Last week we covered the question of “Are you ready to live overseas?” from a personality standpoint. The quiz linked in that article is the best short quiz I’ve ever seen. 15 simple, easy questions that give you a great sense of whether you have the best personality to transition to a life overseas. It takes 2-3 minutes to complete. If you missed the quiz last week, click here to take it now and see how you might fare abroad.

By the way, after you take the short quiz, we have an even more in-depth analysis tool. Many have found it extremely helpful in examining areas of life that tend to be whitewashed over before a move, like, “How close to an English-speaking church do you want to live?” This tool has a series of questions that get into the nitty gritty details of your overseas preferences.

Take the in-depth analysis here

In today’s article, we move into the more fundamental and pedestrian elements of a move and life overseas. These are the considerations that make the move, and life afterwards, possible practically. Financial factors, lifestyle factors, and health factors are all central to this analysis.

When the Grandkids visit Gran Pacifica When the Grandkids are back home

Let’s start with the baseline factor that will green light or red light a move overseas…finance. At either end of the spectrum, the knowledge about whether you can move is easy. You have enough money or you don’t. But the middle ground, the grey area, is where it gets tough. How do we really know if we have enough to move, and then to stay?

A financial advisor is a key element to this analysis. Although, I must warn you, finding an advisor who will be happy about your move overseas may be challenging. They tend to be very conservative in a provincial kind of way. Taking stock of your assets, income, and matching them up to your expected needs is critical in ascertaining your ability to move, so finding a professional who can help you take stock of your financial situation is key. Knowing what you have now and what you are likely to earn or receive through a pension or Social Security post-retirement will allow you to see what options will make the most sense for you long term.

Moving overseas for financial reasons is a good idea, despite what friends, family, associates, and others might say. More on that later. But especially for folks who expect limited income in the future, living overseas can satisfy a desire for a higher quality of life on a budget that would not afford the same lifestyle in the U.S. or Canada.

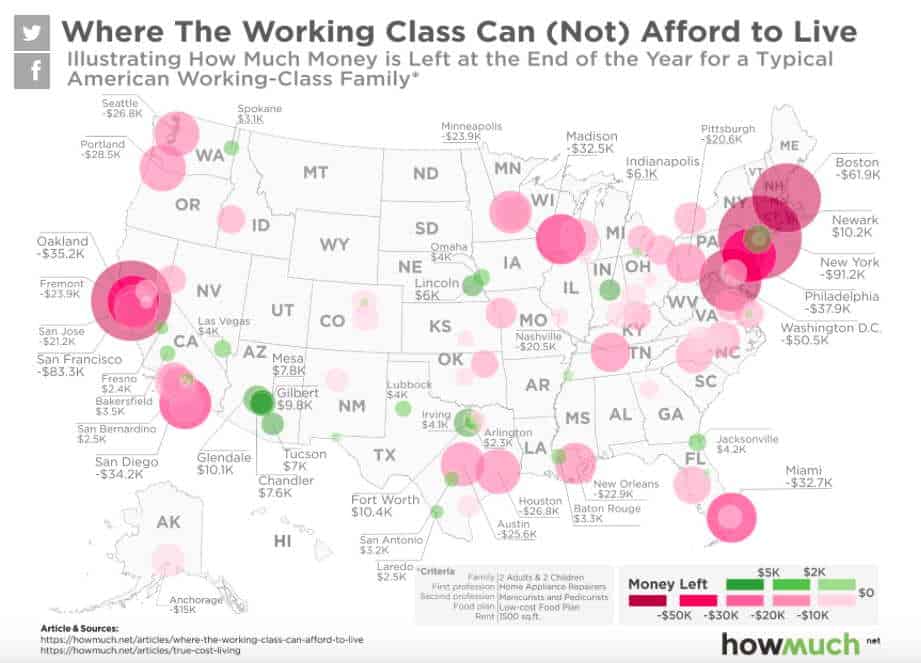

The picture graph below shows the horrendous situation in which many retirees are finding themselves. And it’s not just retirees. Younger folks are having challenges with affordable living as well. Cost of housing is one factor. Cost of living is another. Eating Mac and Cheese, Ramen Noodles, and Dollar Store Dinty Moore Stew is OK for a few weeks, but for the rest of your life? Look at some of these negative cash flow numbers for cost of living. It’s simply unsustainable long term.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

If a move overseas is made for financial reasons, here’s one real strong piece of advice. Rent before you buy, especially if you are financially tight for your move overseas. There are a lot of reasons for this, but sticking strictly to the financial ones here, transaction costs can be high overseas. Commissions are much higher outside of North America generally. So are transfer taxes, stamp duties, and, in some cases, real estate sales taxes. These can add 10% to 15%, or more, to a transaction. So, if your move is a lifestyle decision, making sure that you own the place you want to live in on the first try is important. Renting first is the best way to achieve this goal.

For folks in their 40s, 50s, and early 60s, another option is to buy now for investment and live in the property later. This flies in the face of the last piece of advice of renting first, but as Ralph Waldo Emerson said in Self Reliance, “A foolish consistency is the hobgoblin of little minds, adored by little statesmen and philosophers and divines.” The keywords are “foolish consistency,” because hard fixed rules rarely serve us well.

Why would we look at buying before renting? The simple reason is that many people have one big source of cash to make a purchase. Their IRA. But an IRA is only for, and must be for, investment…..until retirement. Then the money is yours to fund your retirement.

But using a traditional IRA to purchase a home that you may one day want to use is challenging to say the least. Another option that more and more people are exploring is the Roth. Invest into a cash flow property now using your Roth IRA with an eye toward living there later. A traditional IRA won’t work for this strategy, but a Roth will. Sure, you’ll pay some taxes now. But those taxes will be paid sometime anyway.

The Roth strategy is to pay the taxes when you convert now and then buy an investment property overseas. Later, after 5 tax years by law, you may distribute that investment tax-free to yourself. This funding element for a home overseas is wise to consider when looking for additional funds to make a purchase, if you are planning far in advance. Read an entire article about how to use a Roth to pre-fund a retirement home overseas here

Beyond finance, another major factor to consider when moving is healthcare overseas. Generally, the healthcare systems in the developing world are either really good or leave a lot to be desired. The private hospitals are generally world class. The public systems…not so much. There are some exceptions, like Costa Rica and Chile, but generally, you’ll want to be taken care of in private hospitals in the developing world.

The cost of insurance also directly relates to the cost of healthcare. If you have a U.S. healthcare policy, and pay for it yourself, then you know exactly how expensive healthcare coverage is. Until you qualify for Medicare at age 65, paying for insurance can cost an arm and a leg in the U.S. Overseas, affordable expat insurance from a company like BUPA is possible. This is the company that I use. In many cases, the hospitals themselves have their own insurance plans, some as little as $50 per month.

The other nice thing about medical care overseas, beyond the affordability, is the quality of care. The hospitals are actually nice. Many doctors around the world speak English. Some earned their degrees and interned in North America. The sports doctor that performed surgery on my daughter’s foot works at the Vivian Pellas Hospital in Managua. This is a JCI Gold accredited hospital, the 13th hospital in all of Latin America to receive this award. Nicaragua? Not what we expect, right? Lots of pleasant surprises out there if we look for them. You just need to keep an open mind and look.

Managua JCI Gold Hospital Excellent Expat Insurance Johns Hopkins Affiliate Panama

Managua JCI Gold Hospital Excellent Expat Insurance Johns Hopkins Affiliate Panama

Another topic people bring up to me at conferences related to expat healthcare is the proximity to service. This is an issue that some people fret about. If you want to live right beside a hospital, do it. It’s possible.

On the other hand, if you live in many parts of the U.S. or Canada, you can easily be an hour or more from a hospital. So, it’s not unusual for people to travel long distances for medical care, even in North America. Why then does it matter if you are an hour away from world class care in your new home? Granted, some people are city folks, and for them, having a hospital around the corner is a great comfort. If this is the case for you, then locating in a city like Panama City, Medellin, San Jose, or Managua might be a good fit. Each of these cities has world class care and you can live as close to the hospital as it takes to feel comfortable.

Another practical factor about moving overseas is where exactly to move. At the top of the chart we have a country selection, of course. Deciding which country is right for you will be determined by language issues, weather, culture, and cost, primarily. When a country is selected, we then need to zero in on what region, city, or town makes sense. Then what neighborhood, development, and house to select. As we drill down and get into the details, sometimes we can miss the forest through the trees. Here’s one example:

Do you want to live right on the water? Many people say, “Of course I want to live on the water. I can afford an oceanfront condo on the beach in Belize. If I am going to move to Belize, I want to live right on the ocean.”

Let’s examine this a bit more. Many people come to Cancun, Ambergris Caye, Seven Mile Beach, or another fantastic vacation spot and love it. They imagine a condo right on the water with a great resort lifestyle. And it will be. The underlying question you need to ask yourself in this case is, “Do I really want to live in a resort?” A place where the next dive group checks in every Saturday for a week of hard charging diving and partying. If the answer is “yes,” great. If not, then finding a residence off the water, or in a more quiet location, would probably make sense.

I’ve seen this unfold on Ambergris Caye over the 24 years I’ve been working there. People come to the island, fall in love via “margarita madness,” and buy a condo on the water. Sure, as long as it’s a vacation property everything works great. But when they retire and move full time, the dynamic of party, party, party and new neighbors each week gets old….quickly in many cases. Then the search for a property off the water, in a quiet neighborhood, starts to make sense.

This is one of the reasons that we built the Baymen Gardens. We saw tons of people coming to Ambergris Caye looking for a quiet residence, and the only product that met their quality and comfort standards was a property on the water. We knew we could build a North American standard product just off the water and deliver a real community experience to people who wanted to live full time on Ambergris Caye.

The key to community is to have places for people to meet and enjoy the company of one another. The 54 Baymen Gardens condos are built around a huge swimming pool, tennis courts, gym, and club facility where people socialize and enjoy activities like water aerobics or evening tennis. The residential nature of the community makes it a nice place to enjoy with long term neighbors and owners to encounter and build new friendships.

Grand Baymen Gardens Residential Community San Pedro, Ambergris Caye, Belize

Grand Baymen Gardens Residential Community San Pedro, Ambergris Caye, Belize

Affordability is also critical. Condos start from $165k USD/ $199k CAD. Rent monthly from $950 per month if you want to rent before you buy. Grand Baymen even has a rent-to-buy program that credits 50% of your rent toward a purchase, for folks who decide they like it and want to make the Gardens their new home. Click here for details.

Investors must look at different factors when deciding on what makes sense overseas. One rule I like to follow with all my investments is the “Self-Interest” rule. How much does the other guy have in the game? This tells me a lot about how much they believe the marketing pitch they are trying to get me to swallow.

On that note, remember this. Most developers building a resort product sell an investment return based on rentals. You’ve probably seen the formulas. “If we get 70% occupancy at $285 per night, you’ll make 16% ROI” or something similar. I hope they earn that kind of return for the buyers. It’s great for everyone.

But something to ask yourself is this… If the ROI is so great for me buying the condo at a marked-up retail price, how much more would the developer make as an ROI at the wholesale price? Certainly more, right? Maybe 5% more, which would be 21% ROI in this example.

The follow-up question should be this… If the developer would make that kind of a return based on his cost, why sell them to me? So, ask him: “Mr./Mrs. Developer, how many condos are you keeping?”

Really. I hope this makes sense. I want every bit of 16% or even 21% ROI I can get. Don’t you? If the ROI is some double-digit return on the sales price, then at cost of construction, the developer should be keeping as many units as they can, right? Hmmm. Something to ponder if a rental investment property is on your horizon.

Our company builds largely residential product. But in the resort condo space, we keep as many as we can. The Oceanside condos in Belize, for example…we’ll keep 60%. Only 40% are for sale. We want every bit of the ROI we can get from the rentals and the 60% that we keep will do nicely for us. We have our money where our mouth is. Every developer should.

1. Grand Baymen Oceanside

2. Rendering and Location

3. ECI is retaining 60% for Cash Flow ROI

One last thought on moving or investing overseas is, please don’t let your friends talk you out of it. When someone offers an opinion, ask yourself this: Are they qualified to do so? Have they ever left the state they live in? (Disney World doesn’t count) Do they have a passport? Have they been outside the U.S. or Canada? Who are they to offer up an opinion? Just because I can very slightly expound on the merits of the hydrogen-moderated self-regulating nuclear power module (HPM) emanating from the Los Alamos National Laboratory that uses uranium hydride as fuel, doesn’t mean anyone should listen to me about that.

Speaking of nuclear, some comments I heard last week at a conference relate to the topic of moving overseas. There was real concern about Trump and North Korea. People on the left fear Trump and people on the right fear civil unrest. One gentleman told me that WWIII had already started and he was at the conference to find a place to move to right now. He’s going to visit Belize in a few weeks. After talking with him, he thinks that coming and visiting Nicaragua to see the country for himself makes a lot of sense.

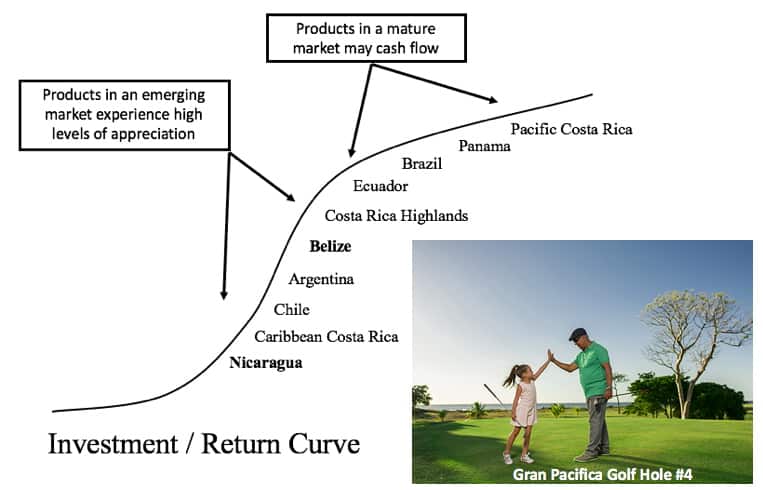

If you have any doubts about Nicaragua, check out two recent articles “Nicaragua: 10 Years On” and “Perception vs Reality” for a glimpse at what might be something to consider. Researching is free and may be the best time investment you’ll make this year. The country has moved a long way up the popularity curve since I moved there in 2002. But as you can see in the graph below, it still has a long way to go. The discounts available to savvy investors and retirees with foresight are significant today. Again, research is free. Dig in and see the facts for yourself.

The “Popularity” Curve – As countries move up the scale, sales prices move accordingly

As an example of the under priced real estate in Nicaragua, an oceanfront condo on one of the best surf breaks in Central America can be $139,900. Even if you don’t surf, tons of Baby Boomer surfers are looking for awesome, empty waves. These are the folks with money, time, and a powerful desire to surf who will be renting your condo on the surf break. Rentals that generate cash flow.

Surfing at Gran Pacifica’s Meatgrinder and Asuchillo Las Perlas Condos

If you are not ready to move yet, but have some IRA funds looking for yield, ROIs are significantly into the double digits on a cash flow basis. And the return gets better when we add the appreciation Nicaragua gains as its popularity grows and moves up the curve. Gran Pacifica is keeping one-third of the Las Perlas II condos to earn the cash flow themselves. Again, a developer who wants to retain units is a developer that believes in the cash flow.

Be in touch if you’d like to learn more about Belize, Nicaragua, or a host of other countries in Latin America, like Ecuador, Panama, Costa Rica, Chile, and more. Resources like the Country Handbooks are a wealth of information for people considering living overseas for retirement, work, or adventure. And remember from last week, keeping a sense of adventure is a great way to enjoy the experience from day one.

Here are a few additional articles that I know you’ll absolutely love:

Moving Overseas? Take Your IRA for Real Estate Investments

Time Machine – If We Could Go Back in Time and Buy Property

6 Countries Where It’s Easy To Get A Residency Visa

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!