Serving on the Board of Directors of the National Association of Realtors permits me to work with top industry experts and collect some interesting data. Last week I was in New York City to present on a panel for the Global Real Estate Summit NYC. Here are some interesting facts you may not know:

Top Data for Inbound Global Business to the United States.

- $153 billion of residential property sold to foreigners last one-year period.

- 50% growth from previous period. $102 billion last period.

- 284,000 homes sold, up from 214,000 last period.

- Average home price purchased by foreigners nearly double the national average.

- Sales to foreigners represent 10% of all property sold in the United States.

Source: 2017 PROFILE OF INTERNATIONAL ACTIVITY IN U.S. RESIDENTIAL REAL ESTATE, NAR Research Group. Study Period: April 2016 through March 2017

This last point highlights the relevance for all U.S. property owners. Let me repeat. Foreign buyers purchased over 10% of all real estate in the U.S. in a period between April 2016 and March 2017. $51 billion more than the previous year.

Why it matters depends on a couple things. Do you own property? If so, it matters. Foreign buyers represent a significant piece of the demand side of the market. Without them and their purchases, prices would certainly fall as demand for 1 in 10 homes on the market would disappear.

Also, if you are a global thinker, then understanding the trends in migration both into and out of the United States is an important part of a complete knowledge set. While many of you, whose primary purpose in reading this newsletter is to understand the options for property ownership outside the U.S. and Canada, know the converse information is important too. We should all know who’s moving to North America and why. Seeing data that is new and different helps us avoid confirmation bias, which can be dangerous to solid investment strategies.

It’s quite an honor to be asked to participate in the Summit NYC, considering the heavyweights with me onstage. Even better is the information shared backstage in the “green room,” ahead of the public panel discussion. Shop talk is fascinating, and it is true what they say about knowledge passed around behind closed doors. It’s not necessarily sinister or all that secret, really. It’s just that in a collegial setting, the shorthand of the industry allows for a rapid fire and concise detailing of events, trends, and news.

Summit on Global Real Estate and Industry Panel

Some of the gleanings from those conversations are sprinkled into this column. They are relevant to anyone who is involved in the real estate business, owns rental properties, or is simply a property owner in the Unites States or Canada for that matter.

By the way, while the U.S. and Canada are two distinct markets, of course, the reality is that for much of the world, North America is viewed as one popular region. The reasons people look to the U.S. and Canada are similar, and in many cases the same, when viewed from Asia or Latin America. Very specific Canadian data is included below vis-à-vis property prices and buying trends in the U.S.

For long-time readers, you know that several of my recent articles have been about the stock market highs and taking money off the table now. You may have also seen “Who’s going to buy them,” a recent column about the stocks, bonds, and properties owned by the baby boomers that will soon be flooding the market as they sell them off to fund retirement.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

This data, specifically real estate data in this week’s column, shows that there are strong trends for foreign buyers of U.S. properties. Pay attention to this data because I may be wrong about the upcoming crisis of not enough buyers. On the other hand, I may not be. It is easy to believe that the volume of products coming onto the market in the coming years will dwarf the demand. And I do. But, that said, it’s not zero demand for that product. In fact, it is significant demand, and that fact needs to be weighed appropriately.

If you are a realtor, this data about inbound foreign buyers matters too, but in a different capacity. As a professional in the business of serving sellers and buyers of properties, having data about who is buying, where they are buying, and giving sound advice will make a difference to your listing clients and offer new opportunities for buying clients too.

So, who’s buying and where are they buying? Knowing the who, where, and why will let property owners and realtors alike zero in on possible buyers who may have been unnoticed previously.

Top Foreign Buyers of U.S. Real Estate

- Chinese $31.7 billion

- Canadian $19 billion

- United Kingdom $9.5 billion

- Mexican $9.3 billion

- Indian $7.8 billion.

Source: 2017 PROFILE OF INTERNATIONAL ACTIVITY IN U.S. RESIDENTIAL REAL ESTATE, NAR Research Group. April 2016 through March 2017

Top States Where Foreign Buyers Purchase

- Florida 22%

- Texas 12%

- California 12%

- New Jersey 4%

- Arizona 4%

Source: 2017 PROFILE OF INTERNATIONAL ACTIVITY IN U.S. RESIDENTIAL REAL ESTATE, NAR Research Group. April 2016 through March 2017

Top U.S. Cities Where Foreign Buyers Purchase

- Miami – Ft. Lauderdale – West Palm Beach Metro

- Los Angeles Valley Metro

- Seattle – Bellingham WA Metro Corridor

- New York – Newark NJ Metro

- Orlando – Kissimmee Metro

Source: https://www.nar.realtor/where-are-global-buyers-searching-in-the-united-states

Global trade, and the free legal movement of goods, services, and people are the foundation of economic success for the capitalist world. The United States economy and consumers of all types benefit from the free flow of capital into the country. Jobs are created, property owners can sell existing homes, move to a new home, downsize, or even upsize as their properties are purchased by foreigners. With more than 10% of all residential real estate sales transacting to a foreign buyer, this reality should be recognized and applauded.

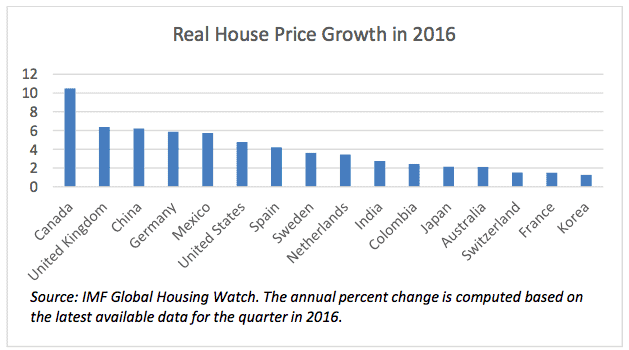

One of the factors driving foreign buyers to look for real estate in the U.S. is the increasing cost of properties in their home countries. Canada, the UK, China, Germany, and Mexico all saw property prices climb 5% or more in 2016, with Canada on average climbing over 10%. The bottom line here is that when property prices soar overseas, buyers there look to diversify property ownership options abroad as a hedge, or a value buying opportunity.

It’s not surprising that Canadians represents 13% of inbound growth for the period of April 2016 through March 2017. Simply look at the chart below showing the cost increase of property in Canada for 2016. Up a whopping 10%.

For Canadians, buying property in the United States is easy and it’s close by. Few language issues exist. The vast majority of Canadian buyers are comfortable with the process as well, because most of Canada uses the common law system.

Currency exchange plays a factor, but interestingly in the April 2016 to March 2017 period, it didn’t really seem to matter much. Even with the stronger dollar compared to almost all world currencies, sales of U.S. property to foreigners generally rose. Canadian buyers are 2nd only to China for U.S. foreign property buyers. Incredibly, inbound Canadian sales were strong, even while the Canadian dollar was trading low, running an average of 1.33 for the year 2016 – making a U.S. property more expensive by about a third.

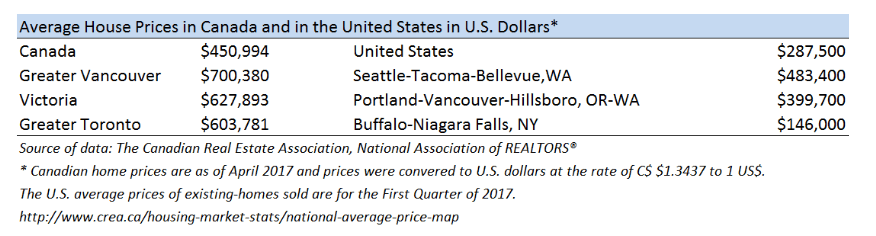

The chart above is interesting because in the similar markets examined, Canadian property prices are significantly more than U.S. property prices using a U.S. dollar constant. The cities shown receive significant Canadian inbound global business. But, to be fair, and with no offense to my friends in the Buffalo area, I’m not sure a Toronto-Buffalo comparison is quite right. Perhaps a more equal comparison would be to the NYC Metro area.

I tried, but to come up with an average price in NYC would be to mix too many kinds of fruit. My friend and NAR President’s Liaison to Nicaragua, Aldo Iemma, said it this way,

“If there is a number it is meaningless. Each of the boroughs is different and Manhattan is in a class by itself, mostly coops and condos. Probably $1.2m for a 2-bedroom condo in Manhattan. For Brooklyn about $850k for a one-family home – and Staten Island, $500k for a one-family home.”

But as a comparison to Toronto, New York City is a much better case study even if we have to break up the boroughs and look at each independently.

Mike Cobb and Aldo Iemma, Presidential Liaison to Nicaragua at Global Summit NYC

Knowing why foreigners are purchasing is key to the knowledge set as well. In about half, 49% actually, of the property purchases, foreign buyers stated that the reason to own in the U.S. was as a primary residence property. 18% classified the purchase as a residential property investment. Vacation home and a combination vacation/investment represented 22% of the buyers. 4% of the buyers responded that they purchased homes for their kids in school.

One of the other reasons that is largely anecdotal, and certainly much harder to quantify, is the desire on the part of foreigners for a “Plan B.” The wealthy in countries like China and India purchase property in the U.S. because the U.S. is seen by these buyers as a safe haven when compared to their home countries, for political and economic stability.

Why somebody is purchasing a new residence, vacation property, or real estate investment in the U.S., in many cases, probably stems from the Plan B motive. This was a green room conversation that was most interesting indeed. This Plan B reason is rarely captured on a survey. Buyers are not likely to make this statement since they remain citizens of their home country. Anecdotally though, it may be a large factor that underlies all the various stated reasons for buying a property in the U.S.

Also of interest was the divergence of how properties are paid for by Indian and Chinese. The Chinese tend to be all cash buyers 65% of the time, whereas the Indians tend to mortgage from a U.S. lending institution about 79% of the time. Again not stated formally in a survey, whereas the Indian buyers want to leverage the purchase and buy more home for less, the Chinese view the real estate purchase as a way to get cash out of China.

New rules in China restricting the outbound flow of capital will have an impact on Chinese buyers for a time, but the consensus in the room was that, “Where there’s a will, there’s a way.” Gabe Pasquale of Landsea Holdings Corporation, and Phillip A. Gesue of Strategic Capital, both work in the business of serving Chinese buyers and investors. The challenges for Chinese to get their money out of China are growing each year, and the new regulations are making it very difficult.

While the Chinese buys are today the largest segment of the inbound global purchasers, and the trend appears to continue for 2017, the reality is that it will require creativity on the part of Chinese buyers to keep the money flow open for the purchases of U.S. real estate that they desire. We’ll certainly be keeping an eye on this since the Chinese buyer represents 13% of the inbound property purchase market in the U.S. – and significantly more in certain cities.

Totally on a different note for a minute, while in NYC before the Monday summit, I enjoyed a great hike on Saturday with Amanda on Breakneck Ridge, about 90 minutes north of the city on the Hudson Line of the MTA. The train actually has a special stop in the middle of nowhere at the base of this mountain to let off folks who want to climb the ridge. It’s a steep hike with a lot of rock scrambling. 1200 feet of vertical in less than 2 miles. The views of the Hudson River are spectacular. They do offer easier trails around the rock scrambles, but as you can see when we saw the sign pointing to an easier route………NO WAY.

Breakneck Ridge Overlooking the Hudson River north of New York City

Mike and Amanda at Lincoln Center for Swan Lake

Also, while in the city, this past Sunday Amanda and I went to see Swan Lake at the New York City Ballet. Principal dancers for the sold-out event were Tiler Peck and Chase Finlay. Amanda even saw ABT corps dancer, Cate Hurlin, in the audience sitting nearby. The performance was incredible, the music powerful, and the company priceless. Nice to be able to tie in some family fun time with the business there.

Circling back to the event in NYC, and to wrap up, one of my colleagues had some comments about the event and why it is specifically relevant for realtors:

These summits are the best way for the global practitioner to stay current with the often rapid, changing events impacting international real estate. By attending, we are able to get a “boots on the ground” perspective from the local broker in the region or country, enabling us to share relevant information with our globally bound clients, so that they are able to make informed decisions. It was an honor to share my experiences as NAR President’s Liaison to Greece along with fellow NAR Liaisons from Honduras, Italy, and the Dominican Republic. Fellow FIABCI Board member, and Leading Real Estate Companies of the World, Paul Boomsma shared invaluable data with us regarding current trends and preferences of high net worth clients as well.

Marsha Collins-Mroz NAR President’s Liaison to Greece, Certified International Property Specialist, FIABCI USA Midwest Council President

Marsha Collins – Mroz 4th from left in orange speaking at NYC Global Summit

Marsha Collins – Mroz 4th from left in orange speaking at NYC Global Summit

For realtors, the opportunity to serve these inbound buyers is huge. Commissions on $153 billion in transactions would exceed $7.5 billion. Real money for anyone except the federal government. However, to be able to serve these international buyers, realtors need to gain the skills and cultural sensitivities needed to interface with a foreign buyer.

The Certified International Property Specialist (CIPS) course is a great way to get the knowledge needed, and more importantly, the network of thousands of other globally minded realtors with whom to share referrals and business data. The reality is that real estate is an international commodity and the competition for property is now worldwide. Bottom line: Go global or be left behind.

Next week, we’ll look at the outbound side of the global property markets and examine some specific properties, including a nearly completed hospital in Santo Domingo, Dominican Republic, that is owned by a bank there. This is another great foreclosure opportunity we’ll share with you. The property is in an excellent downtown location to serve the needs of the market. Larissa Ortiz, a fellow panelist and CIPS Chair for NAR in 2017-18, has the property specifics.

If you’d like to take a preview look before we lay out the details next week, reach her here: Larissa@escapeartist.com

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!