Introduction

In today’s volatile economic landscape, safeguarding your hard-earned wealth is not merely a choice but a necessity. One often underestimated threat to your financial security is inflation. As the value of traditional currencies steadily diminishes, it’s imperative to explore avenues for preserving and growing your wealth. This is where rare assets step in.

The Growing Concern of Inflation

Before we dive into the realm of rare assets and their ability to protect your wealth, it’s crucial to understand the insidious nature of inflation. Inflation silently erodes your purchasing power, where rising prices for goods and services mean your money buys you less. If left unchecked, this phenomenon can significantly impact your standard of living and financial stability.

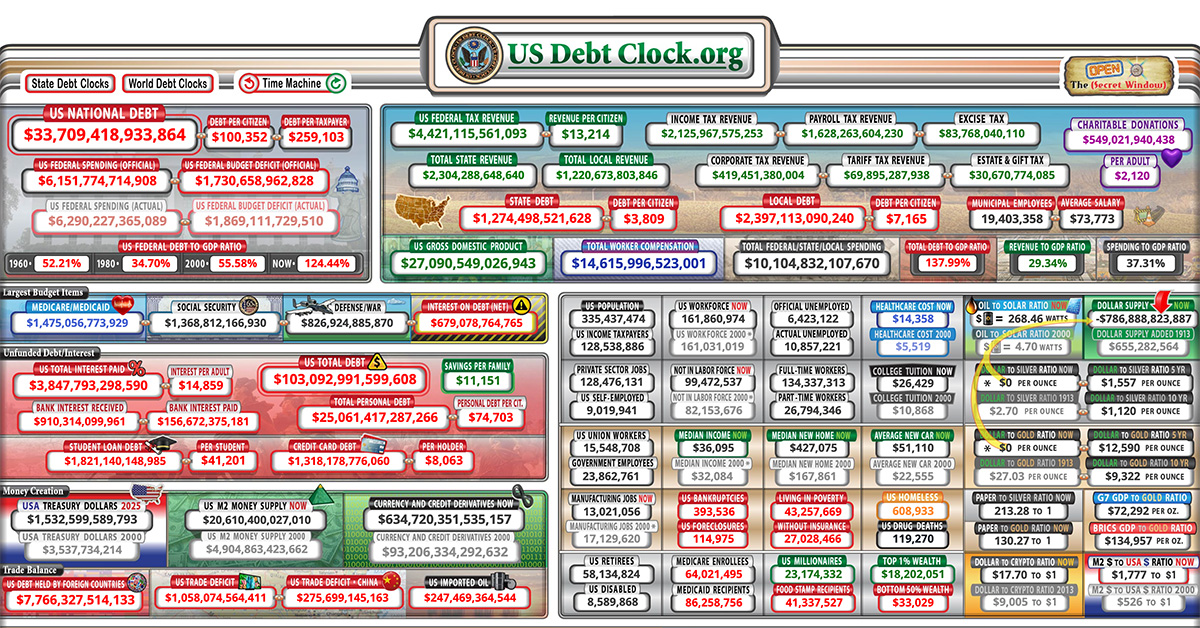

Throughout history, governments and central banks have resorted to tactics such as excessive money printing to revive struggling economies. While these actions may provide short-term relief, they inadvertently set the stage for substantial inflation over time. The consequences of such measures became apparent in 2020 when the Federal Reserve injected a staggering $3.3 trillion into the economy within a single year. However, the full effects of this rampant inflation didn’t materialize until 2022.

Considering the recent economic landscape and the massive influx of currency into global economies, the specter of hyperinflation looms as a real concern in the near future. Hyperinflation is not a mere theoretical concept; it’s a phenomenon that has wreaked havoc in various nations throughout history, leading to disastrous economic and social repercussions. The unprecedented scale of money creation in 2020 and subsequent recovery efforts have created a situation where the risk of hyperinflation cannot be ignored. If the vast money supply remains unchecked, coupled with factors like rising demand for goods and services, disruptions in supply chains, and geopolitical tensions, the stage may be set for a rapid depreciation of currency values. Hyperinflation’s destructive force can erode savings, disrupt essential services, and sow economic instability. Hence, it’s crucial to adopt prudent financial strategies to safeguard wealth against this potential challenge.

Source: https://usdebtclock.org/

Rare Assets as a Shield

So, what are rare assets, and how can they shield your wealth from the corrosive effects of inflation? Rare assets are tangible investments with intrinsic value due to their scarcity and desirability. Unlike traditional currencies, which can be endlessly printed, rare assets have limited supplies, making them a powerful defense against inflation.

Here are some examples of rare assets:

Precious Metals: Throughout human history, gold, silver, and other precious metals have been cherished for their intrinsic value. They have consistently served as a store of wealth during times of economic uncertainty.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

Certain Fixed Supply Cryptocurrencies: Cryptocurrencies like Bitcoin, with their capped supplies, share similarities with rare assets. They provide a digital means of preserving wealth in a world where the digital realm is increasingly intertwined with our financial lives.

Land/Property: Owning land or property, especially in strategic locations, can serve as a long-term store of value. Real estate can be both a shelter and a wise investment choice.

Incorporating Rare Assets into Your Strategy

Integrating rare assets into your financial strategy is a decision that requires careful consideration, research, and a thorough understanding of the assets themselves. Here are some steps to get started:

Research: Begin your journey into rare assets with diligent research. Understand the types of rare assets that align with your investment goals and risk tolerance. Each category of rare assets has its unique dynamics.

Diversify: Diversification is the cornerstone of risk management. Consider spreading your investments across different types of rare assets. A diversified portfolio might include precious metals like gold and silver, select cryptocurrencies, artwork, and real estate. This approach helps spread your risk and optimize returns.

Authentication: When dealing with rare assets, authenticity is paramount. Engage with reputable dealers or platforms to acquire these assets. For valuable items like art or collectibles, consider obtaining appraisals to ensure their true worth.

Storage and Security: Determine how you’ll store and secure your rare assets. Some rare assets, like precious metals, can be physically stored in a secure location or kept in a certified depository. Cryptocurrencies require digital wallets with robust security measures. Real estate ownership should be carefully documented and secured.

Stay Informed: Rare asset markets are dynamic and influenced by various factors. Keep yourself updated about market trends and developments in the rare asset space. Being well-informed is crucial for making informed investment decisions.

Conclusion

In a world where traditional currencies are under constant threat from inflation due to central banking actions, rare assets emerge as a compelling means of preserving your wealth. Their scarcity and inherent value make them an appealing option for savvy investors. However, like any investment, it’s crucial to approach rare assets with knowledge and diligence.

By integrating rare assets into your financial strategy, including precious metals, select cryptocurrencies, land/property, and more, you can take significant steps toward securing your economic future.

But the journey doesn’t stop here. To fully harness the power of rare assets, consider seeking guidance from experts who specialize in these investments. Your financial journey should be an ongoing process of learning and adapting to market conditions.

Ready to Beat Inflation and Secure Your Wealth?

Renegade Lifestyle specializes in strategies that go beyond traditional investment avenues. They guide you on how to beat inflation and safeguard your wealth with alternative rare assets, providing a shield against market volatility.

Whether you’re a seasoned investor or just starting out, their guidance can make all the difference. By booking your coaching session with them, you take the first step toward financial independence and a life less ordinary.

Note: Coaching availability may be limited, so it’s essential to secure your spot today to commence your transformative journey toward financial freedom and embracing the renegade lifestyle.

In the face of economic uncertainty, it’s time to explore unconventional paths to secure your financial future. Rare assets can be your shield; all you need is the right guidance to wield it effectively.

BOOK YOUR FREE STRATEGY CALL ->

George’s journey began in London’s investment banking world at institutions like JP Morgan and HSBC, but a growing curiosity about the financial system and central bank policies led him to explore cryptocurrency in 2019, resulting in successful investments. This prompted him to adopt a defensive investment strategy, emphasizing precious metals and rare assets to help others achieve financial independence beyond traditional banking. Guided by a belief in financial freedom, George launched a podcast to share insights, expanding into discussions on holistic independence, including health, off-grid living, education, and spirituality. His journey isn’t just about escaping the 9-5 grind: it’s about embracing authenticity, leaving a legacy, and living with purpose, championing a life of freedom and self-discovery for all.

George’s journey began in London’s investment banking world at institutions like JP Morgan and HSBC, but a growing curiosity about the financial system and central bank policies led him to explore cryptocurrency in 2019, resulting in successful investments. This prompted him to adopt a defensive investment strategy, emphasizing precious metals and rare assets to help others achieve financial independence beyond traditional banking. Guided by a belief in financial freedom, George launched a podcast to share insights, expanding into discussions on holistic independence, including health, off-grid living, education, and spirituality. His journey isn’t just about escaping the 9-5 grind: it’s about embracing authenticity, leaving a legacy, and living with purpose, championing a life of freedom and self-discovery for all.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!