Retiring abroad is something of a trend now. According to CBS, about 400,000 American retirees are now living abroad because they want to find a place they can afford to live in off their Social Security income. The situation is similar across the Atlantic; for example, about 72,000 British pensioners made Spain their retirement place of choice for reasons such as a warmer climate.

So, many people prefer to retire abroad and still collect Social Security benefits from their home country. But what if you have an opportunity to amass sufficient retirement savings to move somewhere warmer, should you invest in rental property? Could it be a reliable source of steady income?

Let’s answer this question.

In general, international real estate is one of the best investments you can ever make. Of course, the return depends on the country, the quality of housing, and the area, but you still can make a good profit in both the short and long term.

So, let’s suppose you live abroad and consider investing in rental properties to make sure you have enough money when you retire. If you possess a sufficient amount of funds to invest, it is highly recommended you do it.

Why? There are several reasons.

Reason #1: Strong, Guaranteed Income Every Month

A well-located house or apartment can produce an extra $200 to $1,000 per month after expenses. The tenants are likely to pay you in cash, so that’s a wonderful opportunity to generate a steady and a strong income on a consistent basis. Isn’t that what a retired person needs?

Reason #2: Rising Cost of Rent

The cost of renting a house or an apartment rises in almost every country in the world. For example, The Guardian reported that the average rent outside London rose by 5.1 percent in 2016 and hit £764 a month, while tenants in the capital experienced a 7.7 percent increase to £1,543.

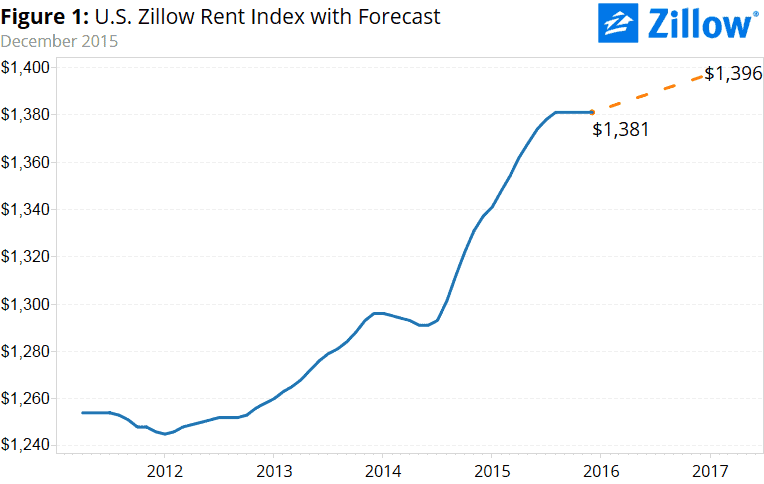

A similar situation is observed in the U.S. The median rent there grows at 3.3 percent annually, according to the 2016 Zillow Rent Index. That’s $1,381 per month.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

Image Credit: Zillow

Reason #3: A Low Risk of Depreciation

Investing in real estate is much less risky compared to investing in stocks and bonds. “Rents are always going to go up; the value of your property is almost always going to go up and most of your costs are going to stay the same,” suggest Andrew McLean, a former casino executive and now an author of numerous books on investing in real estate.

According to McLean, the owner of the property may make a little in the beginning, but the income will climb over the years. The main reason for this is a low risk of depreciation. The data represented in the Zillow Rent Index also supports this: even if economic crisis presents some risks to rental appreciation, rent will keep increasing.

What to Look for When Selecting a Home to Buy

There are a number of factors you must consider before choosing to buy rental property, says McLean. According to him, the home should have enough land for future renovations because many tenants prefer to have a room for additions. Also, a large share of tenants are looking for single-family homes in a district with good schools.

“When I was working as a professor at a university abroad, most of the foreign students I provided assignment help to rented houses in a close proximity to the campus area,” says Dina Wallbridge, an employee of an Australian university.

Another important factor to consider is the proximity to your home. For example, it is not recommended to invest in rental property in areas distant from where you live. If you are a retired person who does not wish to travel long distances on an occasional basis to visit the property, it’s better to purchase a place close to your house.

So, let’s recap the elements of a great purchase of rental property abroad:

- Close to your house

- A district with good schools

- Enough land for additions and renovations

- Single-family home.

If you follow these tips, you will make a good purchase in almost any country in the world.

The World’s Best Cities to Invest in Rental Property

A recent survey by Savills Research has revealed the cities where property rights are strong and where tenants are always available:

- Tbilisi, Georgia

- Jakarta, Indonesia

- Melbourne, Australia

- Miami, Florida, USA

- Panama City, Panama

- Cape Town, South Africa

- Dublin, Ireland

- Tel Aviv, Israel

- Istanbul, Turkey

- Chicago, USA

- Chennai, India

Final Thoughts

Rental property is one of the best ways to ensure a steady income during retirement. If you are considering this option for yourself, you should definitely explore the market. Regardless if you live in your home country or abroad, a low risk of depreciation as well as rising rent rates will ensure that you have a comfortable retirement.

Lucy Benton is a marketing specialist, business consultant and helps people to turn their dreams into profitable business. Now she is writing for marketing and business resources. Also, Lucy has her own blog ProWritingPartner where you can check her last publications. If you’re interested in working with Lucy , you can find her on FaceBook and Twitter.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!