Plus a Self-Directed IRA “No-No” That Many People Don’t Know About

Well, it’s about tax time again, and lots of people are wondering what, if any, forms they need to file. The 3 big forms that offshore investors most often need to file are the FinCEN 114, previously the FBAR (TD F – 90-22.1) form, the 8938, and the 5471. I am asked about these forms a lot and have written about them a few times in the past year. But considering that the penalties for failure to file can be fines of up to $100,000, it’s probably good to review what they are.

Disclaimer: I’m not a lawyer. I’m not an accountant. For legal and tax advice, please consult a tax professional. That said, see below for some commentary on the common tax and reporting forms that you may need to file.

Additionally, the second part of the column this week is something very interesting for anyone who is looking at using a Self-Directed IRA to hold precious metals. Our friends, Michael and Rich Checkan over at Asset Strategies International (ASI), have helped me this week with a brief article on why it’s a “no-no” for you, personally, to physically hold precious metals that are owned by your IRA. This is important to understand if acquiring precious metals is something you are doing or plan to do in the future, using your IRA.

The 3 Main Forms to Know

FinCen 114 (FBAR)

The FBAR tax form stands for Foreign Bank Account Report. FBAR refers to Form 114, Report of Foreign Bank and Financial Accounts, filed with the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Treasury. Any U.S. person who has control or ownership of a foreign account with an aggregate value of more than $10,000 is required to file the FBAR. This includes taxpayers with interest or signature authority over the account.

This form was created to require individuals to report money in offshore accounts. Though the form has been around for many years, FBAR hasn’t been strongly enforced by the IRS until a few years ago.

The FBAR is not filed along with a tax return to the IRS. Instead, it is to be filed separately with FinCEN. With FBAR, you must file foreign stocks or securities held in a financial account at a foreign financial institution, financial accounts held at a foreign branch of a U.S. bank, foreign mutual funds, and foreign-issued life insurance or annuity contracts.

Those who don’t file can be fined $10,000 per violation for not knowing about the obligation. Fines increase to $100,000 for those who are found to have purposely avoided filing the form.

Form 8938

Tax form 8938 is for United States taxpayers who have certain foreign financial assets that have an aggregate value of more than $50,000. The form is to be filed with the IRS with a tax return.

The form is a requirement for those who have an interest in what the IRS calls “specified foreign financial assets.” These include financial accounts maintained at financial institutions outside of the U.S., including bank accounts, investment accounts, and mutual funds; stocks, bonds, and other securities issued by a non-U.S. person and aren’t held through an investment account; any interest in a foreign entity, like a corporation, partnership, or trust; or any financial instrument or contract that has a counterparty or issuer that is not a U.S. person.

There are different thresholds set by the IRS regarding different kinds of taxpayers. For instance, an unmarried person living in the U.S. is required to file 8938 if the market value of their foreign financial assets is greater than $50,000 on the last day of the year, or more than $75,000 at any time during the year. The required market value goes up to $100,000 and $150,000, respectively, if the return is filed by two married individuals filing jointly.

Form 5471

IRS form 5471 is to be filed by U.S. taxpayers who are officers, directors, or shareholders in certain foreign corporations. The form was created by a law that requires domestic corporations to provide their asset and balance sheets on their foreign corporations. The law was created in hopes of stopping corporations from hiding money overseas. Today, the form isn’t just for large corporations. Many individuals are required to file the form.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

The form is meant for taxpayers who meet any of the following requirements: a person who becomes a director or officer of a foreign corporation; a person who acquires ownership interest in a foreign corporation; individuals who dispose of stock in a foreign corporation that reduces his or her interest in the foreign corporation; those who control a foreign corporation for an uninterrupted period of at least 30 days in a year; or someone who is a 10% or more shareholder in a foreign corporation for 30 uninterrupted days in a year and owns that stock on the last day of the year.

Form 5471 is to be filed with an individual’s income tax return. Penalties for not filing can be very steep, including a fine of $10,000 or more.

One Example to Consider – Mexico and a Hidden Reason to Report

For offshore investors, it is interesting to note that foreign property outside the U.S. held in your own name is not reportable assets, according to the IRS. It’s about the only asset that doesn’t get reported. If you hold a property inside a structure like a Company, Trust, LLC, IBC, etc….that entity is reportable. It’s pretty straightforward, with one notable exception.

The exception really isn’t an exception, but a “structure” hidden in plain sight and not recognized by many as a structure, and, therefore, reportable. This is the Fideicomiso, a bank trust used to circumvent the Mexican constitutional provision against foreigners owning property along the Mexican borders, including the oceans. Properties inland do not have this requirement and foreigners can hold title in their own name. But if you have a condo in Cancun, read on.

Expensive Cancun Condos Could be a Filing Liability

The Fideicomiso has been deemed by the U.S. IRS as a foreign structure for the purposes of reporting. Therefore, if you personally bought a condo or property in Mexico and hold it in anything except your own personal name, consult your tax advisor to verify if you need to file and report. Again, the IRS has draconian penalties for simply failing to file the forms. Be sure you know what your obligations are.

A Big “No-No” for SD-IRA Metals Owners

Now for the Bonus Section. Thank you, Rich Checkan, for putting this together so quickly for us:

If you are an expat, doing global business, or have a self-directed IRA, pay attention.

Investors Should Exercise Caution Investing in Individual Retirement Account Home Storage.

IRAs have quickly become one of the most popular ways to prepare for retirement—but investors should proceed with caution when choosing an option for their retirement portfolio. First, however, let’s consider the type of assets you can include in your IRA…

Much like how real estate investments are commonly used as a hedge against volatile assets like stocks and bonds, precious metals also provide this extra layer of security and are a great way to diversify your retirement portfolio. Precious metals, like gold, are ideal for investors looking for a stable investment, as they have proven to hold their purchasing power over many centuries and do not fluctuate wildly like stocks—or the recently popular bitcoin.

Gold is commonly used as a form of insurance because, compared to silver, its prices tend to be more constant over time. Furthermore, gold is generally used as a currency hedge, as it tends to move counter to the U.S. dollar. As the dollar has tested new lows in recent months, gold has moved in the opposite direction—steadily testing higher levels. Because of these features, gold is often a popular option among those nearing retirement.

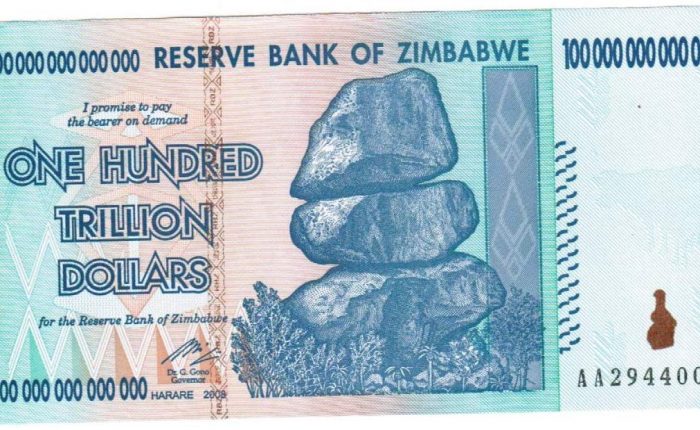

Equal in Value – One Mercury Dime and 100,000,000,000,000 Dollars

Silver, although also seen as a more stable option compared to stocks, is typically valued as the metal with higher upside potential. Silver and gold prices usually move in the same direction; however, silver tends to move much faster (up or down) than gold. This means silver will usually have greater profit potential than gold. And because silver costs significantly less per ounce than gold, it can be easily exchanged in smaller quantities.

Gold for Your Golden Years

When looking for a long-term asset to include in your retirement portfolio, gold is typically a popular option among investors seeking stability. According to some experts, the ideal amount of gold to hold in your portfolio is around 10% to 15% of your investable assets. This provides enough security, should other assets like stocks tank (like they did in 2008), but it still allows room for investors to take advantage of the profits often associated with the stock market.

The precious metals IRA is one such way to add this stability to your portfolio and is one of the most flexible types of retirement accounts available to investors. Because precious metals IRAs are self-directed, you have complete control over how much of which assets you include in your retirement portfolio. And just because you open a precious metals IRA, doesn’t mean you’re limited to gold and silver—you can also choose to include real estate, stocks, and other hard assets in your retirement portfolio!

A standard precious metals IRA allows you to hold physical gold, silver, platinum, and palladium that meet the minimum fineness standards for bullion products. The only exception to the minimum fineness standard is the gold American Eagle coin. When you open an account, you have the option to choose a location, either domestic or offshore, to store your precious metals for extra safekeeping. These options include locations closer to home, like New York City, or secure international locations like the Cayman Islands or Australia.

As with any investment, you should always consult your CPA or tax advisor before making any financial decisions. Not all precious metals dealers abide by the explicit rules established by the IRS regarding IRAs.

Investor Beware: Not All IRAs Are the Same (or Legal)

If you’ve seen your precious metals dealer advertising “home storage” for your IRA, do not proceed without reading this—you and your dealer could face legal trouble with the IRS. You may have heard of a “home storage” IRA, and it might have sounded like an intriguing option for your retirement portfolio. The main premise of a “home storage” IRA is that you can establish an LLC company to store your metals at home (or nearby) for added privacy and control—however, this is in violation of IRS regulations and may conflict with laws allowing tax-advantaged IRA accounts.

The Industry Council for Tangible Assets (ICTA) produced a white paper outlining the explicit legal consequences to which those who attempt to either pass off or engage in home IRA storage may be subject. Investors should be cautioned that investing in a precious metals IRA held in one’s own physical possession (or in a bank safe-deposit box that is not under the custody or control of the bank’s employees) will likely be deemed by the IRS to be a distribution from the IRA in the purchase amount of the bullion resulting in tax consequences and (if under age 59 ½) a 10% early withdrawal penalty. Further, storing IRA assets in your own home may be considered “self-dealing” and treated by the IRS as a prohibited transaction. A prohibited transaction is treated as a distribution of all assets held in the IRA (i.e., not just the bullion that is stored at home), including distribution of any taxable gain on an asset.

With its recent guidance, the IRS has sent a clear message to the public and, indirectly, to dealers marketing to the public that bullion held in an IRA may not be stored at home. Dealers who continue to advertise home storage may be putting their customers at risk and their businesses at risk of confronting legal or regulatory action in the future. For full details about the legal implications of a “home storage” IRA, request ICTA’s FREE white paper below.

Asset Strategies has relationships with all the reputable IRA administrators and trustees, and we have been helping clients cost-effectively and legally place precious metals in their IRAs since it was first allowed in 1986. Use our experience and solid relationships to your advantage to help you Keep What’s Yours!

Thanks, Rich. Great counsel for folks holding metals or thinking about acquiring them. I own metals purchased from ASI and recommend them both personally and professionally. ASI has been in business for over 3 decades, and as you know from other articles I’ve written, companies with track records are really the ones you want to work with. Reach out to Rich if owning metals is something you’d like to consider.

If you’ve read this far, thank you. Here’s a sneak-peek at an upcoming article I’m saving for after April 15th. It will not be a popular one for many folks, but don’t shoot the messenger.

Offshore Corporations After Trump’s Tax Plan

Bad News for the Small Business Owner

In this article, I’ll consider the use and benefits of an offshore corporation in 2018 after Trump’s tax plan. The Republican tax plan rewrote much of the code as it pertained to offshore corporations and the Foreign Earned Income Exclusion (FEIE) in 2018, making 95% of what I and others have published in the past obsolete. So, here’s what you need to know about using an offshore company in 2018.

If you’re operating a business through an offshore corporation in 2018 and netting more than $200,000 a year, you probably want to sit down for this article. Depending on your income level, Trump’s tax plan either changes nothing or changes everything. Stay tuned.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!