When Everything Else Fails, Crypto Will Remain

This article was published in the Escape Artist Weekly Newsletter on August 08, 2018. If you would like to subscribe to the newsletter, please click here.

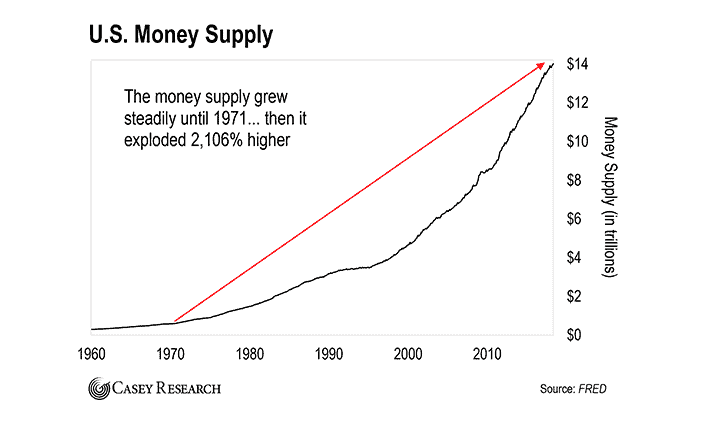

Many countries around the world are experiencing a period of political and economic instability. Just take a look at what is happening in Venezuela. Their currency has become so worthless that people are building purses out of cash. Are we in for the same kind of problems in the developed world? See a couple charts from Casey Research and think about the implications.

The Money Supply quadrupled in less than 50 years.

The Money Supply quadrupled in less than 50 years.

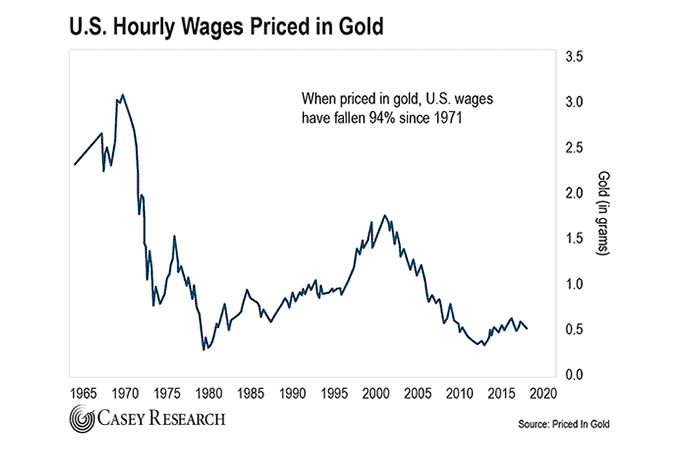

This first chart brings a few questions to mind, the most obvious is, “Won’t this be inflationary?” In simple terms, yes it will. And depending on how you measure inflation, it’s here now. The next chart from Casey Research highlights the fact that this monetary avalanche has already been terribly inflationary, especially to wage earners.

Wages are a great way to gauge inflation. As the chart shows, the wages-to-money supply shows an inverse relationship. More U.S. dollars in the system have caused wages to crash in value relative to a hard asset like gold. Assets like gold are outside the control of politicians who’d always like to make more to garner more favor with voters. But want about other assets? In times like these, we need a currency hero. We need crypto.

Wages are a great way to gauge inflation. As the chart shows, the wages-to-money supply shows an inverse relationship. More U.S. dollars in the system have caused wages to crash in value relative to a hard asset like gold. Assets like gold are outside the control of politicians who’d always like to make more to garner more favor with voters. But want about other assets? In times like these, we need a currency hero. We need crypto.

Runs on the bank and financial failures used to be a trend in the first part of the 20th century, where banks and the market would crash and people were left without jobs and without a penny in their pockets. Nowadays, we have many tools in place and capital requirements to prevent this sort of behavior from the banks.

In recent years, there has been a lot of mistrust towards banks and financial institutions built up (again). They are deemed too big to fail and receive government bailouts, yet they continue to disappoint with the Wells Fargo scandal among others, highlighting the egregiousness of their ways. Because of this, many are turning to alternative assets such as crypto. They are also looking for capital gains and trading profits as alternative passive income streams.

One asset that has been gaining a lot of steam as of late and is stock market crash-proof is cryptocurrency. It first ballooned out of control on hype alone, but now it seems to be on a regulated and relatively steady growth curve.

Cryptocurrencies don’t rely on any financial institutions to exist. Its value is entirely dependent on supply and demand, meaning that a crack in the banks will not impact your digital assets in any way, shape, or form. In fact, a loss of trust in fiat currency would probably push crypto through the roof.

Cryptocurrencies like Bitcoin and Ethereum are not based in any country, they don’t have a place of origin, and their function is not linked to the banking rules of any nation. They use a peer-to-peer transaction service that allows you to make a payment without having to go through an intermediary.

All of the transactions made by Bitcoin and other cryptocurrencies are extremely secure because they use a super reliable technology called blockchain. Blockchain allows for your transactions to be stored among many others, and in case of fraud, the payment can be easily traced.

One of the major advantages that cryptocurrencies offer is that you control your assets through your phone. You don’t have to go to a bank to gain access to your assets or to change something in your account. You don’t need to send a bank wire or pay high SWIFT fees to transmit money internationally.

Experience the Insider community that takes your international lifestyle to the next level. Download your FREE guide

"18 Steps to Implementing Your Plan B" instantly!

Meaning, if you feel that there might be a collapse in the financial institutions, you can rest safely knowing that your income is secured in your online wallet you can access the same way that you access any other app.

And you can take this security one level further. A hot wallet is one connected to the internet. Store some crypto here for faster transactions. A cold wallet is offline and might be stored on a USB drive, laptop, etc. Store crypto here for max privacy and security.

If everything else fails, cryptocurrencies won’t because they are their own regulators. If you have all of your money inside a bank, and all of a sudden the bank goes down, you are going to have a lot of trouble getting that money back.

As a way to diversify and be more competitive in the global market, many Americans are opening bank accounts in countries like Belize, Switzerland, and the Cayman Islands in case anything goes south in the United States. This is smart and should be a strategy for some of your liquid assets – especially since offshore banks allow you to hold multiple currencies, further diversifying your currency risks around the globe.

Well-balanced asset portfolios include a mix of world currencies.

Well-balanced asset portfolios include a mix of world currencies.

But there’s a new form of money now, too. A kind you don’t keep in a brick-and-mortar bank. Think of cryptocurrencies as a way of having a large or small foreign bank in your pocket. You don’t need to travel thousands of miles to access your bank account. You can save a trip to Switzerland by protecting and further diversifying your assets by using Bitcoin.

We are currently experiencing the expansion of the cryptocurrency trend as more and more people around the world are beginning to understand the practicality associated with this type of currency. Mostly young entrepreneurs and tech enthusiasts have joined the crypto craze, but older adults can gain from this as well. And many are.

You can invest in Bitcoin and link all of your earnings to a Digital IRA. You can save for your future by selling and trading digital assets or simply by holding the digital currency as a hedge. This is one way you don’t have to rely simply on paper money.

Digital IRAs are handled by you with the help of an intermediary, so if you are not that familiar with how it works, it won’t be a problem. If your financial institution messes up your 401k, you can still have your retirement via Bitcoin.

These same diversification principles should also tell you to hold some of your funds in high-performing, non-traditional assets. Many people who did very well by investing into Bitcoin and other cryptocurrencies early on are now converting some part of those crypto assets into other hard assets like foreign real estate and commodities like hardwoods and timber. These asset classes, likewise, are independent of politicians printing money and are market driven.

Finally, many crypto investors are moving funds to physical gold held offshore. Because gold generally moves in the inverse to the USD as we see in the wage chart above, they see gold going up as the dollar goes down. While gold has a different demand curve, it’s the recognized hedge against fiat currency and works in concert with crypto.

It would not be wise to turn all of your paper money into digital assets, this is just a way to diversify your portfolio and to consider other alternative methods for precaution. Think of it as having a backup for your backup. Most folks feel that diversifying between 20-30% of any single asset class is wise and prudent.

You will hear many banks and financial institutions telling you to not invest in cryptocurrencies and to keep using the same old tactics. Banks have been scared of cryptocurrencies since the first time they arrived in the market.

Their effort to push down cryptocurrencies has been futile. Financial giants like Goldman Sachs have been forced to start cryptocurrency divisions in their firms. This is concrete evidence of the power and influence that crypto has right now.

To make things clear, we are not suggesting you invest all of your money in Bitcoin, or any one investment for that matter. Crypto is a bet on faith, too. For crypto is simply fiat in a new format. Perhaps a better format, as many would argue, but fiat nonetheless.

What we are saying is that there is another option for you. Own some crypto. Then you don’t have to rely solely on banks and USD or other government-issued currencies to protect your savings any longer.

When there is another market crash, and things are looking like that might happen, very few things will remain. Cryptocurrencies, specifically the large and established ones like Bitcoin and Ethereum are a way to secure your money when the banks and financial institutions fail to do so. Of course, holding hard assets should be a key part of every portfolio, too.

Fantastic fun and exceptional income opportunities for only 20 bitcoins.

Fantastic fun and exceptional income opportunities for only 20 bitcoins.

I hope you’ve found this article on cryptocurrency to be helpful. ECI is already accepting cryptocurrencies for Foreign Real Estate and Teak Timber ownership. If you have asset class concentration in crypto, now would be a good time to examine some hard asset alternatives – and if they make sense, diversify a small part of your holdings for portfolio balance. Until next week, all the best.

This article was published in the Escape Artist Weekly Newsletter on August 08, 2018. If you would like to subscribe to the newsletter, please click here.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Michael K. Cobb is the CEO and co-founder of ECI Developments which has properties throughout Latin America. He speaks all over the world on international real estate and is a board member of the National Association of Realtors.

Like Our Articles?

Then make sure to check out our Bookstore... we have titles packed full of premium offshore intel. Instant Download - Print off for your private library before the government demands we take these down!