Some may say the Puerto Rico is drowning in debt, corruption, and the aftermath of hurricane Maria. Well, that all true, but not the whole story when it comes to the US territory of Puerto Rico.

The Caribbean is characterized by warm waters, palm trees, lush forest and flexible governments. Puerto Rico’s status as a US territory is no exception to the general Caribbean standard. However, due to its unique status this commonwealth is phenomenal for business. In this article I will explain how PR is undervalued, at the moment, and potential business development opportunities that will flourish within the next few years.

For more on the various tax incentives available in Puerto Rico, see A Detailed Analysis of Puerto Rico’s Tax Incentive Programs.

One way Puerto Rico is bailing out is by becoming a blockchain hotspot. As per a NY times article, there has been much talk about the island running blockchain projects. The senate has held hearings as to what is acceptable in terms of the technology and the government developing their own crypto currency called “kokicoin”.

Here’s what the government and businesses suggest:

To host such technology, Puerto Rico needs to consider its infrastructure and the 2 major factors of hosting blockchain hardware;

- constant electricity and

- reliable internet service

Unfortunately, only one datacenter served the last hurricane.

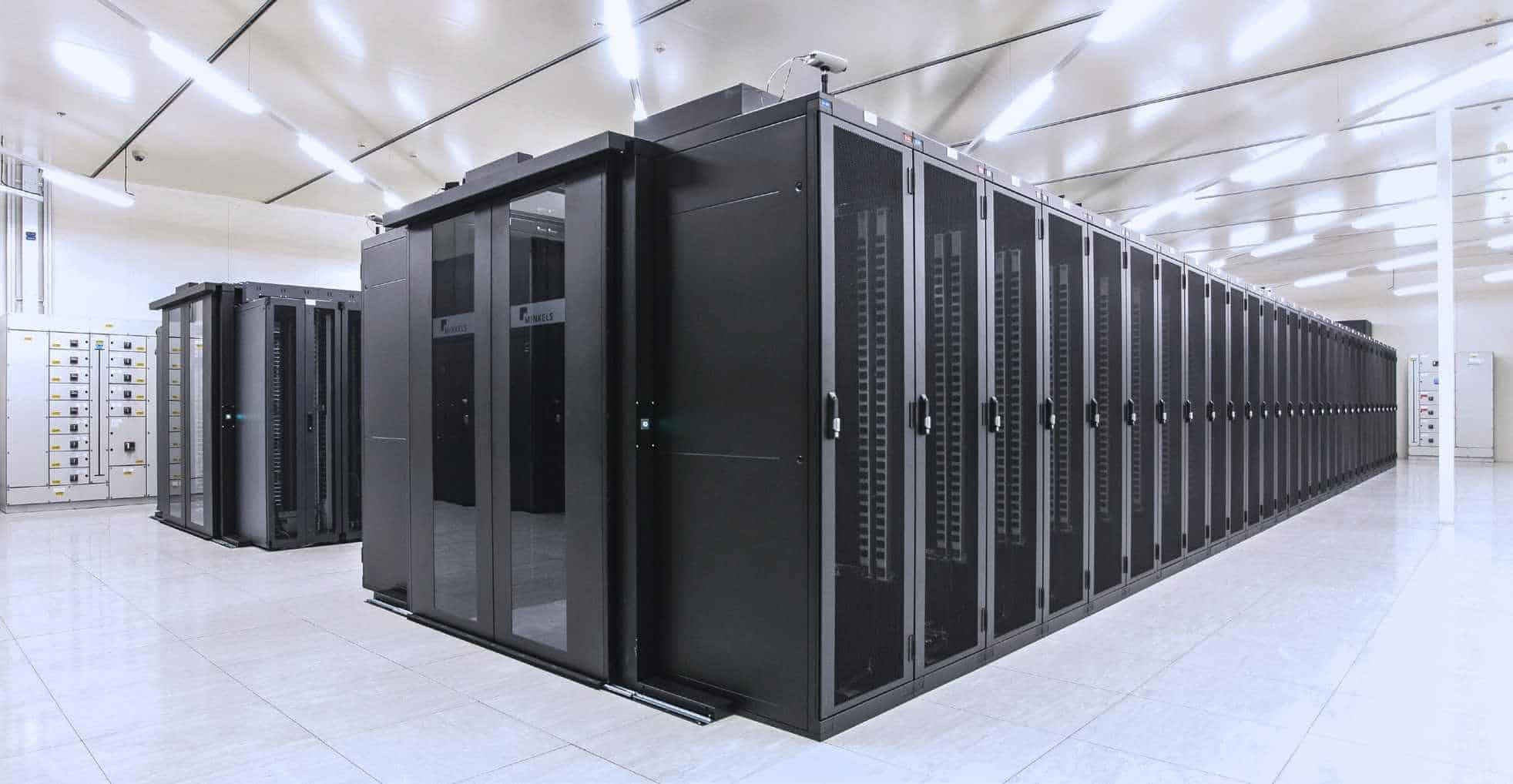

This data center is called Netwave. They are willing to host all new blockchain and fintech companies coming to the island at a fraction of the cost. Their data centers will run hell or hurricane. Most international banks and fintech platforms are housed here.

This is the only company that did not go down with the hurricane, still had power and access to Considering yearlong warm weather of this island, Netwave offers multiple data center options which are strategically placed on the island with real time response.

More over Netwave has connections in Florida, New York, Panama and Colombia. They do:

- Data protection

- Wireless Networking

- Cloud Services

- Surveillance

- Monitoring

- Satellite internet

This is an excellent option to develop crypto business in a US jurisdiction.

On another point, in developing a business you need to consider the tax consequences and the labor laws applicable to the location you wish to use.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

If you are considering maximizing the economic benefits of a blockchain or fintech project, we recommend Puerto Rico for many reasons: tax rate of zero on capital gains under Act 22, business income tax rate of 4% under Act 20, the diverse population, corporation friendly labor laws, and although the creators of despacito PR holds the highest business efficiency of the Caribbean. There is nowhere better than Puerto Rico.

After President Trump’s tax plan, Puerto Rico is the only tax haven open to Americans. If you set up a business in Panama, you’ll pay US tax on your profits. Move you and your business to Puerto Rico and exchange the US rate for a 4% tax deal.

And we’re not talking about tax deferral. This is the ONLY tax you will pay. Your profits and dividends won’t be taxed in the United States if you are a resident of the territory. For more on this, see: Big Changes Coming for Puerto Rico’s Act 20 Tax Incentive Program.

The reliability of the flexible government is such that last year before the hurricane there were even more favorable amendments to the tax exemptions laws. The required amount of employees was eliminated. Further now after the hurricane more tax cut laws a being implemented to retain the current corporations on the island. For more, see: Puerto Rico Eliminates 5 Employee Requirement

And for information on post hurricane plans, see: What’s Next for Puerto Rico After Hurricane Maria?

I hope you’ve found this article to be helpful. For more information on setting up your business in Puerto Rico, please contact us at info@premieroffshore.com or call (619) 550-2743. All consultations are free and confidential.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!