is 15% per annum.

Author Bio:

Yulia Kozhevnikova, real estate expert, & Artem Shitkov, data analyst, at Tranio.com overseas property broker.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

Tranio.com is an international real estate platform with a network of 700 partners worldwide and a catalogue of more than 80,000 listings in 54 countries. The company publishes daily news, high-quality analysis on foreign realty, expert advice, and notes on laws and procedures related to buying and leasing properties abroad so that readers can make their property decisions with confidence.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!